在美国可以给孩子买保险吗?新生儿宝宝可以买保险吗?可以单独给孩子买保险吗?这个保险到底是医疗保险,还是商业保险?这两种保险有什么区别?面对一系列关于“在美国给孩子购买保险”的问题,美国人寿保险指南网邀请了专栏作者 Heather Xiong CFP®️,通过问答的形式,在本文进行了详细说明。

孩子可以买保险吗?

是的。可以申请购买商业保险。

孩子购买人寿保险和医疗保险(健康保险)有什么区别?

在日常生活中提起保险,我们通常会搞混淆“人寿保险”和“医疗保险(又称健康保险)”的情况。

医疗保险(又称健康保险),是政府层面主导提供的保障;而人寿保险,属于商业公司层面主导提供的保障。

在美国现有的法律下,未成年孩子,或者刚出生的孩子来说,他们的“医疗保险保障”,是随着父母的“医疗保险”走的。孩子的医保可以一直跟着父母,直到26岁1。

商业人寿保险公司的保障,属于市场行为,刚出生的孩子,可以申请购买。通常,父母会成为保单持有人。但是,孩子购买商业保险,也有一定的限制,具体我在接下来的内容分析。

孩子购买人寿保险有什么优势?

在经济条件允许的情况下,孩子购买人寿保险,根据购买的人寿保险险种产品,和购买配置的方式的不同,分别具有以下3大优势:

- 锁定可保性和保障权利。伴随着孩子一生的成长,可能会遭遇各种先天性或后天性的健康情况。在孩子表现出这些健康上的变故后,可能没有人寿保险公司愿意继续承保。

- 利于现金值积累。我们都知道,人寿保险是越年轻成本越低。对于孩子购买“现金值类型”的人寿保险来说,“时间”是最大的财富加速器——孩子拥有的积累时间,是最长的。当保单现金值账户的雪球滚起来后,我们可以支取花在任何方面——不光可支付孩子的大学学费,支付长大后买房时的头款,支付孩子的婚嫁金,甚至作为创业的启动资金,孩子长远的退休金账户等等。从利率的角度,向人寿保险公司借贷的成本,通常远远低于向银行或信用卡借贷的利率。这一切,都是走向财务独立的重要支柱。

- 终身受益的财富。虽然给孩子购买人寿保险,并不在孩子自己的愿望清单上,但对于经济上比较充裕的家庭来说,这不光是一个很好的家庭财务规划手段,又是一件身体力行的家庭财富教育方式。给孩子购买和设计好保险账户,在孩子的成长过程中,借此培养子女“储蓄”和“复利”的财务理念,甚至在成年后,传承保单账户所有权。整个过程,不光能让子女得到更多财务上的保障,更能帮助孩子在步入社会之前,提前树立正确的“理财”和“财富积累”的观念。

(>>>推荐阅读:如何用指数保险进行孩子的“教育储蓄计划”和父母的“退休收入”2合1财务规划?优点是什么?)

子女买房支付头款的案例对比

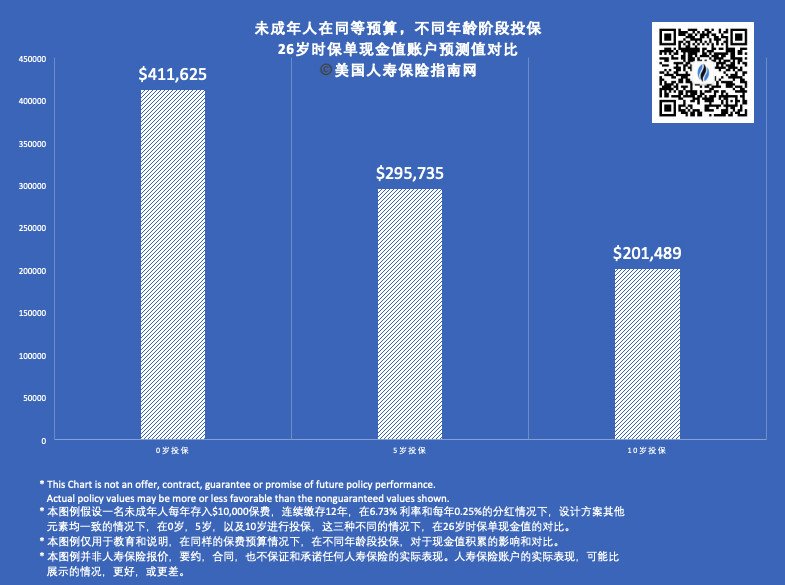

为了形象的说明“年龄越小,越利于现金值的积累”这一概念。我们假设一个未成年,分别在0岁,5岁,10岁时投保,共开设3个人寿保单账户,每张人寿保单账户,每年存入1万美金,连续缴存12年。选择投保的人寿保险公司,险种产品,设计方案及参数都完全一致。那么在子女长大成年,到26岁时,准备买房支付首付头款。

这时,通过对比3张保单账户的预测现金值数值,可以体现投保的年龄因素,以及时间的重要性。

在上图的对比中,我们可以直观的看到,0岁时投保的保单,现金值增长的“时间”最长。而10岁时投保的保单,获得的现金值增长“时间”最短。相比之下,同样的保费投入,0岁时投保的保单账户里,能拿钱出来支付的买房头款($411,625),比10岁才投保的情况($201,489),足足多了104%。

孩子购买人寿保险有什么限制条件?

对比分析了上面这些优势,接下来我会介绍孩子购买人寿保险的限制条件,或者说是“缺点”。

第一个缺点就是,虽然孩子可以买保险,但一些人寿保险公司,人寿保险险种及产品,并不对未成年人进行承保和销售。

第二,即使部分人寿保险公司接受未成年子女,或新生儿,外国人在美未成年子女或宝宝的投保申请,但从国税局的角度,也不会无限制的允许富裕的家庭,利用孩子的“生命”周期优势来“藏钱”。

基于种种因素,一些承保新生儿及未成年的美国人寿保险公司,对于孩子购买人寿保险的情况,有各自不同的限制,但总体来说,主要集中在以下几点:

- 保额一般不超过$50 至$100万美元;

- 父母双方须具备同等保额(险种不限);

- 家庭内部所有孩子平等地承保;

- 身体状况健康,具有可保性;

在现实情况中,这些类型的人寿保险公司,在投保人健康评级表中,专门提供了“青少年”的类别,为符合投保条件的孩子及家庭,提供友好的商业人寿保险服务。

文章小结

总结一下,在美国给孩子买保险是一件常见的事情,新生儿宝宝也可以购买人寿保险。

对于孩子来说,“时间”是他们最值钱的资本,人寿保险,则是将这个“资本”进行放大的一个金融工具。

给孩子购买人寿保险,是一个科学的选品和方案设计过程。举例来说,使用终身寿险进行大学学费(教育基金)专项规划时,首先需要评估,孩子当前的年龄,是否适合使用“人寿保险”这款工具来进行规划,能否能充分发挥“人寿保险”这个财务工具的效率。其次则是,通过对比不同人寿保险公司的产品和设计方案,来验证和提高这个效率。

在现实的市场上,虽然宝宝有资格申请购买,但部分终身寿险产品并不适合现金值积累。其次,不同的终身寿险险种和不同的寿险产品,其积累现金值的潜在能力,也有高有低。

最后,先保障父母,再保障孩子,是一个比较科学的投保顺序。在了解了上面这些步骤和窍门后,为孩子购买人寿保险,可以是一次轻松愉快的教育体验。在专业人寿保险财务顾问的协助下,共同选好保险产品,做对设计方案,我们既能为孩子买到称心如意的保险,也能实现家庭财富的物质积累和精神传承的目标。

附录

01.”Young Adult Coverage”, U.S. Department of Health & Human Services, https://www.hhs.gov/healthcare/about-the-aca/young-adult-coverage/