指数年金保险是什么?

指数年金保险,是四大类年金保险中的一个大分类,英文称为Fixed Index Annuity,简写为FIA。

指数年金保险,本质是一个享受税务优势的金融理财账户。投保人申购了指数年金保险后,保险公司就为投保人开设指数年金账户。

投保人存入保费,保险公司承诺,即使市场指数亏损,保险公司也对该账户的本金提供保护;如果市场指数行情上涨,账户的资产也会享受增值的潜力。

IRA里可以持有年金保险账户,年金保险账户接受其它Qualified Account(401K,IRA等)的资金,少数保险公司也提供转换Roth IRA的选择,可以说是非常灵活。

美国市场上发行有不同保险品牌的各类指数年金保险产品,投保人需要了解指数年金保险的基本运行原理,产品指标及优缺点来进行养老资产配置。下图是美国市场上一款指数年金保险的产品范例。

| 样品:一款指数年金保险的产品封面 | ||

Sample:点击查看FIA样品 Sample:点击查看FIA样品 |

指数年金保险如何理财?

指数年金保险(Fixed Index Annuity)跟其他三大类的年金保险运作的方式不同,不同点在于获取回报的方式。

指数年金保险账户的回报,取决于市场指数的公开表现。指数年金保险账户里,最常见的市场指数是标准普尔500(S&P500)指数。

指数年金保险账户的生命周期和具体理财运行原理如下:

指数年金保险的生命周期和其他年金保险类型相同,通常分为两个阶段:累计阶段 和 领取阶段。

TheLifeTank.com / 指数年金账户的两个阶段展示

TheLifeTank.com / 指数年金账户的两个阶段展示

指数年金保险理财账户的累计阶段

上图左侧展示的,是指数年金账户的资产累积阶段。您向指数年金账户里存入本金,然后选择不同的市场指数进行理财。通过时间的积累,指数的变化,获得资产增值的回报。

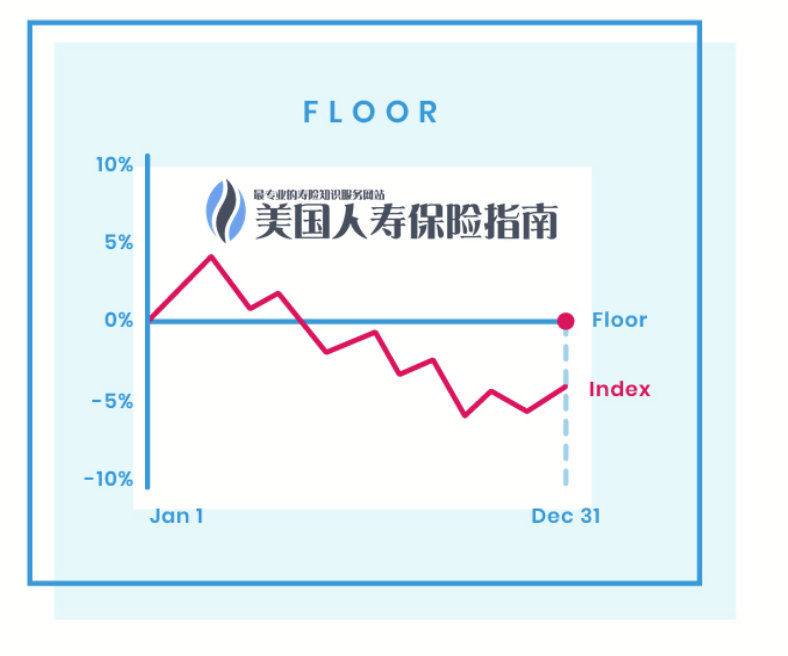

指数年金保险的理财特点:本金保护

指数年金保险理财的最大特点是,保险公司会对本金提供保护。在资本积累阶段,即使市场环境出现动荡,指数出现了下跌的情况(如上图的红线所示),保险公司会对指数年金保险账户里的本金,给予0%的托底保护收益,即上图所展示的FLOOR策略。

举例说明: 在2022年初,您申请开设了一个以S&P500指数计算回报的指数年金保险账户,并存入10万美元保费。

到了2022年底,S&P500指数大跌-19%。

由于Floor保护功能,指数保险账户里,用于计算退休金的余额,并没有从10万本金亏成8.1万,而是保持在了10万。保险公司当年给予了该账户最低0%的收益。

(>>>推荐阅读:科普|美国指数年金保险中,最常见的4种指数策略有哪些?)

