(长按二维码,关注“美国人寿保险指南”微信公众号)

(长按二维码,关注“美国人寿保险指南”微信公众号)

从新型冠状病毒疫情在全美带来的10万死亡数字,到乔治佛洛依德之死引发的全美各地示威游行,偏偏又加上大选年的加持——美国社会在2020年的上半年里,经历着持续的震荡和冲击,这也给市场未来的走势,带来了极大的不确定性。

在5月底由Allianz 北美安联保险发布的调查1显示,54% 的受访美国人明确表达出,“股市根本没有真正见底”的担忧。

而超过72% 的人认为,他们开始重新思考如何从剧烈震荡的股市中,保护好自己未来的退休金。

在面对未来极大不确定性的市场前景下,资金保底和保障的需求急剧攀升,55%的受访者表示,他们愿意放弃一些潜在的收益可能,来换取对亏本的保护。

因此,具备对本金进行保底,并提供“市场波动控制”功能的IUL保单指数策略,就在这个时期,进入了我们的视野。

什么是保单的“市场波动控制”指数策略?

早期的IUL保单账户只能单纯跟踪S&P500市场指数,现金值积累的计算方式和组合策略不多。

在激烈的市场竞争下,保险公司发展出了两个主要方向。其中一个方向是,保险公司和投行等资产管理机构合作,引入了更多基于规则,或基于量化策略的市场指数。这类指数通常是由证券指数,现金和债券构成了一个动态平衡组合,并提供一个市场波动控制率。这类指数,英文称为:Volatility-Controlled Index。

理论上,Volatility-Controlled指数策略的特点是,在股市发生剧烈震荡波动时——如在美股熔断中,S&P500指数可能立刻大幅跳水,但具备“波动控制”的指数策略,将自动调整我们保单账户里的资金组合,重新分配在证券指数,现金,及债券上的比例,达到动态风险控制,降低震荡幅度,守住收益的目的。

如果该指数回报率是负数的话,保险公司同样也会对放入该指数策略账户的资金,进行托底保护,让本金不受损失。

(>>>推荐阅读:美国指数保险和退休年金中,最常见的4种指数策略有哪些?)

Volatility–Controlled指数策略评测

理论上的想法很美好,但现实会不会很骨感?这些带有“波动控制”功能的指数策略实际表现怎么样?2020年上半年的回报率表现如何?美国人寿保险指南©️选出了除了提供常规的S&P500指数策略以外,还提供“市场波动控制”指数策略的保险公司,进行评测。

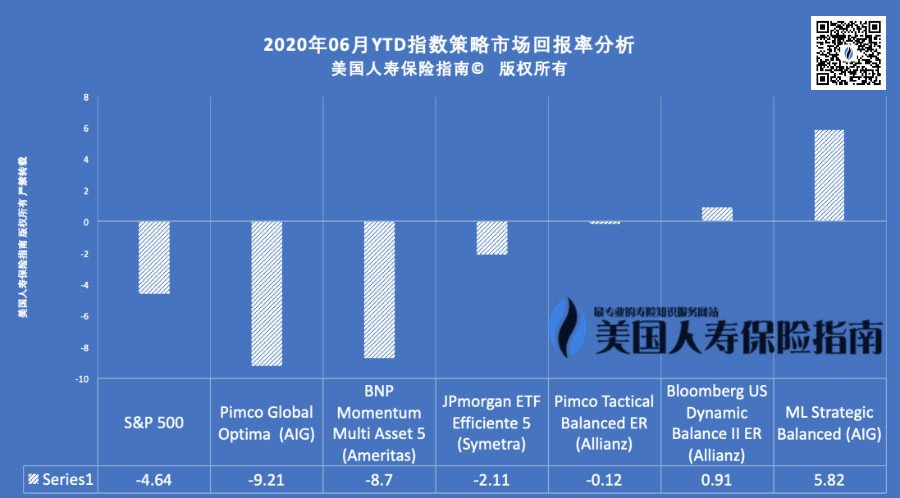

通过和合作机构的持续跟踪监控,美国人寿保险指南©️评测小组带来了这些指数策略,在2020年剧烈震荡的上半年度的实际收益回报率数据。通过下面实际市场表现对比,我们将揭晓哪一家保险公司的指数策略,成为了2020年上半年“过山车”市场里的最大赢家。

