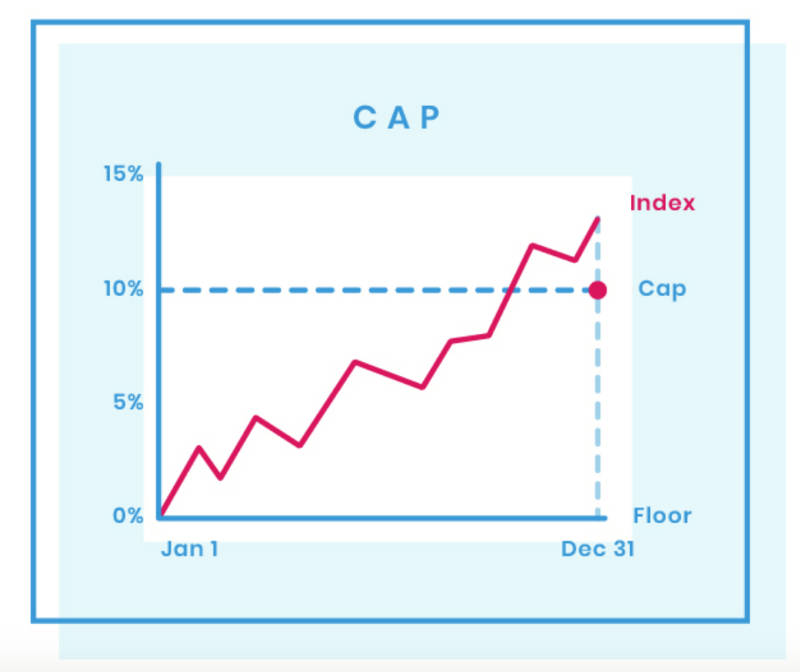

1997年,IUL指数保险(指数型万能险)产品在美国推出。 这种类型的保险的一个核心特点是,在市场环境不好的情况下,给投保人保底。而作为交换,当市场好的时候,保险公司支付给投保人的利息收益有一个上限封顶。

这个上限封顶,就是专栏作者 Heather 将要在本文中回答的“指数保险的Cap(封顶利率)到底是什么?”这个问题。同时,美国人寿保险指南网的这篇文章还将帮助投保人了解,IUL指数保险的Cap在哪里看,IUL指数保险的Cap是怎么形成的,以及我们应该如何选择和比较指数保险的Cap这3个问题。

Cap在哪里看?

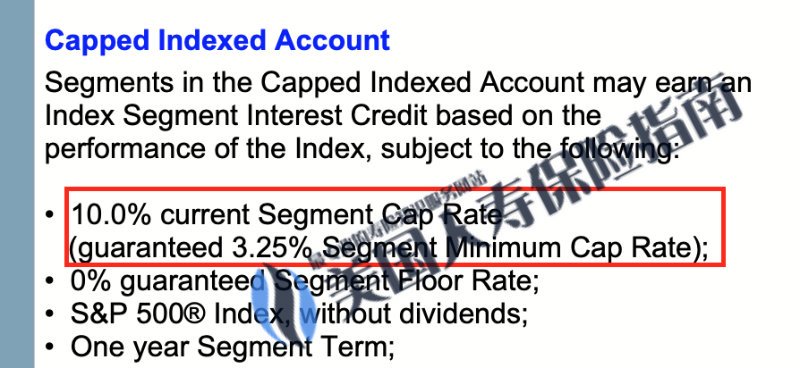

在指数型保单的正式设计方案和具体保单合同文件中,都会明确写入指数策略的Cap值,并注明Cap可以浮动的区间。如下面这样的字段(仅供参考):

在上图中,红框部分指出了该指数保险的封顶指数账户的具体Cap细节,包括:当前10%的封顶利率,以及保证终身都不会低于3.25%的最低Cap利率。

值得注意的是,保险公司拥有在合同约定范围内,调整Cap利率的权利。如一家以“生前福利”为主打的美国人寿保险公司,在2019年一年内,将指数保单Cap值,从11.75%下调了2个百分点到9.75%。

而在2021/22年度,随着基准利率的提升,一些反应迅速的人寿保险品牌,也想继提高了Cap利率。

©️Termlife2go

IUL的Cap是怎么来的?