(>>>推荐阅读:年度晒帐单|指数保险账户的保证最低收益是什么?)

指数年金保险账户的领取阶段

美国年金可以提取码?答案是肯定的。到了指数年金保险账户的领取阶段(什么时候开始领取,由投保人决定),可以选择按年,半年,季度,月来领取退休金。

同时,您还要决定,希望保险公司支付多久的退休金。从这一刻起,保险公司开始您定期支付退休金。

您可以选择“终身提领”,保险公司将一直付钱,直到投保人去世。您也可以选择10年,20年的领取周期。领取周期越短,通常单笔收入越高。

指数年金值不值得买?指数年金保险的优点

指数年金保险拥有以下显著优势:

- 保证本金的安全:投保人不承担任何市场下跌风险。指数年金能保证本金不发生亏损,逐年累计为投保人赚取复利。

- 投资享受税务优惠:指数年金保险的另一个优点是,账户里的年度增值,无需向国税局申报和缴税。

- 提供身故理赔金: 如果投保人在拥有指数年金保险账户期间不幸去世,保险公司会保证向您的收益人(如配偶,子女),提供一笔身故理赔金。

- 没有收入和资金量限制:不同于个人退休账户,享受同样税务优惠的指数年金账户里,没有收入限制和开户限制,也不受年度$5,500/6,000的资金量限制。投保人可以一次性存入任何资金量。单个指数年金账户的存款限制是$1,000,000。

(>>>推荐阅读:数据|开户保费增长138%,美国最畅销年金保险品牌排行榜 )

指数年金值不值得买?指数年金保险的缺点

- 罚金期和退保罚金:如果您在罚金期退保,可能需要支付退保费用。 退保罚金期通常持续3到10年,根据不同的年金保险产品而不同。 退保费用会降低您的投资价值和回报率。

- 提前领取退休金的税务罚金:根据现行税法,如果您在 59.5 岁之前从任何年金账户中取出全部或部分资金,可能需要支付 10% 的联邦税收罚款。一些投保人提出“美国年金保险可以提取吗”这一疑问,往往来源于这个因素。您可以在申购时,向人寿保险财务顾问了解不同年金产品的年度免罚金提前提领额度。

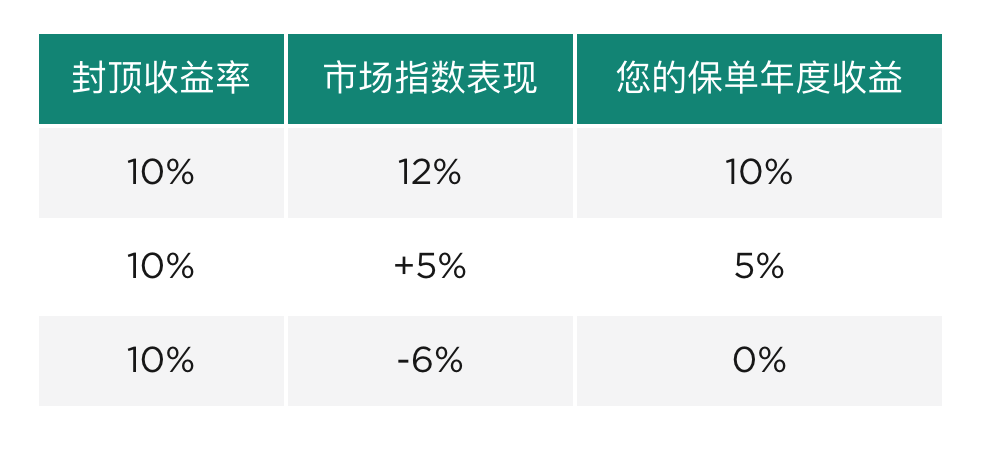

- 收益可能有上限:对于常见的市场指数,如S&P500,NASDAQ-100,指数年金保险产品都有一个年度封顶收益率上限,英文称为Cap,作为对保护本金安全的交换(如下图所示)。

