当开始选购终身人寿保险产品的时候,如何来评估,我们往保单里投入的每一笔钱,多年下来的平均回报率是多少,每年平均下来的成本又是多少呢?同时,我们又如何来衡量,在10,20年,甚至30年的时间里,哪一款保单的年平均回报率相对更有潜力呢?在接下来的这篇文章里,美国人寿保险指南网的编辑将详细介绍,如何使用IRR这项指标,来衡量已经支付的保费对应当前现金价值的回报率。

IRR是什么?

IRR,Internal Rate of Return ,指的是内部收益率。

如同我们日常生活会用尺子来量东西长短一样,IRR通常是投资人,用来对比哪个项目赚钱能力更强的尺子。

IRR定义了导致净现值等于零的复合收益率。请别担心这些拗口的专业术语,我们不会介绍这套复杂的计算方法和数学公式。美国人寿保险指南网只是在这里强调 IRR的重要性,并向读者陈述,它是评估人寿保险保单设计的一项参考指标,可用于将人寿保险产品与其他资产进行比较。

衡量保单的两把尺子:CV IRR 和 DB IRR

当对比人寿保险保单表现的时候,通常有两个IRR指标:CV IRR 和 DB IRR。

- CV IRR,Cash Value IRR,指的是保单现金价值内部收益率。它是以退保时,用户能取出的现金值(Cash Surrender Value)为基础,结合时间价值,计算出来的复合内部收益率。在投保的早些点,CV IRR通常是负数,当到达一个年份以后,转为正值。CV IRR对于评估和比较保单的长期收益表现非常有用。

- DB IRR,Death Benefit IRR,它将积累的保单现金值,与未来年度预期的死亡保险金进行比较得出的保单回报率。该指标在评估不同保单的死亡赔偿金表现是非常有用。

对于关注保单现金价值回报率的客户来说,CV IRR是我们本文介绍的重点。

如何找到我保单的IRR?

在正式申请人寿保单前,保险经纪人首先会给投保人设计一份保单设计方案(Illustration),IRR通常会直接在里面显示。

请注意,即使是同一款产品,不同的保费支付方案,支付年限以及保单需求的方案选取,都会造成完全不同的IRR效果。

接下来我们将展示几份不同类型,不同公司的终身型人寿保单,对IRR这一概念进行说明。

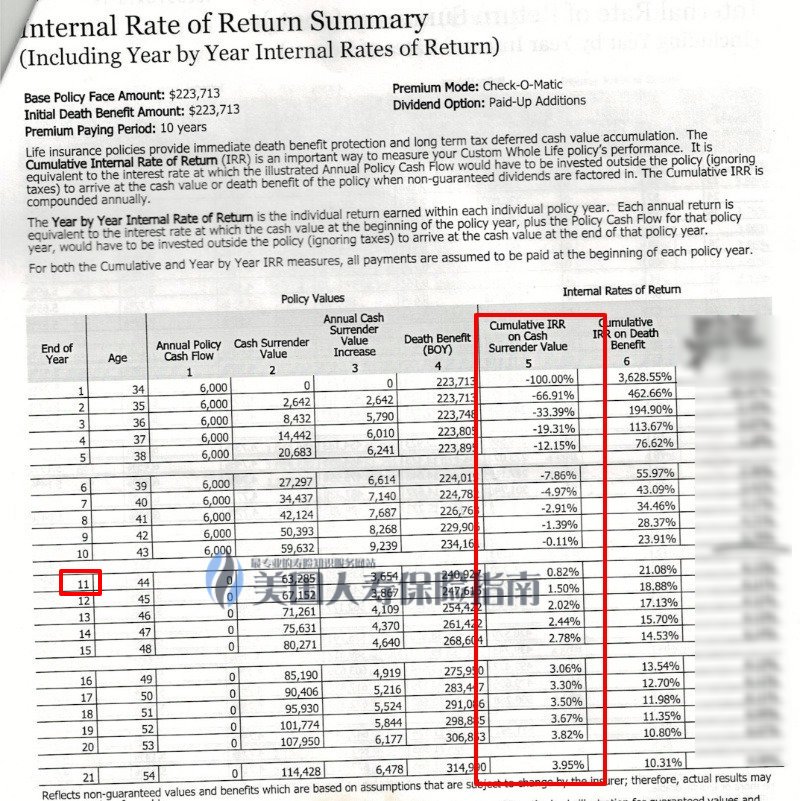

某Whole Life设计方案的IRR说明

上图是某保险公司的储蓄分红型终身保险(Whole Life)的保单设计方案,从上图中我们可以看出,客户采用的10-Pay,每年$6000的保费,10年付清的方案。红框部分是这个保单的现金价值IRR内部收益率展示,从上图我们可以看出,在投保11年后,这款产品的已投入保费的现金值IRR回报率由负转正,在第21年时候,IRR为3.95%。

