美国人寿保险指南网的读者联系说,他听身边的朋友说,保险公司每年的分红有6.x%,7%,还能存钱和取钱,听起来很打动人,想要入手一份。但他又有很多疑问,这个“分红率”靠谱吗?这个取钱的方式安全吗?

在关于储蓄型保险的所有文章中,我们不断说明,保单分红率(Dividends Rate),和保单实际的内部回报率(IRR,Internal Rate of Return)这是两个完全不同的东西。

我们通常把这两者搞混,造成误解,造成文章开头时那种状况。同时,关于从储蓄型保单账户里取钱的概念和问题,市场上也含糊不清,各种专业名词和分类——比如Direct Recognition 和 Non-Direct Recognition——更是把投保人搞得晕头转向。

销售人员要么压根不提,要么会强调,这种保单可以存钱,还有分红,当你需要钱的时候,就可以在早期取钱出来支付账单,如买车,或者作为创业基金。

不少的储蓄型终身保险,都是被打包成“可以很快地从保单账户中取钱”,“打造个人银行系统”,“无限银行(Infinite Banking)”这样的概念下被销售出去的。这些理念出现了很多年,传播这些概念的人有Nelson Nash,Pamela Yellin,这类人很多,他们的理念是:我们应该用储蓄型保险(Whole Life)账户替代银行账户来存钱。

在本文中,我们会首先具体回答第一个“分红率是否靠谱”的问题。我们将采用杠杆财富管理机构CEO马修德克尔的分析方式,用最简单的数学计算,帮助投保人算一算储蓄型保险的分红率和保单内部回报率的问题,看清楚它们到底是什么。

我们希望通过这篇文章的分享,让任何人都可以花5-10分钟的时间,算明白真正重要的核心部分是什么。而在下一篇文章中,我们会回答,上面那些概念,具体到我们个人身上,到底行不行得通。

Dividend Rate 和 Internal Rate of Return

再次强调,保单分红率(Dividends Rate),和保单实际的内部回报率(IRR,Internal Rate of Return)这是两个完全不同的东西。

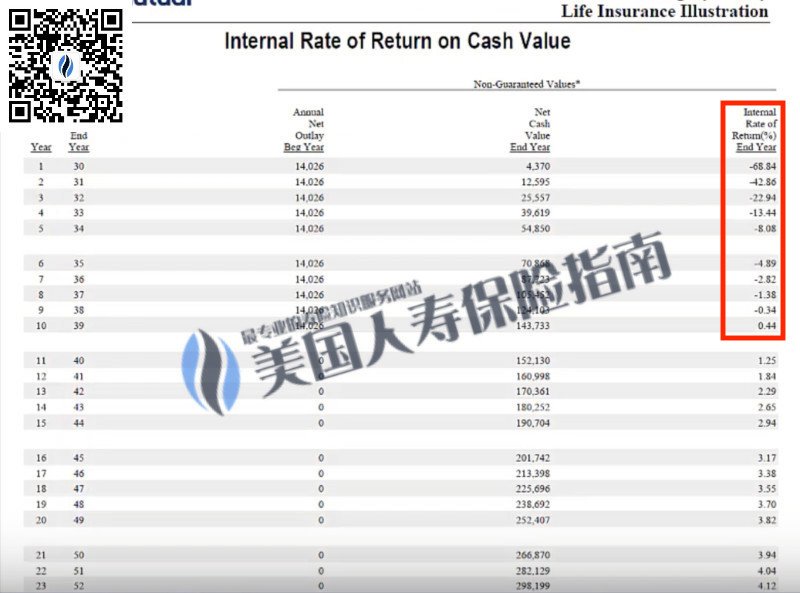

要搞清楚保单分红率和保单实际收益率其实是一件比较容易的事情。我们只需要找销售这份储蓄保单的保险经纪人或直接联系保险公司,索要一份我们保单账户的内部回报率账目表(IRR Ledger)。

