在现阶段创造财富的同时,就为未来做好一份退休收入保障,在将来提供多种被动收入渠道,是我们构建稳固的家庭财富收入金字塔的重要组成部分。

“全球高净值项目”认证保险顾问,金融保险专栏作者 Heather,向美国人寿保险指南网©️分享了关于使用“保险”和“信托”这两个金融工具,帮助家庭构建补充退休收入和财富传承的案例。美国人寿保险指南网将本案例评测分为(上),(下)两个部分,版权所有,未经许可,严禁转载。

案例介绍

Lee先生,45岁,四口之家,膝下有一对未成年子女。Lee先生是在“全球化”过程中成功的新一代创业者,经过多年的深耕,业务覆盖到北美,欧洲,南美洲和英国。

投保人想要的是什么

经过十多年的打拼,Lee先生非常清楚当前做企业的难处——汇率,政治,公共卫生,法律等任何一方面的风险,都足以让多年的心血努力付之一炬。以他分享的保守经验来说,在当前环境下,一家企业到达成熟期后的高利润寿命期通常只有5-10年,然后可能就会走下坡路。

Lee先生希望利用好这5到10年的黄金时期,在打拼的同时,就为家庭做好20年后的退休收入规划和子女的财富传承规划。如果未来市场状况发生急转直下的情况,Lee先生的家庭也有一份被动收入和保障,能够从容地退出。

为什么选择使用“家族保险信托”?

家族保险信托,也称为人寿保险生前信托,是一项结合“保险”与“信托”的金融服务,常用于财富积累和传承的专业领域。

(推荐阅读:1分钟了解美国的生前信托到底是什么?生前信托费用及作用 )

考虑到Lee先生现阶段主要居住在亚洲地区,家庭成员又具有不同的国籍,虽然Lee先生未来有明确的移民意愿,但最终移民目的地在目前无法确定。

为了规避未来可能存在的一系列资产和遗产风险,并结合Lee先生的实际需求和年龄现状,使用“家族保险信托”,就是一个更有利于Lee先生的选择。

另一个选择“家族保险信托”的原因,是它的“便利性”。除了可以灵活转换所有权以外,Lee先生同时还拥有完全的控制权。在合法合规地进行相关文件处理等方面,也提供了更加便利的体验。

在明确了“家族保险信托”所有权后,我们也帮助Lee先生确立了以“财富积累”为目标的核心诉求,Lee先生也确定了$30万/年的补充退休收入意向,我们接下来将进行下一步工作:

对比和选择资产管理策略

作为金融保险独立Broker来说,最大的制度优势,就是不受限于一家产品供应商;而最大的专业优势,则是独立团队的专业素养。

我们将帮助Lee先生穿透“保险公司”这个壳,直接分析对比背后资产管理策略团队的优劣和历史表现。并按照投保人的需求,呈现给投保人进行对比和选择。

*编者注:对于高净值和超高净值群体来说,从来都不是”没得选“的问题,而是选择太多,到底“哪一个方案最适合我”,“最符合我的社会地位”,“最符合我的价值观取向”这三个层次的选择问题。

我选择了在业界享有盛誉的3家“资产管理”型金融保险公司,并评估了多种不同的资产管理策略,并绘制下面的简表。

从下图可以看到,Lee先生每年存入17万美金保费,按照Lee先生的意愿,进行为期10年的缴存。而Lee的这张家庭信托保单的保额,仅设计为5百万美元,并不算高。为什么一定要进行“低保额高保费”的设计,我将在最后的总结部分说明。

(应用3种不同保单资管策略的对比)

资产管理策略评测

PIMCO(太平洋投资管理公司)和 Merrill Lynch(美林银行)都是享誉世界的顶级私人财富管理机构。通过特定的保单账户,我们也能低成本地享受到它们一流的资产管理服务。

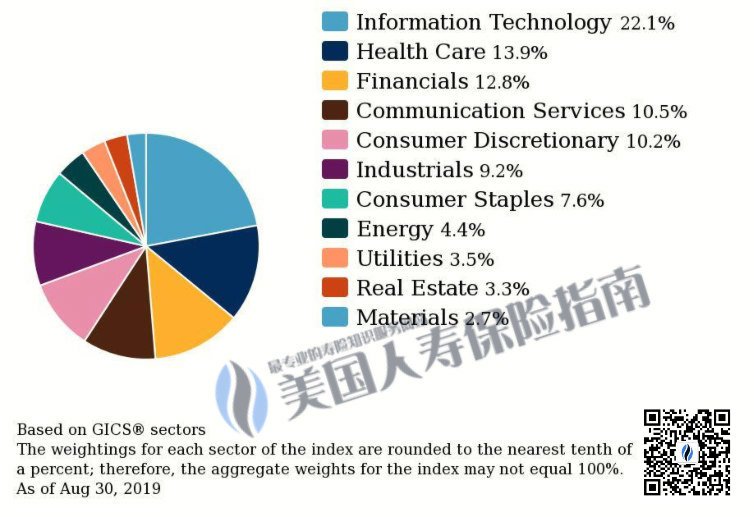

在该保单账户的资产管理策略评测中,PIMCO 和 Merrill Lynch 提供的资产管理策略类似,它们是由股票,现金和债券构成了一个动态平衡组合,并提供一个波动控制率。

这类策略的特点是,在股市进行剧烈波动时——如在近期的美股熔断中,具备波动控制的策略将自动根据设定的规则,调整资产在股票/S&P500指数,现金,及债券的比例,降低股票/S&P500指数成分比例,提高现金和债券比例,达到动态风险控制的目的。

(S&P500指数成分股构成,并每个月进行投票更新)

(S&P500指数成分股构成,并每个月进行投票更新)

由9人指数委员会(大多数成员身份保密)共同管理的S&P500指数,代表着美国市场的风向标,也是诸多其他资管策略的重要组成部分。该指数策略由纯粹的股票构成,构成由上图所示。虽然该策略没有波动控制,但相比之下具有更高收益的潜力。在美国人寿保险指南©️的行业数据报道中指出,“指数保单中,选择S&P500 策略的保单占比达到75%”。

当任一资产管理策略方遭遇零负收益时,在保险公司层面,将对保单的现金值资金账户进行“托底”的资金保护,形成指数保险的核心竞争力。

我向美国人寿保险指南网©️提供的最新数据显示,截止2020年4月9日,在新冠肺炎疫情的冲击下,S&P500在今年已经下跌了-13.65% (YTD),PIMCO的量化资管策略下跌了-2.29%(YTD as 04/08/2019),而Merrill Lynch 的资管策略却保持了 +3.93%(YTD)的正回报率。

通过和Lee先生对比家族保险信托账户的不同资管策略表现,和更加详细的历史数据分析,我们最终能帮助Lee先生进一步敲定设计方案,并展示出福利分配情况。

福利分配情况

从上图红色粗体部分的数字可以看到,预测在60岁后,每年取出30万美金,作为家庭的补充退休收入。在连续领取20年后,累计将领取600万美元。

在为Lee先生一家连续提供了20年的补充退休收入后,家庭保险信托的保单将继续自动运行。在运行期间,高龄的Lee先生如果发生任何意外离世,或需要“长期看护”等专业医疗护理服务*,或被诊断出末期疾病后,该保单都将提供巨额的福利金赔付。

从上图的表单中可以看到,90岁作古时,Lee先生将为子女及家庭留下400万至600万不等的现金赔付。

然而,这些数值一定可以实现吗?这些数值代表了什么意义?存在什么样的误区?请点击访问美国人寿保险指南网©️专栏:如何使用家族保险信托,实现每年$30万的退休收入和财富传承规划?(下)半部分

Disclaimer:

*本文内容是对公众进行一个既有市场策略的说明,用于学习和教育的目的。所使用的图表,数值,假设情况并不保证,也可能随时更改。现实的实际结果可能比文中描述情况更有利或更不利。

*本文并不构成美国人寿保险指南网及作者的投资建议,及对相关策略方案的拥护,也不构成美国人寿保险指南网及作者对随之而来的税务后果的保证。

*本文内容不作为税务或法律建议。在对本文内容中包含的任何信息采取行动之前,请咨询您的律师或会计师。

*长期看护赔付附加条款视不同保险公司,投保人所在的国家,地区或美国不同的州而定,具体赔付条件需以保险公司及保险局的规定文件为准。