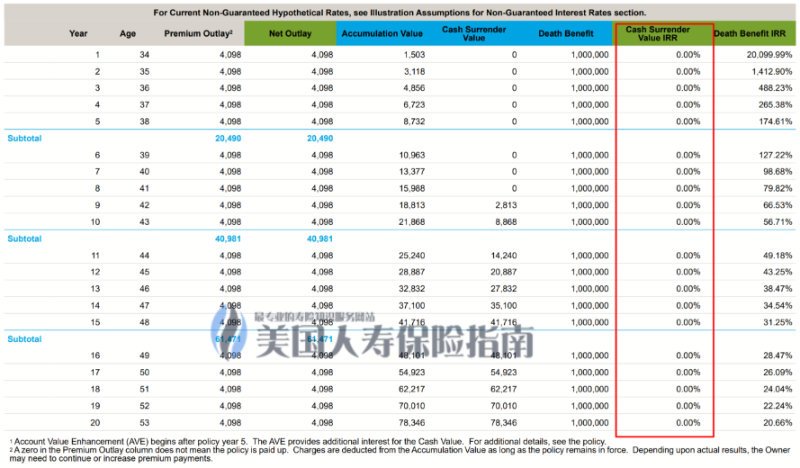

某公司IUL指数型保险设计方案的IRR说明

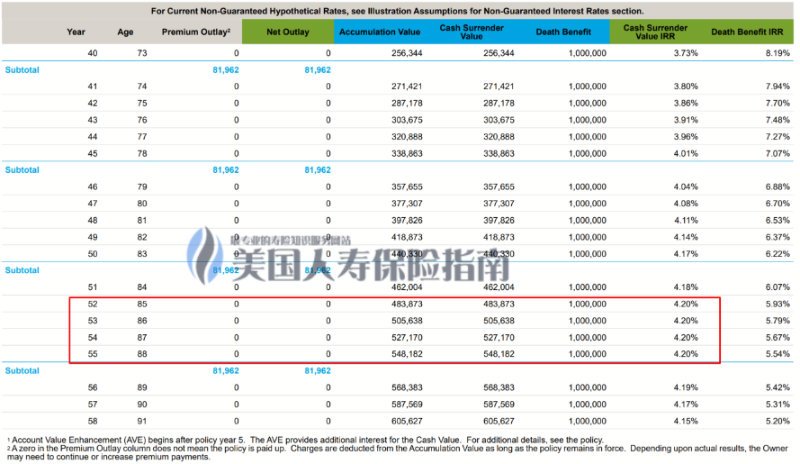

上图是某保险公司的指数型保险保单(IUL)的保单设计方案,从上图中我们可以看出,客户的保费是每年$4098,持续交保20年的方案。红框部分是这个保单的现金价值IRR内部收益率展示,在这个保单设计方案里,在投保20年后,这款产品的已投入保费的现金值IRR回报率显示0%。

在上图中显示,当保单进入第52年时,该设计方案的IRR为4.20%。

保单设计方案不显示IRR上怎么办?

