在insurGuru©️保险学院上一篇“保单融资到底是什么?我可以向银行借钱来买美国寿险吗?风险有多大?”的专栏里,资深行业专家Jim跟美国人寿保险指南网的读者分享了保单融资的理念,并介绍了一份“典型”的保单融资方案,最后,还对使用指数型保险保单融资方案进行了历史数据下的风险压力测试。

在今天的专栏文章中,我们将继续深入,用一个具体的策略案例,对比使用和不使用保单融资策略这两种情况下,保单的回报差异。

大额保单融资案例分析

今天要请出我们的案例君Jeff,男性,45岁,经营着一家高分子材料公司,公司经营状况稳定,每年有持续的现金流入。

Jeff有一个幸福美满的家庭,家里有两个孩子,就要准备去念大学了。

Jeff开始考虑趁着年轻,寻找一个20年的中长期财务策略,能为65岁之后提供稳定的开销。Jeff不抽烟,爱好跟朋友打高尔夫球,身体非常健康。

Jeff打算在这个财务方案上投入$24万美元。Jeff准备从65岁后,每年从保单取钱出来维持家庭的开销,一直到90岁,共计需要提取25年。

我们接下来就来看看,每年能从保单里拿出多少免税的钱来,以及两种方案的对比。

常规不融资方案

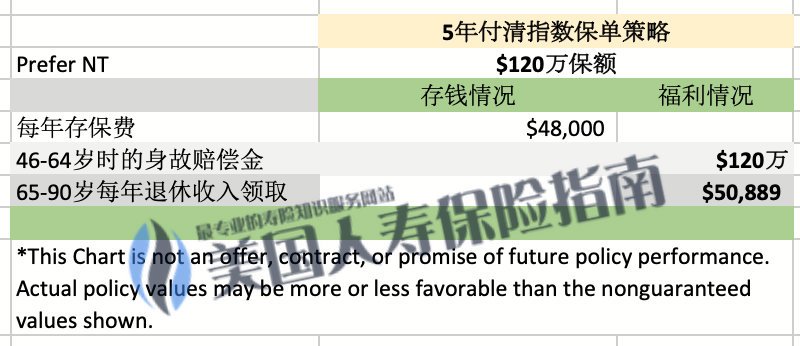

我们先看一下,按照每年存入$48,000元,连续存5年,不使用保单融资的常规方案,Jeff的保单账户表现:

方案选用了一家现金值表现极强的顶尖保险公司,采用了旗下5年就能付清的指数保单作为容器。在连续5年,每年存入$48,000元后,该方案策略开始稳定运行,在6.9%的年平均预测收益下,Jeff在退休年龄到来后,每年能领取$50,889的免税退休收入。

方案选用了一家现金值表现极强的顶尖保险公司,采用了旗下5年就能付清的指数保单作为容器。在连续5年,每年存入$48,000元后,该方案策略开始稳定运行,在6.9%的年平均预测收益下,Jeff在退休年龄到来后,每年能领取$50,889的免税退休收入。

该产品和策略方案的搭配设计,累计投入$24万美元,累计支取$127万,杠杆比达到1:5.2。如果Jeff在100岁身故离世,同时还给后人留下一笔$117万的免税遗产。

