(美国人寿保险指南网 03/21/2023讯)随着美国银行业地震波及欧洲,瑞士政府在近日宣布,经过紧急磋商,瑞士最大银行瑞银集团(简称 UBS,瑞银)同意收购陷入困境的第二大银行瑞士信贷银行(简称Credit Suisse,瑞信)。

在这次始于美国硅谷银行破产的银行系统危机中,各国政府一改08年的态度,相继充当起了救火急先锋的角色。

而随着瑞信银行以市值一折的价格“贱卖”,对远在美国的哪一类个人及家庭投保人的钱袋子或将产生影响?

(>>>相关阅读:美国SVB硅谷银行破产后,保险公司如何进行理赔?)

(TheLifeTank x 畅聊 Youtube频道)

保险机构投资组合或清零

根据路透社的报道,瑞信银行发行了约172.4亿美元的AT1债券,根据合约,票面价格将会清零,大型机构投资者的这笔投资,面临清零的状态。

根据美国人寿保险指南社区亚太合作机构的数据指出,瑞信银行发行的部分永续债券,在2022年初的利息约为9%,也对进行“保费贷款”的超高净值家庭及个人出售。

晨星数据显示,太平洋资产管理集团(缩写:PIMCO)通过旗下的资管基金,持有约60亿的瑞信AT1债券,是目前已知持有最大的持仓机构。

路透社的报道指出,瑞信银行债券的投资者考虑进行法律诉讼。太平洋资产管理集团(缩写:PIMCO)拒绝就此事发表评论。

太平洋资产管理集团(英文缩写:PIMCO)由位于美国加州太平洋人寿保险公司创办,后被德国安联集团收购。随着事态的发展,更多美国保险集团的直接或间接持仓或将被披露。

(>>>推荐阅读:保险公司拿着我们存入的保费,都投资了些什么?)

个人钱袋子的指数策略前途未知

根据美国人寿保险指南发布的“2022年第四季度美国保险市场中文数据报道”显示,近8成的投保人是因为“美元资产配置(理财增值)”这一原因,投保指数保险。

保单账户,是诸多家庭多年储蓄理财和退休金积蓄的钱袋子。

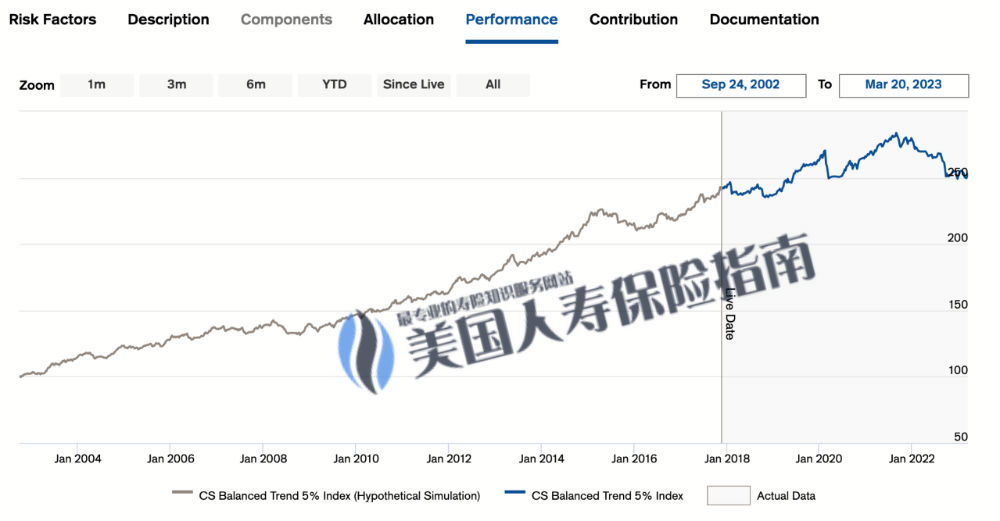

目前,在华人指数保险市场占有率较高的国家人寿保险公司,旗下发行的指数保险产品,均提供了由瑞信集团管理的Credit Suisse Balanced Trend 5% Index (CSTREND5)指数策略。

在过去一段时间发行的指数保险产品中,所有存入保费,默认采用瑞信推出的Credit Suisse Balanced Trend 5% Index (CSTREND5)指数策略进行演示。

自2022年4月底后,国家人寿保险集团调整了旗下指数保险产品的默认演示指数策略,从瑞信银行的Credit Suisse Balanced Trend 5% 指数策略,转变为了法国兴业银行提供的US Pacesetter指数策略。

瑞士银行(UBS)收购瑞信银行(Credit Suisse)后,原有生效的指数策略是否面临业务调整,是否将会进一步影响到华人社区这部分投保人的切身利益,美国人寿保险指南将进一步跟踪报道。(全文完)

(>>>相关阅读:美国指数保险是什么?优缺点及适用领域 )

(>>>相关阅读:美国指数保险中最常见的4大指数分别是什么?)

(>>>相关阅读:人寿报道的“演示”(Illustration)是什么?有什么争议和优缺点)