指数年金保险的现代指标

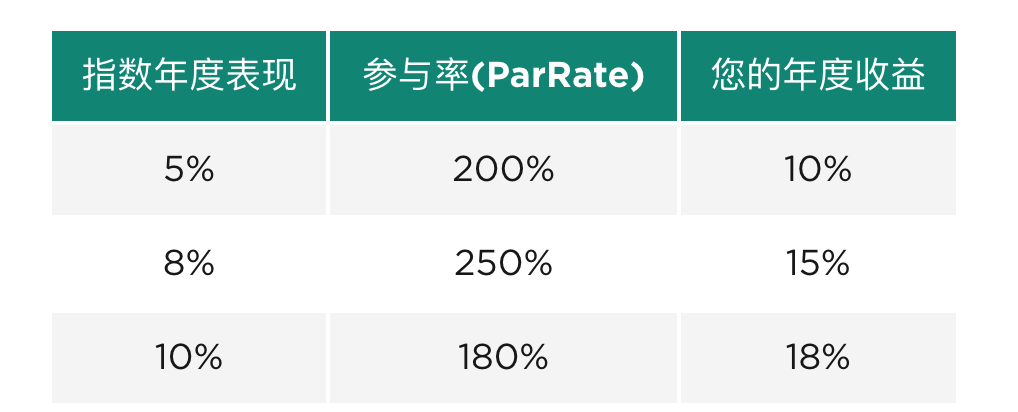

为了提高市场竞争力,增强现金值回报,不少指数年金保险产品,同时提供了没有封顶收益率(Cap)的低波动指数或另类指数供投保人选择,并通过参与率(ParRate)这一指标来计算账户回报,下图提供了这类指数年金保险使用ParRate指标进行收益结算的说明。

(>>>推荐阅读:小工具|哪一款具体的指数年金保险适合我?最新的利率指标是多少?)

(>>>推荐阅读:评测|2022保险部分低波动指数评测和收益率排行 )

指数年金保险总结

指数年金账户是一个享受税务优惠的长期理财账户,适合于不愿意本金亏损,同时追求高于固定储蓄利率回报潜力的群体。它通常被认为是一个为养老进行储蓄理财的渠道,在多年后为投保人提供长期稳定的退休金收入。

根据行业权威机构LIMRA的数据,在2021年里,2548亿美元的保费资金流向了指数年金保险账户。如果按照销量数据来看,许多投资人认为指数年金保险是一个“两全其美”的保险产品*。

指数年金保险账户的年度收益率,会受到Cap封顶收益率,ParRate参与率,成本等合约的影响和限制,保险公司也会对Cap和ParRate进行调整,请向专业人寿保险财务顾问了解不同指数年金产品的最新利率。

在您选购指数年金保险产品之前,建议使用TheLifeTank.com提供的“最新利率指标小工具”,“年金保险产品评测”和“退休金储蓄计算器”进行参考。在实际的投保过程中,您需要结合自身的年龄,风险承受能力,退休金收入预算,在专业的人寿保险财务顾问的协助下,详细了解不同指数年金保险产品的性能指标,并做出理性的决策,从而找到实现您退休目标的年金保险方案。(全文完)

(>>>推荐阅读:科普贴|3分钟看懂年金保险的前世今生 )

(>>>推荐阅读:攻略|美国年金保险产品类型比较 价格 及 美国年金优缺点(最新版))

引用:*https://www.investopedia.com/articles/personal-finance/051214/how-good-deal-indexed-annuity.asp