这份保单账目表会展示每一年的实际内部回报率。

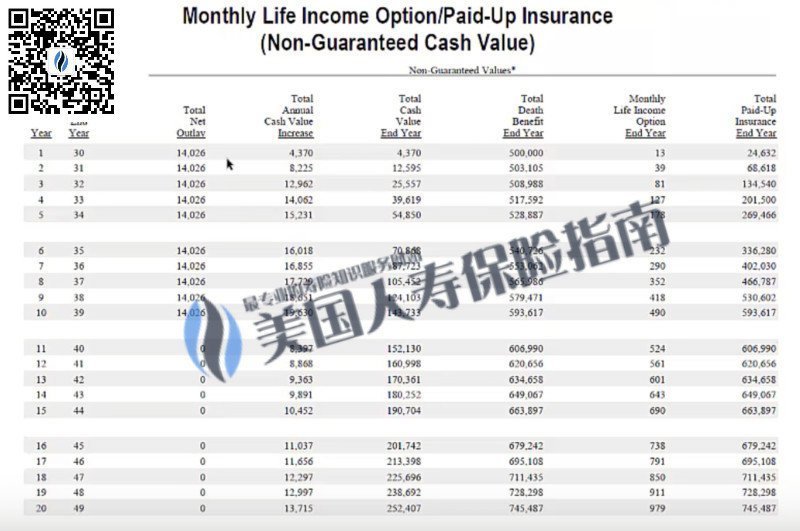

下图展示了一份储蓄型保单,发行公司是知名的M,这家公司在储蓄型保险领域拥有最好的历史分红记录。

这份保单刚好具有文章开头所说的“高达”6.4%的分红。大多数人认为,如果申请了这种类型的保单,他们每年就会实际拿到6.4%的收益。会是这样吗?

先说说分红,如果我们买了$10万块的福特汽车的股票,福特宣布说,我们今年的分红是6.4%,那么我们的股票账户就会得到6400的分红收入。这就是分红的工作原理。

但让我们看看保单,结果却大不一样。

这是一份10年付清的储蓄保单,投保人每年存入$1,4000元,存10年。

这份保单关于投入产出的基本信息是,

- 在头10年,保单的内部回报率为负数,爬升到0

- 在第9年和第10年间,保单的回报率由负转正

- 第10年时,保单账户的现金值打平了投入资金

以上3点是储蓄型保单常见的特点,并不奇怪。

而我们真正需要关注的是,以一辈子的时间为刻度,找到保单的最高内部回报率。

在上图中,我们能找到的最高内部回报率是4.85%。这个数字比6.5%的分红率缩水了不少,为什么会这样?这是有以下两个原因:

一、保险公司账本和个人账本的不同

保单分红率本来就不等于内部回报率,这是两个完全不同的东西,任何储蓄性保单的合同文件里,涉及分红率的时候,都会有一行小字部分,声明分红回报率,并非保单实际收益率。

简单的说,分红率,是保险公司这份公司账本的记账方式,而保单内部回报率是关于我们自己个人账本的实际记账方式。我们不能错误地把保险公司按照公司记账方式计算出来的市场数据,当作我们个人账本上的收益率。

二、储蓄型保险是最昂贵的人寿险种的原因

其次,在我们能申请的所有人寿保险险种中,储蓄型终身人寿保险险种是最昂贵的。最贵的原因是,储蓄型保险提供了3项“确定性(Guarantee)”:

- 要交的保费是确定的;

- 身故赔偿的金额是确定的;

- 提供确定的保证现金值;

在人寿保险中,“确定性”,是非常昂贵的一件事物。如果我们想要在保单中加入“确定”的部分,那么,不管“确定”的对象是什么,也无论险种(储蓄型保险,投资性保险,指数型保险),保单立刻就变得更贵了。

因此,虽然保险公司公布说,今年从公司账本上给到储蓄型保单投保人的保单“分红”是6.4%,但是最后从个人账本算下来,这份保单终身最高只有4.85%的收益。

文章总结

高额的分红利率数字充满了诱惑,但买保险,并非为了投资来发财致富。一味追求数字上的好看,可能会失去投保的初心,在利诱和冲动的双重驱使下,可能最终付出代价。

美国人寿保险指南网一直倡导“Learn Before You Buy”的原则,投保人掌握了一定的基础知识后,通过和专业保险代理人或财务顾问的合作,能更加明确自己的核心需求,避开各种投保误区,从而找到能真正适合和保障自己的产品和设计方案。