导语:刚开始投保时,当收到以现金积累为目标的IUL指数型保险保单的年度财务报告时,一些消费者可能会发出这样的疑问,保单的成本开销到底有哪些?费用都花到什么地方去了?交进去的钱和现金值积累的金额怎么不一样?会不会越扣越多?

导语:刚开始投保时,当收到以现金积累为目标的IUL指数型保险保单的年度财务报告时,一些消费者可能会发出这样的疑问,保单的成本开销到底有哪些?费用都花到什么地方去了?交进去的钱和现金值积累的金额怎么不一样?会不会越扣越多?

这篇由Heather提供的专栏文章,帮助美国人寿保险指南网©️回答了这些问题,并进行了知识普及,说明关于IUL指数型保险的成本费用到底有哪些,消费者的保费是怎么被扣除的,以及,说明为什么这类IUL保单合约的最佳策略是长期持有。

美国指数保单IUL的费用说明正文

首先,我一再强调,IUL指数型人寿保险保单首先是一个保险产品,并非投资品。保险公司推出的一切功能,都是围绕“保障”这个核心来进行设计。

在IUL指数型保险险种中,保险公司会从保单里的现金价值部分,扣除几种不同的费用。我们可以将这些费用分为两个部分:

- 固定的费用

- 变化的费用

其中,IUL指数型保险保单收费里,固定的费用和变化的费用的具体项目如下表(包含但不限于,视保险公司具体产品而异):

| 固定的费用(Fixed) | 变化的费用(Variable) |

| 保费存入时的收费(Premium Load Charge) | 保险成本收费(Cost of Insurance) |

| 月费(Monthly Expense Charge) | 附加条款的收费(Rider Charge) |

| 保单收费(Policy Charge) |

IUL费用说明:保费存入时的收费(Premium Load Charge)

当消费者支付每一笔保费的时候,都会根据保费存入的金额大小情况,被扣除一笔收费,这个固定收费,就叫做Premium Load Charge,中文称为:保费存入时的收费。

IUL指数型保险的这笔收费,大部分是支付联邦和各个州关于保费的相关税收及费用。为了便于理解,我们姑且把收费中的这一部分,比喻为消费税:消费者购买了一份保险服务,并不间断的为这个服务支付消费费用,因此需要支付这类“消费税”。

在2020年美国人寿保险指南网©️评测的多家IUL保险公司中,根据公开的消费者数据显示,IUL指数保险产品的的平均Premium Load Charge为7.0%-10%范围。

IUL费用说明:月费(Monthly Expense Charge)

美国保单IUL费用说明的第二项,是固定费用里的月费(Monthly Expense Charge)。

保险公司对身故赔偿金额(保额)中的每一个$1,000单位,收取一个比例的费用,通常是持续10年左右的费用评估期,具体比例和周期视各个保险公司和具体产品而异。保险公司保单一经生效,月费就开始收取,而且通常是前置收费(front-loaded)。

IUL指数型保险的这笔收费,是支付保险公司列出的经营成本。这些成本用以支付包括但不限于以下服务:

- 保险公司的医疗费用

- 获取医疗记录的费用

- 创建和启动保单合约的费用

- 支付各环节人员的日常运营费用

- 支付佣金的费用

- 其他…

IUL费用说明:保单收费(Policy Charge)

IUL保单的第三项固定收费通常被称为Policy Charge,中文称为保单费用。通常按年或者按月收取,收费期通常会持续为保单合同的期限。

在美国人寿保险指南网©️评测的几家保险公司中,这笔费用的实际金额大小在每月$5-$10之间浮动。

IUL费用说明:保险成本收费(Cost of Insurance)

IUL保单一个核心的浮动收费项目被称为Cost of Insurance(COI),中文称为保险成本收费。这一项收费是根据投保者的风险评级,保额大小,当前年龄,以及生命表死亡率等因素动态调整的一项收费。

跟月费(Monthly Expense Charge)一样,保险公司对身故赔偿金额(保额)中的每一个$1,000单位,按照不同消费者的个体情况,收取对应比例保险成本费用。这项收费理论上随着消费者年龄的增加而不断增长,通常以月或者以年为单位,从保单现金值中扣除。

