2021年10月,美国国内通货膨胀数据再度“爆表”,消费者价格指数(CPI)同比上涨6.2%,超过5.8%的预期,创下1990年以来的新高。

在物价上涨的浪潮中,又以佐治亚州亚特兰大都会区10 月通货膨胀率接近8%,物价涨幅高居全美大城市第一。

在TheLifeTank的专栏文章“在美国退休下来到底需要多少钱?退休4%法则是什么?”一文中,作者指出了为自己存退休金的计算方式。

然而,在通货膨胀的冲击下,退休一族的退休资产组合,以及常见的退休收入提取计划,也面临缩水的影响。

(>>>推荐阅读:美国人都去哪里养老?美国10个物价宜居退休城市排行榜 及房租价格 )

通货膨胀冲击退休4法则

在TheLifeTank的退休储蓄专栏中,我们介绍了常见的“退休4%法则和10倍法则是什么?”

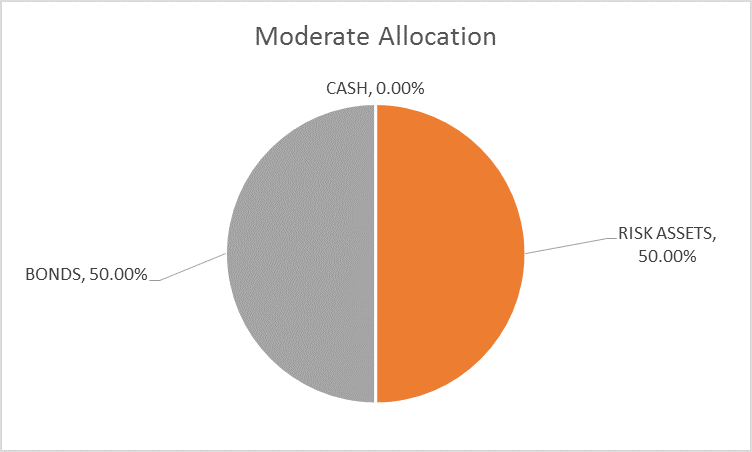

退休4%法则起源于1994的一项研究。在回溯了自1926年以来的历史数据,该研究发现,只要退休资产50%放在股票里,50%放在债券里,那么每年提取初始资金的4%,就可以终身提供退休收入。

然而,在目前超预期通货膨胀的影响下,根据Morningstar的分析,退休一族可能需要缩减开支,降低4%的收入提款比例,才能实现终身提取退休收入的计划。

退休4法则降低0.7%

在接下来准备退休的人们,可能会发现退休4法则,要缩减为3.3%,降低了0.7个百分点。

也就是说,如果我们到了退休了年龄,存下来$100万美金。按照过往的“退休4法则”,每年提取资金总额的4% ——而如今,100万美元的退休资产组合,每年的预计收入将从4万美元,降低到3.3万美元,每年收入将显著减少7千美元。

同理,500万美元的退休资产组合,每年的预期收入将从20万美元,降低到16.5万美元,每年收入将减少3.5万美元。

(>>>推荐阅读:卖房套现后,2种终身现金流退休收入方案科普 和 对比(图))

政府上调养老金,70%靠自己

根据1973年的立法,美国退休一族的养老金,会根据通货膨胀数据,进行调整。

社会安全署在近期发布了官方通知*,退休一族的养老退休金,将会在2021年12月后,上调5.9的百分点。第一笔上涨后的退休养老金,将在2022年1月发到退休人员的手中。

根据社会安全署提供的2020年数据报告,全美有4600万退休族,领取政府养老退休金,平均每人每月领取仅$1,555 美元。政府发放的养老退休金,占到了退休一族收入来源的30%*。

最终,退休后70%的收入来源,仍然需要我们每一个人在退休之前,进行积累和打理。在当前通货膨胀的情况下,随着资产价值的贬值,以往被视为铁则的“退休4%法则”也面临了缩水。

如何有效对抗资产贬值,寻找合理的的退休理财渠道,就成了为退休收入规划的当务之急。(全文完)

(>>>推荐阅读:退休后$100万美元能用多久?看看美国各州的排名)

附录

*https://www.ssa.gov/oact/cola/latestCOLA.html

*https://www.ssa.gov/news/press/factsheets/basicfact-alt.pdf