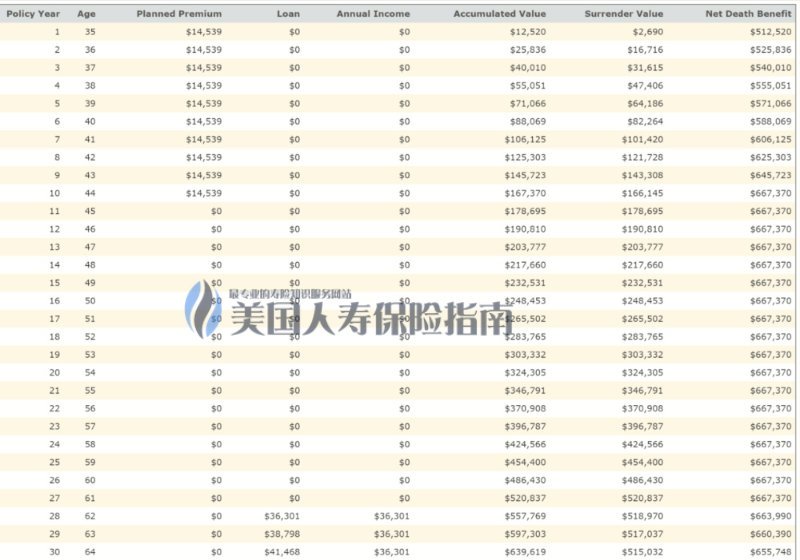

IRR并非一样强制指标,所以不是所有的保险公司都需要展示。对于一些订制的保单,IRR不直接显示在保单设计方案上,你可以向提供设计方案的经纪人,或者保险公司询问。我们以一份不显示IRR的IUL指数型万能险公司的设计方案举例,展示计算后的IRR回报率。

IUL指数型保险方案计算IRR

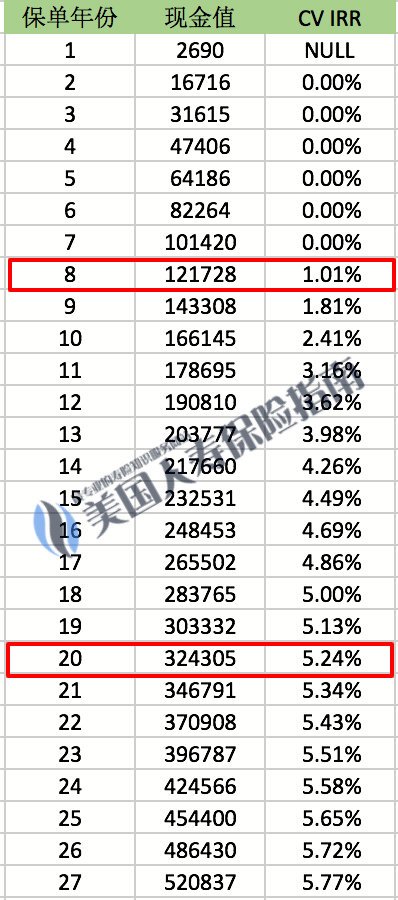

在上图这份IUL指数型保单的设计方案里,给客户设计的是年付$14539,10年支付期限的方案。这份设计方案里,并不显示IRR,通过美国人寿保险指南网编辑的计算,下面是这个设计方案的IRR收益率表:

这张表分为3栏:

- 保单年份,我们选取了27年的时间长度;

- 现金价值,显示当年保单里的现金价值;

- IRR,显示保单在该年份对应的内部收益率;

图表显示,这张保单的这个设计方案,在第8个年头,内部收益率开始又负转正,在20年的时候,保单IRR收益率为5.24%。如果这张保单设计方案的设计方案利率(Projected Interest Rate)为6.0%,那么我们就能计算出,这张保单的平均成本就是0.76%。

综述和总结

单纯地对比今天用于展示IRR的三张范例保单设计方案,我们可以看出得出以下结论。

- 第1张保单设计方案的IRR,在11年的时候由负转正,在投保20年后保单内部平均收益率为3.82%;

- 第2张保单设计方案的IRR,在20年后才由负转正,在投保20年后保单内部平均收益率为0%;

- 第3张保单设计方案的IRR,在第8年时由负转正,在投保20年后保单内部平均收益率为5.24%;

相信了解到这里,作为读者的您,应该知道上述哪一张保单的设计方案的回报最低,风险最高。

IRR指标,往往是很多专业寿险经纪人评估保单的一件秘密武器。从IRR回报率角度进行合理的分析和度量,能判断出一份保单设计方案的财务健康程度和可持续性。通过采取更积极有效的投保方案,能有效避免投保10年后,甚至20年后可能出现的保单风险。在保险经纪人的帮助下,合理设计的保单可以做到风险和回报的更好的平衡,以满足投保人的具体需求。

美国人寿保险指南网旨在提醒公众,专业的保险人员,在帮助家庭,企业和个人找到最适合她们需求的保险产品方面,所发挥的重要作用。

如果您希望了解你的保单设计方案的IRR,可以通过以下两种方式获取免费服务:

方式1:扫描二维码,向持有执照的社区贡献者微信询问

方式1:扫描二维码,向持有执照的社区贡献者微信询问

方式2:向美国人寿保险指南网邮箱提问

[email protected]