自2015年来,美国发生了多起针对保险公司,关于万能险(英文Universal Life,简称UL)保单的诉讼。这类诉讼案件,警示了这类产品可能给不够细致专业的理财顾问和投保人带来的风险。而我们作为投保人,能从这些法律诉讼案中学习到什么呢?以下是美国人寿保险指南带来的报道。

(美国人寿保险指南网讯)全美人寿保险(Transamerica,又译为泛美人寿),安盛人寿保险(AXA)和林肯人寿保险(Lincoln National Corp)这三家公司,就是目前处于这类交叉诉讼案中的例子。这些公司陷入官司的原因,都是因为在某些UL(万能险) 保单中,向投保人提高了保险成本。

全国人寿保险公司(Nationwide Life Insurance Co)还在5月,与两名客户就VUL(投资型万能险)发起的诉讼进行了和解。 约翰汉考克人寿保险(John Hancock Life Insurance)公司在7月以9125万美元的价格和解了一起与UL(万能险)保费成本相关的诉讼。

艰难的选择:维护保单或者断保

万能险(Universal Life),跟定期寿险(Term)和储蓄分红型终身寿险(Whole Life)不同,它是终身有效,具有现金价值的人寿保险。因为这些特点,它允许投保人灵活的进行支付。具体来说,这个灵活性在于,投保人可以比储蓄分红型终身寿险低廉的价格,来维持住保单。但是,保费成本一旦上涨,投保人就面临一个痛苦的选择:从腰包里掏更多的钱出来,维持住保单,或者断保。

“客户不知道自己能做些什么,”美国消费者联合会人寿保险精算师詹姆士杭特说。 “他们支付了保费,他们以为这笔钱是保障一辈子的。现在,他们突然收到极高的保费账单,说才能维持住保单。”

利率问题成为主要诱因,消费者不愿为此买单

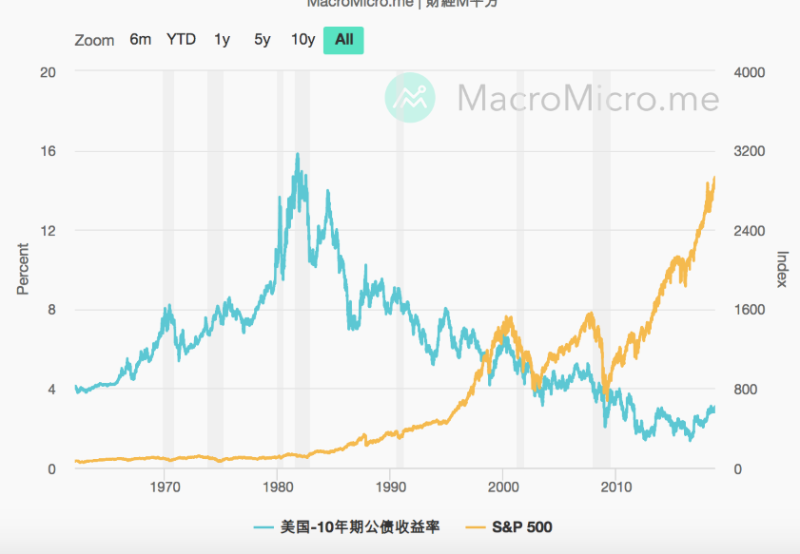

专家表示,在2015年左右开始突然出现的保险诉讼浪潮,主要是针对1980年代和1990年代出售的万能险保单。 由于当时联邦政府的基准利率很高,保险公司向保单持有人提供了约4%-5%的最低保证最低利率,相当有吸引力。

但在2008年金融危机之后,债市十年来最低的利率,降低了保险公司投资在债券市场上的回报率——而债券是保险公司这类保单的核心托底产品——因此消耗了保险公司的盈利能力,甚至收益倒挂(保险公司投资的国债收益率为3%,而承诺给保单持有人的保障收益是4%)。于是,部分保险公司对部分UL保单进行了涨价。(编者注:同期,对比挂钩美国S&P500指数的指数型万能险IUL保单产品,在这十年间的收益率节节攀升。)

虽然UL(万能险)保单合同,允许保险公司根据某些因素,调整保险费用,最多到一个封顶的最高费率,但原告普遍声称,保险公司提高成本,是用来弥补在利率市场赌博失败后的损失。 而保险公司则声称,涨价是必要的,因为死亡因素会增加他们理赔的频率。

集体诉讼案件数量增加

美国消费者联合会在2016年致函全美所有州的保险专员,称许多UL保单“在利率不够高的情况下,正在陷入麻烦或将要陷入麻烦”。

因为保险成本(COI,Cost of Insurance)增加而引发的近期相关集体诉讼案件数量爬升到2位数至3位数。

“这是恶意行为,”在林肯人寿一案中,原告代理律师约瑟夫·盖恩蒂尔谈到了这一数字增长的时候说。 “(涨价)这根本没有与死亡率,赔付等因素挂钩。而是因为和利率的变化等原因挂钩。保险公司的精算师在错误的时间做了错误定价。”

全美人寿保险(Transamerica,又译为泛美人寿)的发言人汉克·威廉姆斯和林肯人寿保险(Lincoln National Corp)发言人杰伊·鲁索表示,在法院裁决之前不方便发表评论。安盛人寿保险(AXA)的发言人则没有回应。

约翰汉考克人寿:另类的法律诉讼

约翰汉考克人寿保险(John Hancock Life Insurance)公司的法律诉讼案件与其他家有些不同。

原告状告这家保险公司,在如今死亡率下降的情况下,这家保险公司继续使用错误的死亡率计算公司,没有降低保单成本。

据美国人寿保险指南网记者讯,在这一案件中,约翰汉考克人寿在2018年7月20号在纽约联邦法庭递交了和解书,同意支付超过9100万美元来结束这场集体诉讼。

专家建议,不断学习和维护自己的权益

莱诺克斯顾问集团的合伙人格雷戈里奥尔森说:“自金融危机爆发以来,许多经纪公司和经纪人的裤衩都快输掉了。你的万能险(UL)保单或投资型万能险(VUL)保单费用可能会飙升,你应该学习,然后反击。如果你还没有从这个事情中学到一点什么的话,那你还是装作什么都不知道,把你的脑袋埋在沙堆里吧。“

持有UL保单,要先完全了解,当保险公司一方面支付最低保证收益,另一方面产生合同约定最高的保险成本的市场情况。在林肯人寿一案中的律师盖恩蒂尔说到,对于灵活性非常强的保单来说,最明智的维持保单的方式是,支付保费的时候,要考虑上述两种情况都发生的情形。

(Update)2018.10月最新报道:“Transamerica(泛美人寿)支付投保人1.95亿美元寻求和解”