我举一个例子:保额$500,000的IUL保单,男性,在30岁投保,被评级为最优级别,那30岁时纯COI月费约为$40上下。

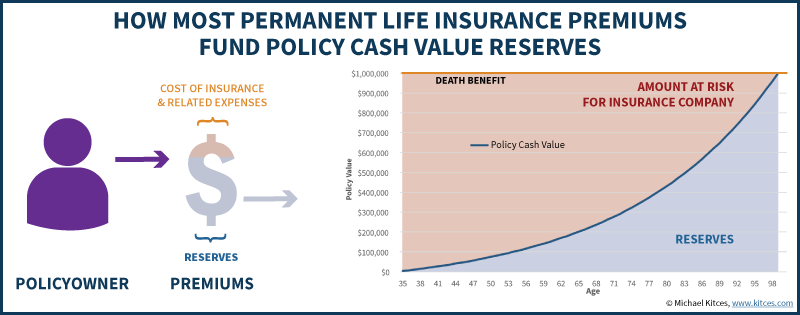

关于这项收费,最重要的是要了解,它是跟保险公司承担的“风险净值(Net Amount of Risk)”,即保额和内部现金价值之间的差额有关。 随着保单中现金价值的增加,保险公司承担的“风险净值”将减少。

IUL费用说明:附加条款的收费(Rider Charge)

IUl保单的另一个收费项目是Rider Charge,中文称为附加条款收费。

要让IUL保单实现不同的财务目标,就需要搭配不同类型的Rider,而一些Rider是需要额外支付费用的。比如一款以实现长期护理的目标的IUL指数型保险,就需要搭配长期护理类型的Rider,并可能会支付费用。

不同的Rider收费,具体金额大小视Rider类型和不同保险公司的政策而异。通常Rider的费用是从保单现金值中,以月或年为单位进行扣除。

IUL保险的费用 VS VUL保险的费用

虽然市场上有很多不同的IUL指数型保险产品供选择,但其成本收费,主要也就是本文介绍的这几种。在消费者的IUL保单文件里,收费项目也会一一列举,做到公开和透明。同时,在下面我做了个对比,用IUL指数型保险险种产品和NationalWide旗下VUL投资型保险险种产品的收费项目进行比较。从下表中可以看出,IUL指数型保险的收费项目,比VUL投资型保险的成本收费项目,减少了不少。

| IUL指数型保险费用 | VUL投资型保险费用 |

| 保费存入时的收费(Premium Load Charge) | 保费存入时的收费(Premium Charge) |

| 月费(Expense Charge,per $1000) | 月费(Expense Charge,per $1000) |

| 保单收费(Policy Charge) |

保单维持费(Administrative Charge) |

| 保险成本收费(Cost of Insurance) |

保险成本收费(Cost of Insurance) |

| 附加条款的收费(Rider Charge) |

附加条款的收费(Rider Charge) |

| 死亡和运营风险费用(Mortality and expense risk Charge) | |

| 基金管理(Fund management Fees) | |

| 交易费用(Transaction Fees) |

IUL保险的费用总结和经验分享

一份IUL指数型人寿保险合约的费用支出金额,通常堆积在早期阶段(前十年)。但随着时间的流逝,现金值在进行不断的积累,现金值和保额之间的差值,就在不断缩小。这个差值,我们称为“Net Amount of Risk”,中文称为风险净值 ,这就是保险公司承担的风险,也在不断减小,因此,投保人支付的对应风险转移成本费用,也在随之降低。只要保单里的现金值不断增长,收益能支付保单的各项成本,保单就应该能继续积累现金值和执行下去。

顶部Death Benefit横线和实际现金值之间的距离在不断减小

顶部Death Benefit横线和实际现金值之间的距离在不断减小

这也是为什么说,如果是以现金值积累为目标的保险规划,就必须要理解这是一个长期的财务策略。这个财务方案设计的逻辑是,在消费者投保的早期阶段,是消费者最不急于动用这笔钱的时候,所以大量的费用支出,都集中在这个阶段。当20年过去后,消费者可能最需要这笔钱的时候,此时的保单收费,由于风险净额的减小,就相对于减少了。

再次强调,IUL并非投资品,而是一份终身型人寿保险合约。重要的是,IUL的现金值增长是可以规避资本利得税等费用的,而且还能以免税的方式提取,这是这类产品的最大优势。同时,IUL提供了在震荡波动的市场环境下,对投保人资金的保护功能(IUL保险运行原理专栏)。以上的这些功能特点,在正确合理的规划设计下,使得IUL保单成为提供稳定退休后收入的完美工具。

最后,美国人寿保险指南网提示,在购买了带有现金值功能的人寿保险产品后,消费者每年都会收到保险公司发来的年度保单财务报告。请每年定期和您的经纪人或理财顾问进行保单Review,充分了解保单里的财务健康状况。(全文完)

(>>>推荐专题:美国人寿保险保单账户评测专题)

(>>>推荐阅读:数据|2020Q4美国IUL指数人寿保险市场排名Top5 )

(>>>推荐阅读:给父母买人寿保险的4个选择|投保指南)

(>>>推荐阅读:(图)颠覆三观!美国终身保险的成本到底是有多高?)