人寿保险的理赔金没有税务问题似乎成为了一个常识*。正常情况下,人寿保险合约的理赔金是免税的(详细说明)。

然而,不少家庭或公司在申购人寿保单时,在不知情的情况下,将人寿保单合约做成了“缺陷”的三角保单,从而让保险理赔金,失去了免收入税的优势。

TheLifeTank©️邀请了人寿保险专栏作者 Heather Xiong CFP®️,在本文分享了在申购人寿保险过程中,常见的三角保单“缺陷”情况和后果,以及补救方式。

TheLifeTank©️邀请了人寿保险专栏作者 Heather Xiong CFP®️,在本文分享了在申购人寿保险过程中,常见的三角保单“缺陷”情况和后果,以及补救方式。

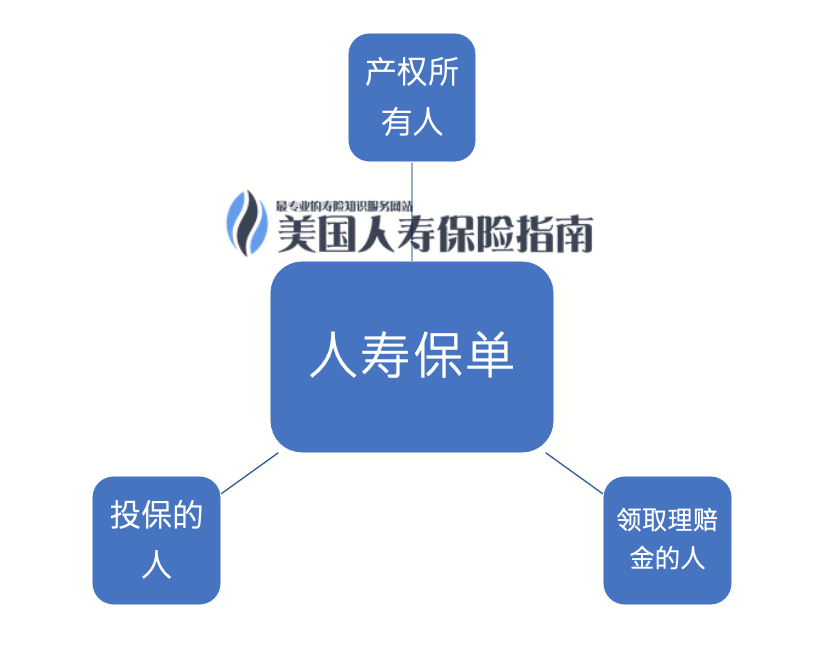

人寿保险三角问题是什么?

在申请人寿保险过程中,我们要填写三个重要的角色,他们分别是:

- 保单的产权所有人(也称持有人)

- 被保单进行保护的人(也称被保人/投保人)

- 保单理赔金的受益人

您可以点击“寿险学院|人寿保险是什么”了解更详细的说明。

当这三个角色分别是不同的人或机构时,这类保单就变成了“三角保单”。

一个最常见的情况就是,丈夫给妻子(或妻子给丈夫)购买人寿保险,受益人设置为子女。这就形成了三角保单。

三角人寿保险面临的税务问题

对于美国境内家庭的三角人寿保单,当保险保护的人,即被保人,去世后,这笔保险理赔金将被认为是一笔赠予,从而需要进行纳税。

具体一点,张先生给妻子李小姐投保了一份100万美元的人寿保险,受益人是子女。李小姐不幸过世后,这$1,000,000万美元将会认为是张先生给子女的馈赠。因此,这笔理赔金需要额外缴纳一笔高额的赠予税。

以2022年父母给子女的赠予税为例,超过$16,000的部分,将会被课税。

而我认为,这背离了人寿保险理赔金免税的设计初衷。

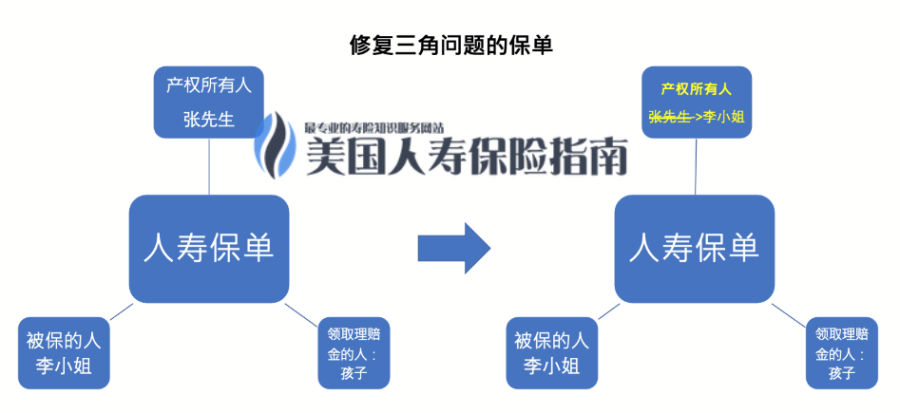

如何修复有三角问题的保单?

一个简洁的修复方式,就是将这三个角色中的两个,设置为相同的人或机构。

其中一种解决办法

让我们对照一下人寿保险三角原则,以上面的家庭举例,只要让李小姐成为这份保单的产权所有人,又是这份保单的被保人,在受益人不变的情况下,我们就避免了这个三角保单所带来的潜在问题。

如果李小姐过世,子女得到这笔免税的人寿保险理赔金。这笔资金可以完全自主支配,用于购房,生活开销,教育等方面。

然而,在现实中情况会更加复杂,不同的家庭,有各自不同的财务生活阶段,实际执行起来,通常会面临不少现实的问题。

我总结一下,对于家庭来说,要避免三角保单问题,需要我们在申请时,将保单合约里三个角色中的两个角色,设置为相同的人。而对于公司购买和高管福利保单的三角情况,我会在之后的专栏中单独说明。(全文完)

(>>>相关阅读:最爱买人寿保险的机构是谁?答案出乎您意料 )

*本文并非税务建议,我们建议咨询您的税务顾问来讨论特定的税务问题