为了帮助特定家庭,特别是年长(60岁及以上群体)投保人家庭成员了解大额保单相关的费用,核心投保要点,美国人寿保险指南网©️邀请了保险专栏作者Heather Xiong CFP®️,通过对不同规划方案的分享,厘清不同财富传承保险产品的底层逻辑,协助投保人判断更适合自身需求的产品方案。

为了帮助特定家庭,特别是年长(60岁及以上群体)投保人家庭成员了解大额保单相关的费用,核心投保要点,美国人寿保险指南网©️邀请了保险专栏作者Heather Xiong CFP®️,通过对不同规划方案的分享,厘清不同财富传承保险产品的底层逻辑,协助投保人判断更适合自身需求的产品方案。

/ 正文 /

在本文中,我将通过回答“购买1000万美元保险需要多少钱”这个提问,进一步帮助投保家庭识别财富传承中的一个核心问题:

- 财富传承保险的“确定性”是什么

Whole Life(储蓄分红型保险)的保费是多少钱?

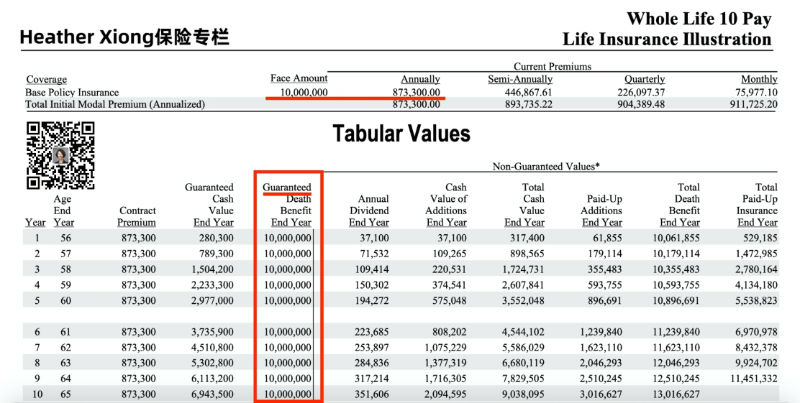

我以一份1000万美元传承金额,10年付清的储蓄分红保险保单的标准计划书为例,如下图的展示。

文件上方的红色横线部分指出,一份保额为一千万美元的终身型储蓄分红保单,每年需要缴存87万3千3百美元的保费。

那这笔钱都买了些啥?听我细细道来。

保险的“确定性” – Guaranteed 是什么?

红色方块部分,是展示“Guaranteed”——意思是“保证”,或“确定”的情况,我用红色的横线进行了标示。

这是由保险法规要求,必须展示的极端情况——在“最坏”的情况发生时,保险公司确定能够给出的理赔承诺保证。

在这里的意思是,在投保时我们就会确定,只要每年按时缴足约定的保费(87万3千3百美元),那么投保人只要终生期间(Whole Lifetime)离世,保险公司一定会按照合约进行理赔,并保证支付1000万美元给投保人指定的受益人。

对于核心追求保险保障理赔,并非使用保险进行投资理财的投保人,理解美元保险的“确定性”,至关重要。这份“确定性”,就是保险最大的成本。

“确定性”,是保险最大的成本

对于身体健康,55岁的男性投保人来说,通过储蓄分红保险来购买到这一“确定性”,每年需存入$87万的保费,累积10年,共$870多万的保费。这个费用对于任何家庭来说,都是一笔不小的家庭开支。

同时,用$870多万的保费,来杠杆$1000万的“保证”财富传承金,相对杠杆也比较低。

如果投保人家庭确实有这个财富传承需求,那除了用保费贷款筹措资金以外,还有什么保险方案,能以“保证(Guaranteed)”的合约方式,更低成本地实现我们财富传承的目标呢?

升级型保障人寿保险的保费是多少?

