在2021/22由美国人寿保险指南网©️的数据报道中指出,超过70%的投保人,选择指数保险的主要原因是为了理财——即,“现金值的积累”。

而对于一些寻求保险杠杆保障的家庭,他们只是希望“购买一份单纯的终身保险”,想要避免“买保险买成了理财”这种情况;如果一辈子没病没灾,还有可能把“保费”的退换拿回来。那么在美国市场上,有什么样的保险产品可以选择呢?

为此,TheLifeTank®️邀请了美国人寿保险专栏作者Heather Xiong, CFP®️ ,为读者解答了这个问题。本文经过编辑整理,简要介绍了以“保证不断保理赔”为特点的定制型保险类型人寿保险是什么,它的适用群体,保费价格对比,以及选择这类保险的3个核心诀窍。

保障型指数保险是什么?

保障型指数保险,英文称为Protector Indexed Universal Life,简称为PIUL。

保障型指数保险,是人寿保险公司,针对寻求“保证的保险理赔”,而并非“保险理财”的这一部分家庭需求,推出的特定类型的指数保险。

PIUL 对比 IUL ,保障型指数保险解决的问题是什么?

常规的指数保险(IUL),通常侧重于现金价值的积累能力,大部分应用于保险理财领域。

常规IUL保险产品,配合低保费获取高杠杆的终身理赔保障的设计方案,需要非常专业的风险管控能力,和年复一年的数据监控和分析;后期的调整,几乎是不可避免的。这种设计方案,并不太适合单纯寻求保障的家庭。 ——Heather Xiong CFP®️

业界通常将IUL比喻成一个税务优惠的综合理财产品,这也是70%的投保家庭,以“保险理财”作为选购指数保险的理由。

但对于一部分投保人来说,我们并不想去关心封顶收益率Cap,指数波动,和年度收益计息等涉及到保险账户是否符合预期正常工作的情况。我们只是想要从保险公司得到一个确定性,免去“断保”的烦恼——在申请保险的时候,就能立刻确定下来保证的理赔福利承诺,和得到保证的理赔年限承诺。

对于这部分群体来说,需要一个真正意义上的,纯粹提供保险功能的保险产品,而不是理财型保险产品。

PIUL保障型指数保险的面世,就很好解决了这一点。

一方面,投保人可以使用PIUL提供的市场杠杆,来降低终身理赔的保费成本;另一方面,在申请的那一刻起,投保人就可以得到保险公司具体的不断保承诺,提供保证到90岁,100岁,或120岁的保险理赔。

不确定性和保证的确定性,是IUL保险和PIUL保险,这两者之间的最大区别。

(>>>相关阅读:第一次购买人寿保险需要注意什么?4个必须拷问灵魂的价值选择是关键)

PIUL保障型指数保险的选购指南

PIUL是一个更容易被大众理解的传统消费型保险产品,它以寻求保障为绝对目标,保证终身理赔,还提供“退还保费”的潜在选择。

在了解了这一点后,在选购PIUL保险过程中,只需要考虑以下3个决定因素。

- 选择保险公司品牌

- 确定保费价格(预算)

- 定制保证不断保的理赔年限

1.选择保险公司品牌

不同人寿保险公司品牌所发行的PIUL保险,通常提供了不同的理赔范围供投保人选择。

从只提供纯粹的身故理赔,到全面涵盖生前福利的重大疾病理赔,慢性疾病理赔,末期疾病理赔,和长期护理理赔,投保人需要结合保费价格情况,选配不同的保险品牌。

投保人也可能有自己的保险品牌偏好。一些投保人看重悠久的品牌历史和客户服务,另一些群体则可能中意熟悉的知名品牌。

(>>>相关阅读:科普|美国人寿保险的生前福利Living Benefit是什么?如何选择?)