美国IUL产品的Cap(收益封顶值),很大程度上取决于美国保险公司的资产管理水平和采取的投资策略。

insurGuru™️保险学院在“指数保险公司是如何管理我们的保费的”这一篇分析专栏里进行了详细的介绍,如果需要寻求专业的答案,可以点击这里访问学习。

Cap对我们的好处

不同保险公司的指数型保险产品,其指数策略拥有不同的Cap值。

在美国人寿保险指南社区的协助下,笔者挑选了两家发行IUL产品,并在Cap设计上非常具有代表性的两家保险公司进行了对比评测,其中:

- 保险公司A:基本指数策略Cap值为10%,无附加福利,保底值0.25%

- 保险公司B:基本指数策略Cap为10%,外加1.55倍收益倍增福利,保底值0%

从上图可以看到,在第3列,是美国股市S&P500指数在过去20年间的实际收益情况。经过计算,在过去20年间,S&P500指数的平均年度回报率是6.78%。

第4列是保险公司A给予投保人的回报,由于挂钩的是S&P500指数,当S&P500指数下跌的年份,保险公司给予投保人0.25%的现金值收益;当S&P500指数上涨超过10%的年份,保险公司给予投保人CAP(上限封顶)收益,即10%。经过计算,在过去20年间,保险公司A指数账户的平均年度回报率是6.33%。

第5列是保险公司B给予投保人的回报,当S&P500指数下跌的年份,保险公司给予投保人0%托底的现金值收益率;当S&P500指数上涨超过10%的年份,保险公司给予投保人Cap(上限封顶)收益,即10%,并额外乘以1.55倍的附加福利*,实际收益率为15.50%。经过计算,在过去20年间,保险公司A指数账户的平均年度回报率为9.69%。

结论,Cap值越高的指数保单,可能给投保人带来更多的现金值增长回报潜力。如果投保人的目标是进行现金值的积累,在其他条件完全一样的理想情况下,我们应该选择具备更高Cap值的保单产品。

(>>>相关阅读:评测|“别人家”保险一年“赚20%”,而我为什么只有不到10%?揭秘Cap影响下的保单收益)

文章小结

通过本文对指数型保险Cap值的说明,投保人可以通过Cap值,大概识别出一家美国人寿保险公司的资产管理能力,从而主动判断出一家保险公司是否最优的匹配我们的投保需求。

从历史数据的图表对比中我们可以看到,更高的Cap值,给投保人带来的是更高的年度平均收益率(Credit rate),从而带来更加强劲的保单现金值增长潜能。

但从另一面来说,美国保险公司为了避开AG49法规这个紧箍咒,也会开始在Cap的附加福利上大做文章,让不同保险产品的对比显得更加扑所迷离。

(>>>推荐阅读:人寿保险的Illustration(保单建议书)有什么争议和看点?投保人该如何看待?)

综上所述,选择合理的收益率Cap,全面了解不同的指数收益和附加功能的成本费用,并在专业人寿经纪人的帮助下进行量身订制的规划,将成为未来投保美国指数保险的一个趋势。

“Gather ye rosebuds while ye may”

20210405更新:

>>>投保人专访|”我以为小数点(回报率)写错了”,2021指数保险晒账单,收益率刷新新纪录

>>>科普贴|美国指数保险和退休年金中,最常见的4种指数策略有哪些?

Disclaimer:

*本文内容是对公众进行一个既有市场策略的说明,用于学习和教育的目的。所使用的图表,数值,假设情况并不保证,也可能随时更改。现实的实际结果可能比文中描述情况更有利或更不利。

*本文并不构成美国人寿保险指南网及作者的投资建议,及对相关策略方案的拥护,也不构成美国人寿保险指南网及作者对随之而来的税务后果的保证。

*指数收益的放大器或倍增器附加福利,可能需要额外的付费。