这张保单账户运行了历时14年,投保人累计缴存160个月。期间,保单账户经历从发行公司A兼并到新的保险公司B的迁移,到如今,该保单账户准备开始进入“保单急救”程序。

该保单账户在申请(方案规划),运行(公司并购)及打理(管理维护)的这3个阶段,分别遇到了极具代表性的事件,也分别对应了三个投保人关心的问题:

在征得投保人同意后,美国人寿保险指南网©️和金融保险专栏作者Heather将通过对该14年期保单账户的分享,来说明开设现金值保单账户的注意事项,投保要点,常见误区,以及持有过程中可能形成差异的原因,并帮助投保人了解:

- 指数保单账户的优势

- 为什么会发生这样的情况?

- 我的保单会不会发生这样的情况?

- 如何避免这样的情况?我可以如何避免?

- 如果最坏的情况发生,我有什么解决办法?

案例基本情况

2006年,Thomas念大学时,申请开设了一份终身型指数保单账户。保单发行公司是位于俄亥俄州的一家保险公司A*。

2014年10月,一家拥有162历史的爱荷华州保险公司B*兼并了该A公司,并完成了保单账户的迁移管理。

2019年11月,保险公司B向Thomas发送了最新的保单账户运行状态账单。

开设保单账户时的设计方案

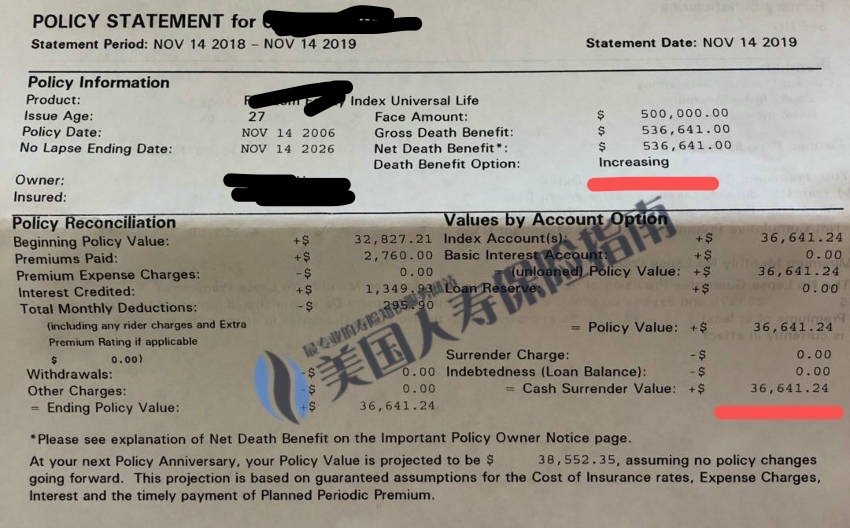

上图是保险公司每年都会寄给投保人的一份年度保单账户对账单截图(一)。从上图我们我们可以了解到,这张指数保单账户在2006年开户设立,起始的保额是50万美元。

我用红色的部分标注出,该保单账户在设立时,

- 使用了的 Increasing 的保单方案设计模式

- 截止2019年11月,该保单账户里有$36,641.24的现金值

- Thomas累计缴存$38,640保费

开设账户时的保费缴存方案

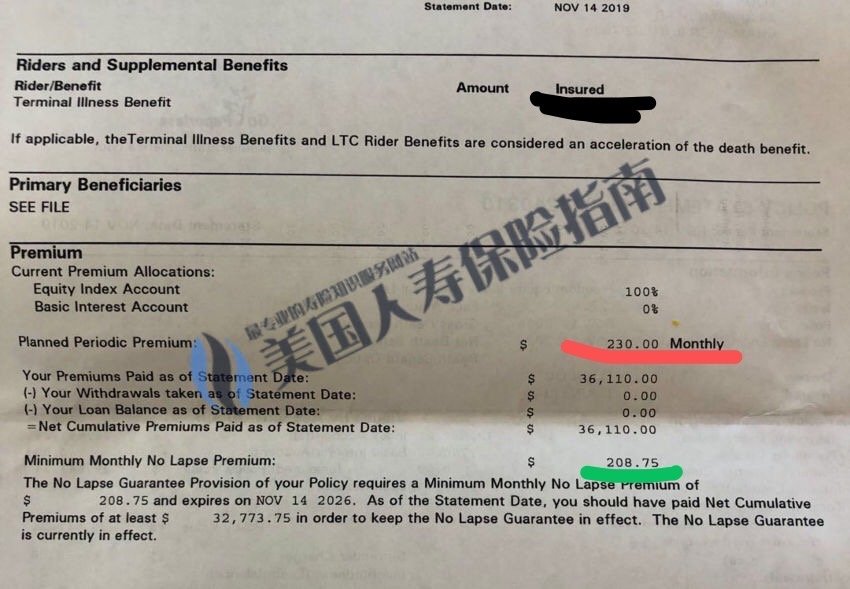

在上面这张保单账户对账单文件截图(二)中,我用红色和绿色标注了两项需要特别注意的两点。

红色部分-表明保单账户设立时给出的缴费设计方案,是每月支付$230美元。客户按照这个方案,实际已经执行缴存了13年又4个月。绿色部分在评测(下)部分说明。

保单账户的收益情况

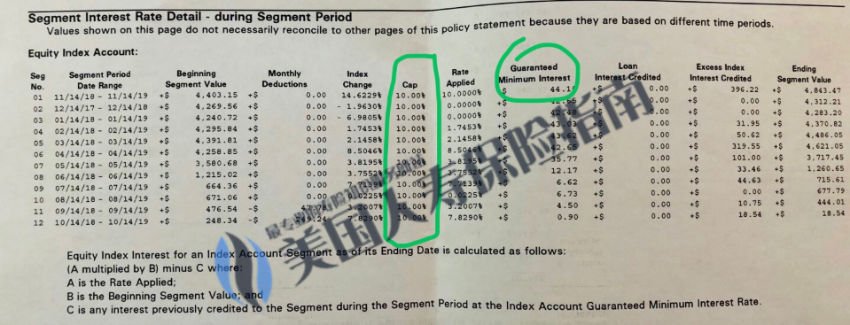

上图是该指数保单账户的年度收益情况。我用绿色的地方标注指出,保险公司提供的收益上限封顶是10%,保证筑底收益至少1%:

- 当年收益为负数或低于1%,补齐到1%;

- 当年收益高于1%,给予封顶最高 10%的收益率;

从这个角度来看,这款2006年生效的保单账户在发生保险公司兼并,换了新东家接手后,依然可以称做“优秀”。

(推荐阅读:什么是美国指数保险的收益上限封顶?对我有什么用?)

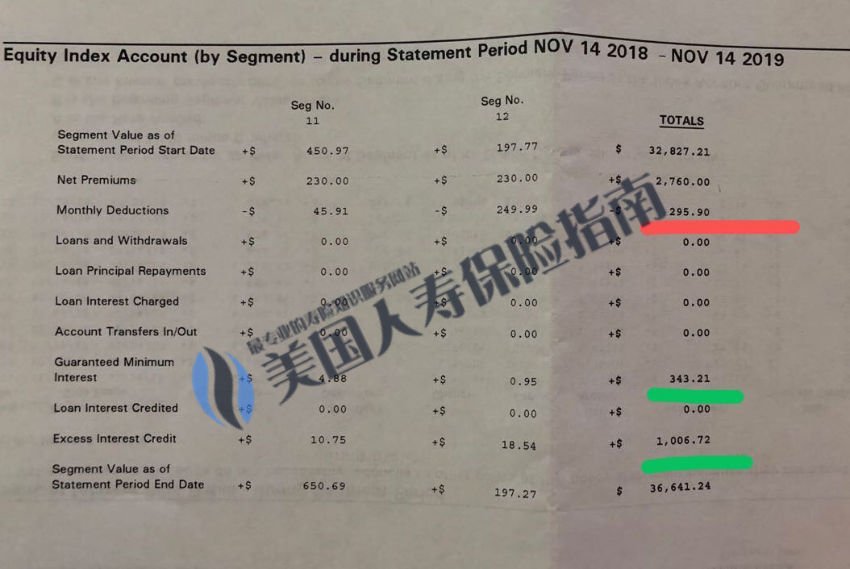

保险成本的问题

人寿保险产品每一年的保险成本(Cost of Insurance),随着我们年龄的增长和逐年增加。由于该产品账户只提供单纯的身故理赔,也没发生借贷,所以没有任何除COI以外的其他费用。

(推荐阅读:开设美国指数保险账户的费用和成本详细说明)

在上图的对账单中,我也用红色的部分标注出了,这份保单当年的保险成本为$295.9元。而绿色部分则是保单账户当年整体的收益,两者相加为$1,349元。

收益计息扣除保险成本后,该保单账户年度实际净收益为$1,053元,从而将保单账户余额从去年的$32,827,推高至$36,641。

这也正是“美国指数保单”的核心原理——通过长达10年20年间的现金值积累,账户每年所产生的一部分收益,完全可以对冲掉每年上涨的保单综合成本,多余的部分,完成继续推高现金值的功能。

写到这里,我自己都禁不住提出疑问,为什么看起来这么好的一个产品,“性价比”如此高,还在不断产生正向现金流,却可能面临着进入“保单急救”的流程?

当罗列出详细的数据分析,以及和对投保人的沟通后,理性的思考最终驳斥了主观的感受。我们最终将发现,潜在的风险都被系统性地推向了30年后:70岁到80岁之间——在我们已经步入退休,最需要保障的时候,我们将可能突然暴露在失去保障的风险中。

我们将在(下)部分的分析部分指出。

参考附录

* “WRL SERIES LIFE ACCOUNT ” , U.S. Securities and Exchange Commission, 04/28/2004, https://bit.ly/2VUrjQC

*. “APPROVING PLAN OF MERGER WITH WESTERN RESERVE LIFE ASSURANCE CO. OF OHIO” , U.S. Securities and Exchange Commission , 04/21/2014, https://bit.ly/2z6xmbz