2.确定保费价格(预算)

不同的保险公司品牌,综合服务水平,和理赔项目各不相同,品牌也会存在溢价,因此,保费的价格也会存在差异。

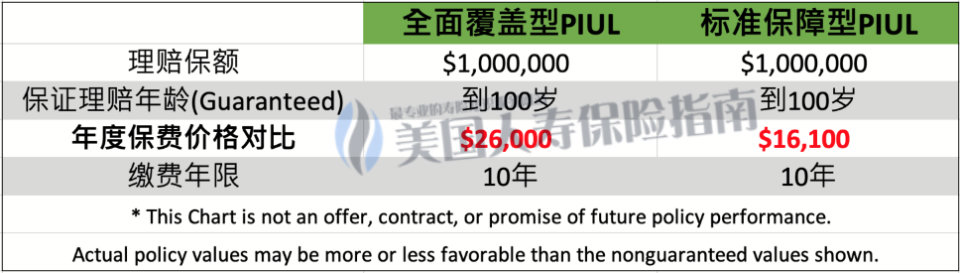

保障越多,保费越贵。额外提供了全面生前理赔——如重大疾病理赔,慢性疾病理赔,长期护理理赔,和末期疾病理赔的PIUL保险产品,比起只单纯提供身故死亡理赔的PIUL,保费会增加。

一个简单的保费价格对比说明,如下图所示。 *同一45岁女性优选健康体$100万保额,不同福利的PIUL保费对比说明

*同一45岁女性优选健康体$100万保额,不同福利的PIUL保费对比说明

选购需要的理赔项目,制定合理的保费预算,是投保人需要和您的人寿保险顾问讨论的重点。

(>>>相关阅读:知识贴|人生有几个理财阶段?不同阶段应该做什么财务考虑?)

3.定制保证不断保的理赔年限

我们可以自行定制“保证不断保”的理赔年限,是选购PIUL指数保险的特点。

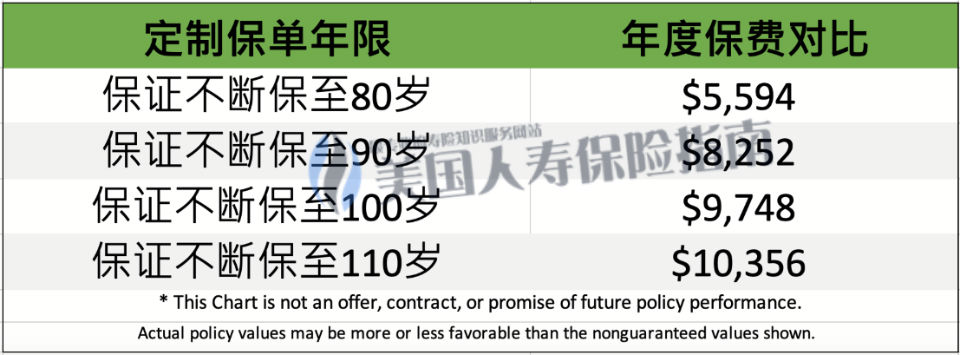

一份典型的PIUL保单,投保人可以评估家族寿命历史,从而定制从保证保到90岁,到保证保到120岁之间的保单。

我们选择的保证不断保理赔年龄越大,保费价格越贵。保证不断保理赔到100岁的PIUL保险,其保费费用,要高于保证理赔到90岁的PIUL保险。

我们以一个45岁不抽烟优选健康女性为例,年度费用的对比展示如下图所示。

*$100万保障型保单,20年缴费期的保费对比

*$100万保障型保单,20年缴费期的保费对比

保证不断保的理赔,让PIUL指数保险变得像储蓄型保险(Whole Life)一样,但保费却相对便宜。

(>>>推荐阅读:给子女留一笔钱,选择保证不断保的保险是不是一个好主意?)

文章小结

PIUL保障型指数保险的保费价格,相比较于Whole Life来说,显得更加实惠,却同样得到了类似于Whole Life的保证理赔承诺。

此外,保障型指数保险,提供了可个性化定制的不断保年龄,从而适用于寻求保障杠杆的不同年龄段的群体。(全文完)

(>>>推荐阅读:评测|千万保单价差超过50%,选对保险方案立省40万美元 )

(>>>相关阅读:知识贴|保险断保(Lapse)是什么意思?美国保险断保的实际统计数据是多少?)

(>>>相关阅读:数据|2022年Q1美国最畅销人寿保险品牌及产品排行榜Top5)