受局势不明朗的俄乌战争,美联储加息计划的持续冲击,2022年1月以来至5月,美国证券市场遭受重挫,股市市值已蒸发超过7万亿美元。

不少家庭的资产,在这一轮的市场震荡中,大幅缩水。在美元理财市场里,人人都开启了明显的避险模式,积极“寻求资产的保护”。

固定收益类指数年金保险,因其资产保险的属性和特定的功能,在这个“跌跌不休”的动荡市场环境中大放异彩,季度开户保费总量环比增长了18%,达到了170亿美元。

1. 固定收益类指数年金保险是什么?

固定收益指数年金保险账户,英文称为Fixed Indexed Annuities,简称为FIAs,是人寿保险公司发行的一类理财账户产品,以保护市场下跌,提供固定收益为主要特征。

2. 固定收益型指数年金能为我做什么?

固定收益类指数年金保险账户,为投保人提供了两个核心理财功能:

2.1 我的本金得到保护,避免市场下跌带来的损失

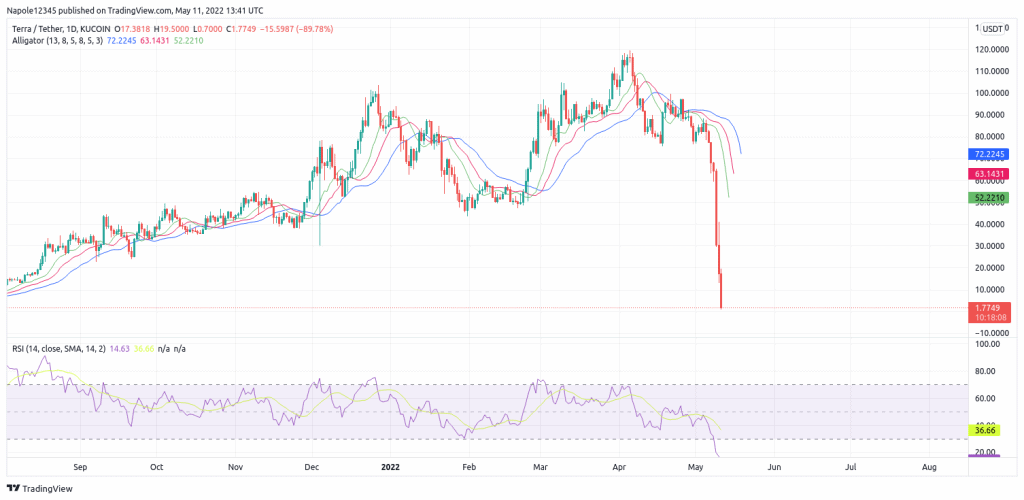

在2022年上半年期间,美国证券市场遭受重创,短短几个月之间,蒸发了超过7万亿美元市值。

在剧烈的市场下跌中,投资人任何直接参与市场的投资理财账户,如IRA退休账户,401k,403b,股票,基金,期权,虚拟货币,都可能面临大幅度亏损。

由人寿保险公司提供的固定收益类保险理财账户,可以锁定“0”的亏损状态,在剧烈震荡的市场行情中,保护资金安全,帮助投保人避免因市场下跌带来的损失。

更重要的一点是,得益于保险对积蓄的保护,每一个家庭在面对剧烈变动的市场环境时,依然能拥有一份从容和平静。

2.2 我的账户资金增值部分,免交资本利得税(Tax-Deferred),不用每年报税

和美国其他退休账户类似,保险公司这类理财账户,享受Tax-Deferred的税务优势。具体说来是指,保险账户里的资产,每年增长的部分,是不用年度申报,不用年度交税的。

对比我们自己在个人券商账户里进行理财交易,到了每年的税季,都需要对每年的分红收入,资本利得,进行额外的申报和交税。这是保险账户理财的另一大特点。

2. 固定收益型指数年金保险是怎么工作的?

2.1 选择几年期的产品

第一步,投保人首先需要选择,开设锁定“几年期”的保险账户,通常的选择有5年期,7年期,10年期锁定期。如下图范例:

>>>【Athene AccuMax℠ 5年期/7年期保险账户范例】产品评测

>>>【Athene AccuMax℠ 5年期/7年期保险账户范例】产品评测

“锁定期”这一点,和银行的几年期定存的概念比较类似。锁定期内,投保人需要支付一笔费用,才能进行全额支取。通常,一些新型的保险产品,会额外提供年度无罚金免费提取的上限额度。

锁定期结束后,投保人可以选择继续把资金存放在保险公司账户里,也可以随时另作他用。

2.2 选择固定收益计息的方式

由于属于固定收益类产品,投保人,或投资者,需要选择具体的固定收益计息的方式。对于固定收益型指数年金保险来说,通常是在“年度固定收益率”,或“一年期点对点”收益计息方式之间做出选择。

(>>>推荐阅读:美国保险理财是如何存钱的?4个不可不知的保险理财知识?)

2.3 选择对应的指数

保险账户收益的多少,基于一个公开的市场指数。所以,在最后一步,我们需要选择一个由保险公司提供的公开市场指数。

我们的收益,取决于对应指数的涨跌。但我们的保费,并没有直接进入市场去买指数,保险公司按照我们选择的计息方式,和对应指数的涨跌,在账户合约写明的收益范围内,逐年给予我们收益计息。

(>>>推荐阅读:科普贴|美元保险产品里,4大常见市场指数是哪些?)

固定收益型指数年金保险适合哪些人?

- 如果需要的话,可能需要不定期从账户里取一些钱来使用的家庭。

- 想给子女或家人留一笔财富

- 在动荡的市场周期里,寻求资产增值潜力,税务优惠,以及避免市场亏损的理财渠道。(全文完)

(>>>推荐阅读:【科普贴】组合年金保险账户是什么?可指数年金保险相比有什么优点和缺点?)