张女士这个月刚过了50岁生日,她希望给自己购买一份额外的补充退休收入年金。

张女士希望在65岁后,每年能从退休年金保险里,领到$2万美金,作为终身领取的补充收入。但张女士并不清楚,她需要投入多少钱,同时也在考虑,是存年金保险好,还是做其他的投资理财好。

为了帮助张女士做出决策,美国人寿保险指南©️社区的年金先生专栏,针对这三个问题进行了说明。通过分析选择不同的年金保险类型,各个选择的优缺点,以及选择的要点,每一个投保人可以为自己的补充退休收入,做出理性的决策。

- 我该买哪种类型的年金保险?

- 如果现在(50岁)就开始存年金,需要存多少钱才能在退休后每年领2万,领一辈子?

- 如果现在拿这笔钱去做其他投资理财,等到65岁再一次性买退休年金,那么需要多少钱,可以在退休后每年领2万?

/ 年金保险怎么买 /

我该买哪种类型的年金保险?

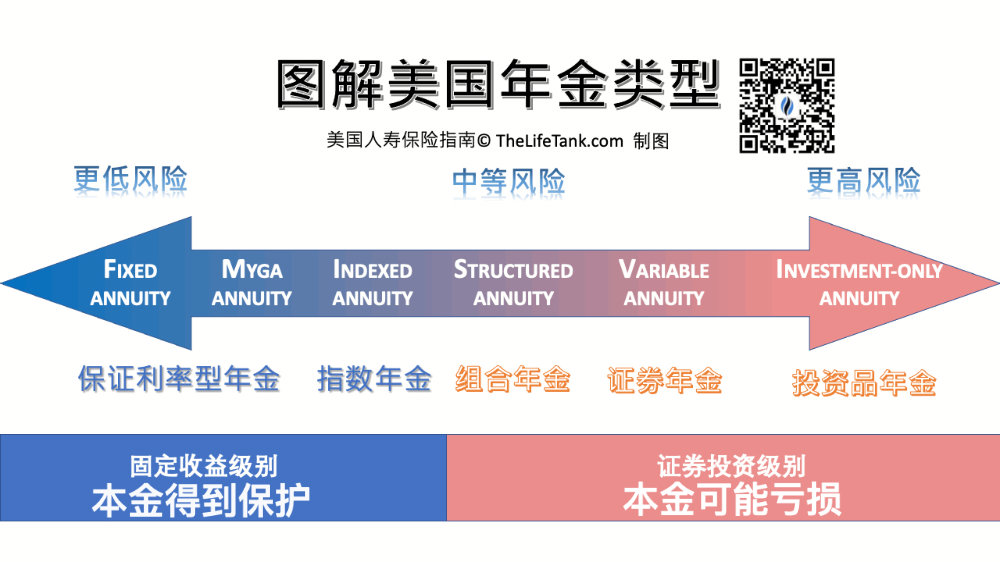

总的来说,为退休收入做投资理财的年金投保人,有4个偏好选择。这4个偏好选择,风险等级逐步提高。

这么听起来比较生硬,更直接的做法就是上图,一张好的图片说明,往往胜过我唠叨半天,请看下图:

1. 买固定收益型年金保险…

选择固定收益的年金,特别是多年期保证利率(MYGA)的年金保险,每年收益利息在3%-6%之间*(09/2023利率环境),这类年金简简单单,非常好理解,被行业里比喻为“超级定存”,也并非浪得虚名。

以当前年金市场举例,保证的多年期固定收益利率,已突破5%,高于同期银行存款利率,同时也不用为每年的利息收入申报税务和交资本利得税。

根据2023年9月的市场利率推算,如果50岁开始存这类固定收益年金,那么需要存入$16万美元左右的保费,就能实现65岁后每年2万的终身退休收入领取。*

在申请时,请了解你所购买的固定收益年金保险的当前利率,或使用我们免费提供的美元退休年金保险自助利率报价小工具进行查询。

(>>>推荐阅读:知识帖|固定收益年金是什么?有什么优点和缺点?适合哪一类人?)

2. 买指数型年金保险…

如果希望退休本金不受到任何损失,同时追求多一些的增值潜力,可以进一步选择指数收益型年金——按照巴菲特巴老的心得,使用长期投资低成本被动指数的方式,来换取增值的可能性。

通常这类跟踪指数的年金保险,一定会有0%的保底,但同时也会有一个年度收益率封顶(Cap)。检查你所购买的指数年金保险的Cap,了解保单的最高收益封顶是多少。

按照目前的指数市场环境,一些优秀的指数年金产品的S&P500年度封顶收益率普遍在8%-10%左右(*09/2023利率环境);专用于资产积累增值的指数年金产品,现行封顶收益率可能达到10%以上,或了提供不封顶的其他指数选择。

指数收益年金保险优点明显——0%的保底增长,保证了投保人的退休资金是稳定的复利增长。

按照过去10年的市场数据保守推算,如果50岁开始存指数年金保险,那么需要存入$10万美元左右的保费,就能实现65岁后每年2万的终身退休收入领取。*

除了一次性缴存,指数年金保险还提供了分期,如5年期,10年期存入保费的选择。

(>>>推荐阅读:小工具|哪一款具体的指数年金保险适合我?最新的利率指标是多少?)

