现金值人寿保险常用于补充个人或家庭的退休收入。投保人在退休时,可以按月,或按年从人寿保单账户中拿钱作为退休金。这笔从人寿保险里拿的钱,需要交税吗?

本文并不讨论人寿保险的税务问题,而是以我们的观点,给出了“正常”和“异常”的分水岭,并试图帮助独立思考的您来判断,自己的保单是否符合这些状态。

同时,通过本文的分享,我们也希望帮助投保人了解,为什么会发生这样的情况,以及,如何在投保的时候避开这些问题。

营销类社交媒体擅长于制造问题,放大“异常”,随之,再以“权威”的角色出现。如果消费者不能忍受自由市场所固有的危险,放弃自我学习的责任,那么在喧闹的社交媒体里,消费者将屈从于“最大的声音”。 -insurGuru保险学院 LBYB原则

(>>>推荐阅读:科普|用人寿保险进行补充退休收入规划的4大优势)

哪些情况才会收到税表?

美国人寿保险指南网编辑查阅了CFP®️委员会对“现金值”人寿保险的税务规范,其中明确指出:

“Tax will be due only when the policy is surrendered or when withdrawals exceed the cost basis.”

“只有当退保的时候,或者支取(Withdrawals)超过了已付保费本金总数的情况下,才会产生税。”

这个说法很明确,第一种情况,当您有一张现金值人寿保险,基于种种原因,您决定退保,取出保单账户中累计的所有现金值。这种情况下,投保人会收到人寿保险公司寄来的文件。

第二种情况,是我们直接从保单账户中支取(Withdrawals)的金额,超过了我们存入的本金的情况。举例来说,如果我们累计往保单账户里存了10万保费,多年下来,保单账户里的现金值积累到15万,那么,当我们支取(Withdrawals)超过10万后,将会收到人寿保险公司寄来的文件。

人寿保险会寄什么文件来?我收到后该怎么办?

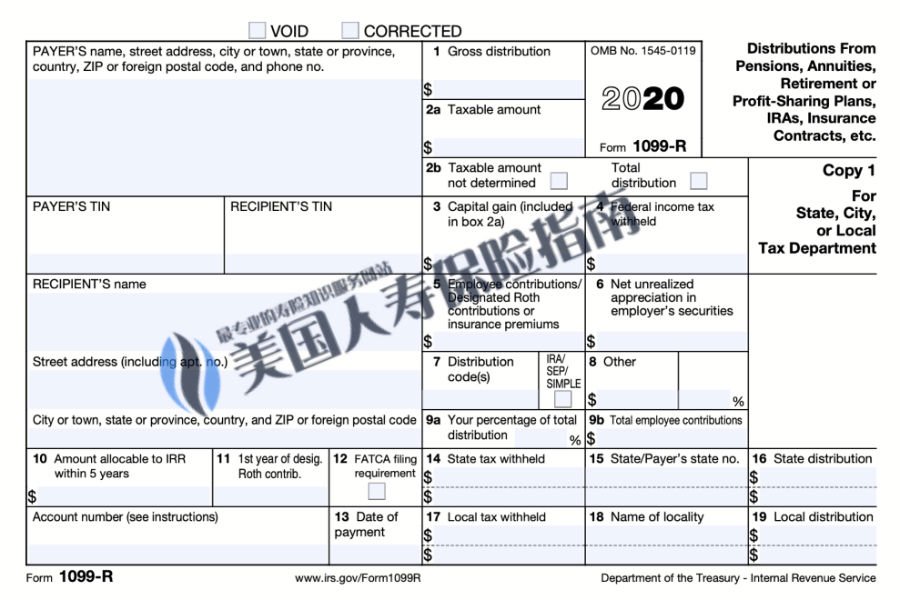

当发生上述情况后,人寿保险公司通常会在每年的税季来临前——通常是在1月——邮寄给投保人1099-R表,如下图所示。

在其中的2a部分,人寿保险公司已经帮投保人计算好了当年需要申报纳税的收入。在即将到来的4月,投保人用此表进行税务申报。

用于退休收入规划的保单,如果收到这样的文件,则意味着已经发生了“异常的事件”。而我们的核心目标是搞明白,为什么会发生这样的情况,以及,如何在投保的时候避开这些问题。

(>>>推荐阅读:退休|如何用终身人寿保险来准备退休的5个问答?)

如何避免发生这种情况?

退休规划保单的投保人,不应该遇到这样的问题。

对于使用人寿保险进行补充退休收入规划,侧重在生前从保单拿钱的投保人来说,遇到上面的情形,均属于异常。

在投保时接受了不合理的保险选品和设计方案,以及在领取收入时,缺乏人寿保险经纪人的专业服务,是导致发生“异常”的两个主要原因。

由于投保时不合理的选品,导致投保人在多年后对产品表现不满意,随后,在缺失专业帮助的情况下,又进行了一次性提取的操作,这是现实中最常见的产生“异常”的案例。

以“退保”为例,不少投保人认为这是从保单账户中提取现金的方式。但这并非“税务”友好的提取方式,也不是拿钱的唯一的方式。

(>>>推荐阅读:科普|退保金是怎么一回事?退保到底划算不划算?)

在您准备从保单中拿钱时,请务必联系您的人寿保险顾问,了解当初申请的人寿保单产品,有哪些提取退休金的方案选择,不同提现方案各自有什么优势,如何计算出拿钱的金额并设计对自己最有利的提现方案,从而避免遭遇上述的“异常”问题。

最后,我们再次总结,从退休规划型的人寿保险账户里拿钱,是一件非常灵活的事情,并没有一个标准的答案。但如果投保人一开始接受的保险产品教育和方案选择就对自己不利,那么在多年后遭遇“异常”的几率就会大幅增加,更会花费更多的代价,去弥补修复“异常”的成本。

(>>>推荐阅读:从人寿保险借贷到底是怎么一回事?借贷是好的拿钱方案吗?)

常见问答

1.我的人寿保单断保了,我没有收到任何钱,但是却收到了一张保险公司寄来的1099-R表,这是为什么?

答:只有一种情况下,会发生这样的情形。即断保的时候,保单账户里还有未偿还的贷款,同时保单在过去的时间里,现金值还出现过增值。满足这3个条件,那么投保人就会收到1099-R表。

在没有断保之前,从保单里拿出的任何现金借贷,都被认为是免税的。为避免这种情况,我们建议选择具有“过度贷款保护功能”的人寿保险产品。

2.我在过去申请的人寿保单账户现金值增长不满意,于是进行了1035转换,结果却收到了1099-R表,为什么?难道1035转换不是免税的吗?

答:法律要求人寿保险公司汇报所有的保单转换行为。因此,如果我们对保单进行1035转换升级,也可能会收到1099-R表。但在绝大多数情况下,表中的应税区域会是空白。

如果在进行1035转换升级时,保单既有收益,又存在贷款,这时候也不打算将贷款转到新的保险公司,那么旧保险公司将会计算出数值,填写在应税区域。如果您坚持这么做,请务必联系专业人寿保险经纪进行保单账户测试。(完)

(>>>推荐阅读:【税季】从人寿保险里拿了钱怎么报税?收到1099表怎么版?保单账户取钱常见问题及解决办法 )

(>>>推荐阅读:【税季】从人寿保险里拿了钱怎么报税?收到1099表怎么版?保单账户取钱常见问题及解决办法 )