1比3保单融资方案

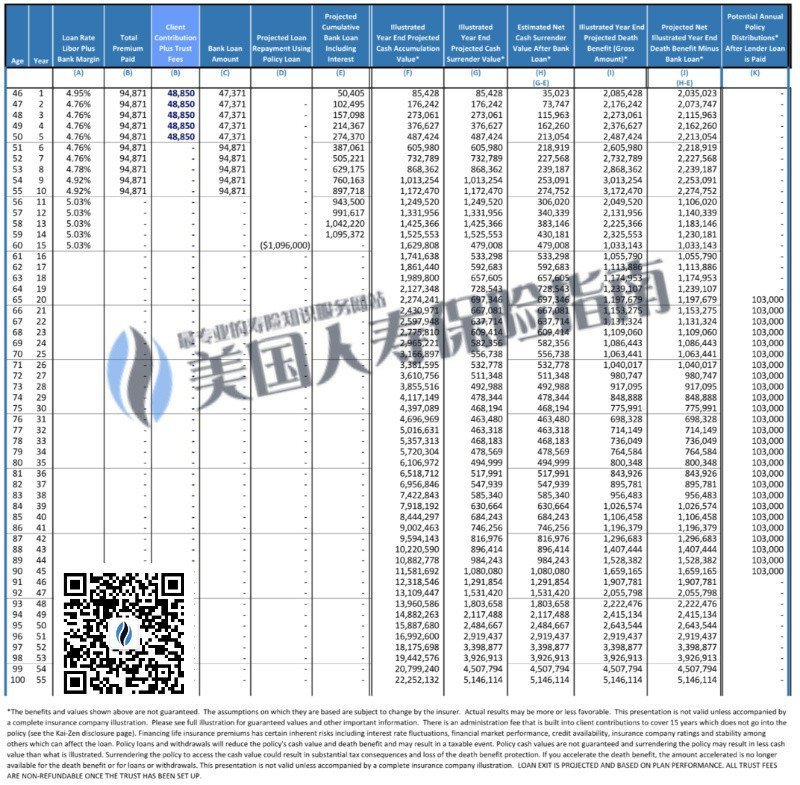

美国人寿保险指南网接下来使用上一个专栏文章提到的1比3融资方案,在同样的选品、预测利率、健康评级条件下,按照下面的策略协议进行保单融资。

- Jeff在头5年,每年存入$48,850的保费,累计支付$24.4万

- 贷款银行在头5年,每年存入$47,371的保费

- 从第6年到第10年,Jeff停止存入保费

- 贷款银行从第6年到第10年,每年存入$94,871的保费

- 融资合约利率为 LIBOR + 1.75%

按照这个策略进行保单融资后,Jeff累计向保单账户存入了$24.4万美元($244,250),贷款银行累计存入了$71.1万美元($711,210),本金和贷款比例为1 : 2.91,接近1:3。

该融资策略方案选用了一家保险公司旗下10年就能付清的指数保单作为容器,以10年付清的方式进行设计。在6.42%的年平均预测收益下,该方案策略开始稳定运行,保单账户现金值超过$300万美元,此时,Jeff欠银行贷款及利息累计$89万。

在11年后,由于市场的变化,借贷利率上升至5.03%,Jeff考虑直接用保单的钱偿还贷款。

在15年的时候,Jeff决定用保单里滚出来的现金值,一次性连本带利偿还了15年累计的银行债务:$109万。随后,保单账户完全归Jeff所有。

20年后,Jeff决定从他的65岁开始,从保单账户里拿钱作为退休收入,每年能领取的金额为$103,000,且完全免税。

该产品和策略方案的搭配设计,Jeff累计投入$24.4万美元,累计支取$257.5万,杠杆比达到1:10.5。比常规投保方案累计多拿$130.5万美元。

如果Jeff在100岁身故离世,同时还给后人留下一笔$514万的免税遗产,是常规方案的4倍多。

(>>>推荐阅读:保费融资进行家庭财富退休计划的优缺点对比及风险评测 )

文章小结

美国人寿保险指南网认为,大额保单保费融资策略,是一个专业且强大的工具型金融策略,整个流程涉及银行部门、信托管理机构,法律服务机构、税务服务机构、金融保险公司以及专业保险经纪人等多方的协作,复杂程度及专业化程度较高。

如果我们的税后个人收入在$10万美金以上,比较关注保单融资带来的杠杆收益,对相关风险有充分的认识和理解,可以考虑在专业的保单融资经纪人的帮助下,选择适合自己的融资产品和融资策略,达到最大化增长潜力的目标。

美国人寿保险指南网将继续关注大额保单融资相关内容,对于有保单融资方案需求、或者有相关经验的行业经纪人或行业理财顾问,欢迎和我们及专栏作者进行沟通学习和讨论。