(>>>推荐阅读:科普帖|怎么去找最优“利率”的美国年金保险?)

(>>>推荐阅读:知识帖|美国指数年金保险中,最常见的4种指数策略有哪些?)

3. 买组合型年金保险…

如果能进一步承担本金亏损的风险,投保人可以选择组合型年金,来获得更大的收益增长机会。

组合型年金保险属于证券产品,这类年金提供了一个比指数年金更高的封顶收益率,但同时,也不再提供了0%的保底,而是提供一个-5% ~ -20%范围的最低收益率,可按照投保人的风险承受能力,定制最低收益率和封顶收益率。

因为是在购买证券产品,所以投资组合型年金保险的收益是无法确定,因此也没有办法给出一个参考保费数值。

个人认为,依靠建议书(illustration)来判断并没有太大实际意义,产品口碑和实际性能也许更加重要。检查你所购买的组合型年金保险的最低收益率和封顶Cap。

(>>>推荐阅读:【科普贴】组合年金保险账户是什么?可指数年金保险相比有什么优点和缺点?)

4. 买基金型年金保险…

如果是成熟投资者,还愿意承担更多市场风险来换取更高的收益潜力,那么保险公司发行的基金收益型年金是接下来的一个选择。

基金型年金保险属于证券产品,结构相对更加复杂,在购买前请仔细阅读“招股说明书”。投资基金型年金保险的收益是不确定的,在市场下跌的时候,账户会承担对应的损失,而在市场上涨时,没有“封顶收益率Cap”的限制,会获得对应的收益。

因为是在购买证券产品,所以投资组合型年金保险的收益是无法确定,因此也没有办法给出一个参考保费数值。

(>>>推荐阅读:比较|指数年金和基金年金,哪一款年金保险更好?(最新版))

买年金保险的文章小结

通过4种年金保险类型的对比,投保人张女士了解到了不同年金类型的风险区间,收益方式和优缺点。结合提供的保费参考数值,张女士最终能做出符合自己实际情况的选择。

但如果张女士选择自己去投资理财,如个人退休账户,个人投资账户等,来建立自己的退休本金,等到65岁的时候,张女士将这笔钱,转入到一份收入型年金保险里,来提供终身收入,那到时候需要多少钱?

5. 买收入型年金保险

事实上,如果您今年65岁,能保证终身领取的退休收入年金,可能才是投保人关注的重点。那么上面介绍的几类年金可能都不适合您。申请一份即期收入年金保险,一次性存入29万美元保费(*08/2023市场利率),就能立刻开始每年2万美金的终身退休收入领取。(全文完)

(>>>推荐阅读:美国年金保险产品类型比较 价格 及优缺点(最新版))

(>>>推荐阅读:小工具|哪一款具体的指数年金保险适合我?最新的利率指标是多少?)

(>>>推荐阅读:【科普贴】组合年金保险账户是什么?可指数年金保险相比有什么优点和缺点?)

(>>>推荐阅读:专栏|购买美国年金保险必读!您最关心的8个常见问题及误区 )

(>>>推荐阅读:投保攻略|如何迈出第一步?详解和保险顾问必须讨论的4个常见话题)

(>>>推荐阅读:(图)美元人寿保险的年度对账单是什么?每年保单收益计息怎么看?)

(>>>推荐阅读:买房3部曲 vs 买保险3部曲?怀疑自己的保险账户会断保该怎么办?)

关于LifeTank©️ – LBYB

LBYB – Learn Before You Buy,是TheLifeTank.com – 美国人寿保险指南©️提出的一种个人及家庭进行金融保险配置的指导理念。鉴于美国人寿保险及年金保险极其多元化的金融工具属性,这类产品在财富积累和传承领域的应用,已经超越了传统意义上消费者所能理解的消费型保险产品。缺乏相应的基础知识教育和片面教育的影响,可能在多年后会对您的利益造成伤害。在申请保单之前,美国人寿保险指南©️提倡消费者和投资人,事先学习和了解这类金融产品的基本运行原理和功能,从而得到真正能保护家庭及财富的方案。

*年金的保费取决于市场实际表现,利率环境,本文中的数字仅用于估算和供投保人参考,并非或对回报的保证。This is NOT a Guarantee to your annuity investment.