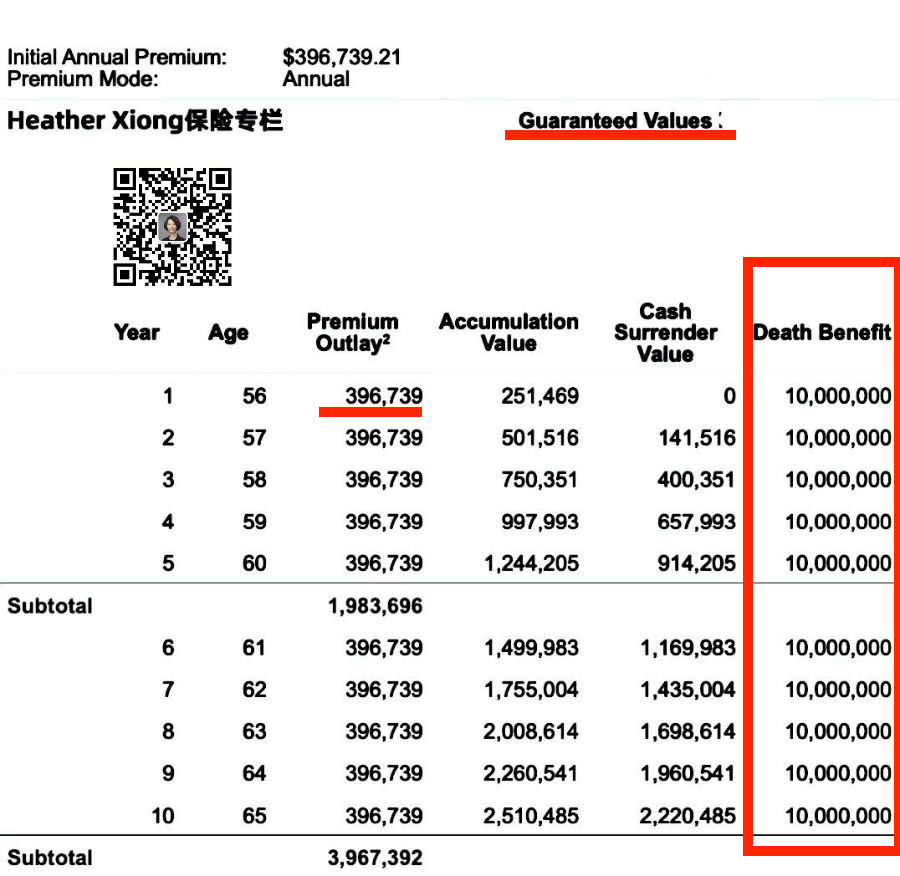

对于同一投保人,我采用了升级型保证理赔到100岁的保险设计方案,并进行了方案对比,具体数值如下图所示。

“确定性”的价格降低50%

对比正式保险计划书(方案)文件的“Guaranteed”部分——即,保险公司保证的情况。我们可以从红色部分标示的横线处看到,使用升级后的终身型万能险保单,一份1000万美金保额所对应的年度保费为:39万6千7百39美元。

相对于上面87万3千3百美元的保费,通过该保险方案对“确定性”进行购买,其保费成本节省了超过50%。

10年累积近400多万的保费,来杠杆$1000万的保证财富传承金,以55-65的年龄来说,资金的杠杆效率得到了显著提升。

确定性:保险福利承诺保证到100岁

保险价格便宜一半这么多,对应的保险福利会不会打折呢?这可能是不少投保人关心的问题。

通过对红框“Guaranteed”——保险公司确定“保证”这一部分的展示,我们可以看到,保险公司对$1000万的财富传承金(身故理赔金),也提供了“保证”到100岁的承诺确定。

换言之,在投保时我们就会确定,只要每年按时缴足约定的保费(39万6千7百39美元),那么在投保人100岁之前去世,保险公司一定会按照合约进行理赔,并保证支付1000万美元给投保人指定的受益人。

文章小结

“确定性”,是保险公司出售的核心商品服务之一。我们向保险公司购买用于财富传承的人寿保险,很大程度上,就是购买一份“确定性”。

在本文中,我简单分析对比了传统和现代两种运行原理截然不同的人寿保险险种,在同一财富传承需求下的基础保险方案,并对两者的保费价格进行了对比,先行说明了“确定性”的原理,并随后展示了从购买“确定性”这一角度出发,选择不同保险设计方案,所产生的保费差异。

与100多年前相比,现代美国人的寿命大大延长,家庭的财务构成也发生了巨大变化。诞生于80多年前的储蓄分红型人寿保险,虽然提供了广谱的确定性,但由于高昂的价格,缺乏灵活性,可能并不符合很多现代主流家庭的保障型保险需求。 ——Heather Xiong CFP®️

介于储蓄分红型保险和现金值指数保险之间的保障型保险方案设计市场,在50年来,不断地学习借鉴储蓄分红保险的“保证”功能,引入指数保险的“杠杆”功能,并将两者的优点进行了一个中和,从而在美元保险方案市场上,开辟出了独特的细分市场领域。

通过保险财务顾问的合理选品,加上定制的方案设计,这类新兴的保单策略,为追求财富传承“确定性”的年长投保家庭,提供了预算更加友好的新选择。(全文完)

(>>>推荐阅读:评测|王牌对王牌,储蓄分红保险Vs指数保险终极评测大公开 )

(>>>推荐阅读:评测|$100万美元的保单要花多少钱?分红保险 , 指数保险, 万能险价格PK )

(>>>推荐阅读:攻略|人寿保险投保时的Illustration(设计方案)是什么?有什么争议和看点?)

*文章中的方案图标,数字仅仅作为教育和信息分享交流之用途,并非保单实际的合同内容和保险公司的承诺,不具有相应法律效应。实际情况请咨询专业人寿保险财务顾问,并以英文保单内文为准。