#Benchmark: S&P500指数

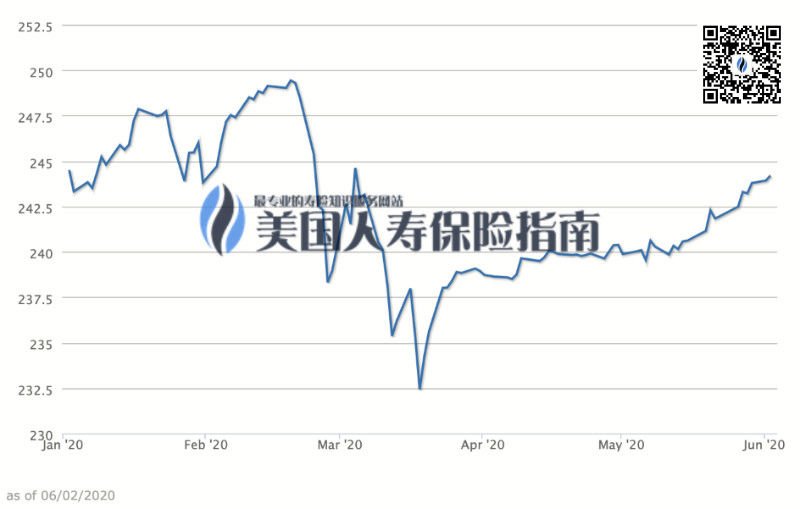

为了展示不同公司的“波动控制”功能指数策略,在市场剧烈起伏,充满巨大不确定性的现实环境下的实际表现和具体差异,我们选择使用S&P500指数策略,从今年1月1日到6月3日这段时间的市场数据,作为基准对照组。

截止2020年6月2日,S&P 500指数年度YTD对照回报率: -4.64%

由于标普指数代表着美国经济的基本面,参与评测的大部分指数都跟着有不同程度的下跌。比较有趣的是,投资组合标的中,涉及全球市场,或者新兴市场的指数策略,跌幅均超过标普指数。而投资组合标的以美国经济体为主的“波动控制”指数策略,跌幅普遍小于标普指数。

文章小结

从标准的S&P500指数策略账户,到提供“波动控制”指数策略账户,指数型保单账户的管理策略正向着多元化,工具化以及透明化的专业方向持续发展。

“75%的指数型保单持有人选择了的S&P500指数策略账户。” ——LIMRA报告

对于投保人来说,好处是我们拥有了更多的选择,应对不同的市场和社会环境。而坏处也是,选择可能又实在太多了,各自细分领域的专业化要求又不断提高。

因此,选择专业的资产管理型保险顾问合作,定期根据不同的市场环境和时期,灵活配置指数策略,方能从长远的角度,给我们保单账户带来稳定的回报。在纷乱复杂的市场不确定性中,持续给我们带来心灵上的平静。

美国人寿保险指南也将继续服务支持社区发展的GA和IMO机构,持续监控不同指数策略在不同社会环境下回报率变化情况,向华语投保人提供最前沿的美国保险资讯。(全文完)

(>>> 评测|“别人家”保险一年“赚20%”,而我为什么只有不到10%?揭秘Cap影响下的保单收益 )

20210405更新:

>>>投保人专访|”我以为小数点(回报率)写错了”,2021指数保险晒账单,收益率刷新新纪录

>>>科普贴|美国指数保险和退休年金中,最常见的4种指数策略有哪些?

20220214更新:

>>>评测|2022年回报最好的IUL指数账户和保险公司排行榜

了解更多?和社区保险顾问联系

附录

01.”Americans’ Retirement Plans While Anxiety over Continued Market Risk Remains”, 05/28/2020, Allianz Life Insurance Company of North America, https://bit.ly/2Xv9WGO

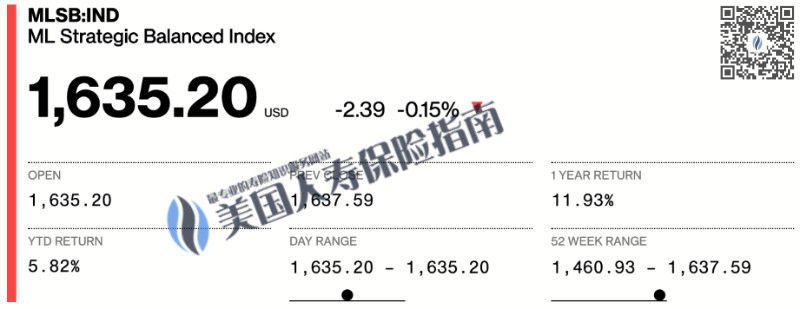

截止2020年6月2日,该指数策略年度YTD回报率为:

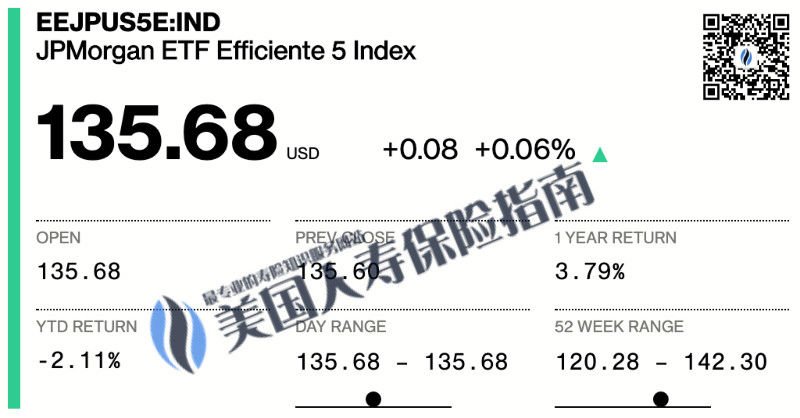

截止2020年6月2日,该指数策略年度YTD回报率为: