编者注:本文是“全球高净值项目”认证保险顾问,金融保险专栏作者 Heather,向美国人寿保险指南网©️分享了关于使用“保险”和“信托”这两个金融工具,帮助家庭构建补充退休收入和财富传承的案例(下)半部分。(上)半部分请点击这里浏览。

Recap:企业主Lee先生准备在60岁时,为家庭创造$30万美金的被动退休收入流,以应对未来复杂多变的实业环境。

经过评估保单持有结构,保单资产管理策略,结合Lee先生的现状和核心诉求,我们制订了一份补充退休收入的初步说明表,如下表所示:

该表展示,在三种不同的保单资管策略方案下,如果要实现每年$30万美金的被动退休收入预期,Lee先生如今需要每年存入$17万美金,累计缴存10年。事情就到此为止了吗?

另一面:数值,预期和现实

由于未来尚未发生,预测“数值”是建立在市场历史表现的基础上。因此,一切保单设计方案上的数值,都属于“预期”,未来的实际表现,可能比“预期”更坏,或更好。

同时,保单设计方案也是“人”的产物,不同的人,对于同一工具的运用具有主观差异性,数值的展示也会因此各不相同。

最后,“数字”的展示,只是未来千万种情况下,某一种特定情况的展示,在专业规划的过程中,仅用于评估和参考。如果完全迷信数字,则很容易陷入下面的迷局和误区。

(>>>推荐阅读:美国家庭保单理财误区(三):我们买的到底是什么?)

因此,在实际的退休财富规划的过程中,(上)半部分的数字展示过程,仅仅代表了整个规划过程中的一个方面。

而更为关键,却通常被很少提及,往往是“被忽略”的另一面。

在我们的服务理念中,这个重要的“另一面”理念,不光真正关系到彼此的共同利益,也是专业人员向社区公众传递投保理念的一个重要组成部分。

因此,真正重要的事情,说三遍是远远不够的,我希望说给有心人“千千万万遍”:

1. “数值”仅代表预期。

2. 保单设计方案是“人”的产物,“数值”会因人而异。

3. “数值”的展示,仅用于规划过程中的评估和参考。

因此,这两面其实相辅相成,缺一不可。当Lee先生理解这一点后,就很方便进行下一阶段的分析对比。

最终方案沟通和认定

以(上)部分这“一面”的数值,做为规划的理论参考和基础,并对规划中存在的“另一面”进行详细说明和对比分析,Lee先生立刻一目了然地纵览了全局。在评估完风险预期后,很快和我达成了共识。而这份共识,就形成了最终的可执行设计方案。

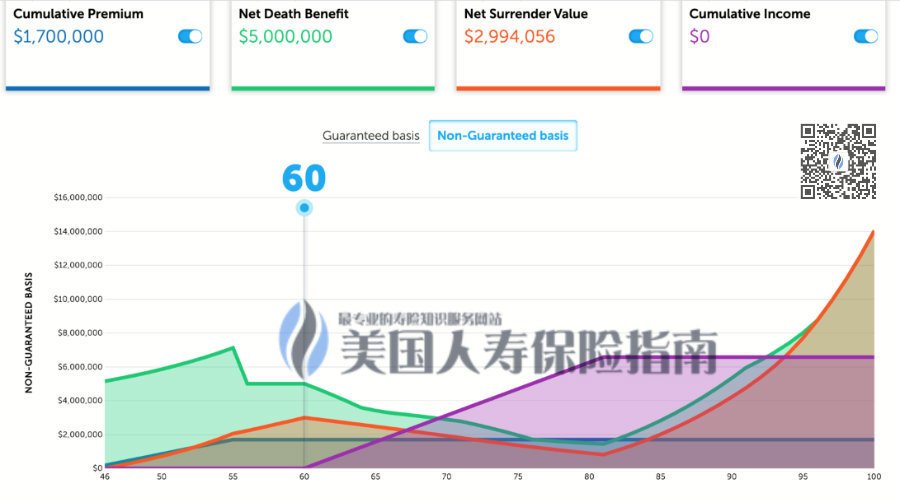

我们向Lee先生动态地展示新的方案下,每年可以从家庭保险信托账户里提领的数值范围,和对应同期的保单理赔金额。帮助Lee先生及家人,能更直观的了解到,在各个年龄阶段,家庭能掌握的财务主动权和范围。

60岁时的家庭保单保单账户运行情况(场景一)

60岁时的家庭保单保单账户运行情况(场景一)

*蓝色曲线( Cumulative Premium ):累计存入的保费;绿色曲线( Net Death Benefit ):保额/保单理赔金额度;

*桔色曲线( Net Surrender Value ):退保金额;紫色曲线( Cumulative Income ):累计提供的收入;

上图示中,横轴表示Lee先生的年龄数字,纵轴表示对应的金额。随着年龄的增长,不同的曲线对应不同的金额。

在60岁时,Lee先生累计存入170万美金,对应的理赔金额度是500万美金。如果Lee先生此时决定放弃此退休收入计划,或不打算将这笔资产留给后人,取消了这个保单,那么Lee先生将一次性从保险公司拿回299万美元*。

80岁时的家庭保单保单账户运行情况(场景一)

80岁时的家庭保单保单账户运行情况(场景一)

到了80岁时,我们可以从上面的图表看到,代表支取的紫色斜线上升延伸了20年,表示Lee先生在这20年间,每年从保险账户中提取一个固定金额的情况。而这20年间累计提取的上限是$625.9万美元。

当提取收入到80岁时,如果Lee先生此时决定取消了这个保单,那么Lee先生将一次性从保险公司拿回89万美元,由于这种领取方式会引起不利的税收后果*,这种方式通常不常见。

而如果Lee先生在80岁时,发生任何意外离世,或需要“长期看护”等专业医疗护理服务*,或被诊断出末期疾病后,该保单将将提供147.8万美金的福利金赔付额度。

从上面的图示也可以看出,该家庭保险信托保单的设计,提领,以及福利赔付条件,是非常灵活的。最终方案不光适应现代社会的养老模式和现代人多元化的生活方式,也帮助Lee先生家人实现了彼此的预期目标。

至此,Lee先生及家人采纳了整个顾问方案,并接受了年度服务协议。

文章小结

在华语互联网社区里,家庭保险信托,补充退休收入保单规划似乎和我们遥不可及,商业的营销和吹捧也喊出了“没有千万上亿的身价就不要考虑了”这样的口号。

各种“误导”的观念和过度的营销,让美国社会里这类朴实的国民普惠性基础金融服务,瞬间被包裹上了华丽的外衣,变得“高大上”起来,并让人产生远在云端的距离感。

然而,这并非事实。

美国人寿保险指南网认为,保险信托和金融类人寿保单,仅仅是金融服务业的两个基础工具,费用上的成本其实并不高。则而通过和专业人员合作,对两者基本工具的灵活搭配使用,并结合每个家庭各自的情况来量身定制,就能达到真正保护自己和家人,综合提升效率的目的。

Q&A:为什么要执行“低保额高保费”?

在(上)部分文章中,我提出了为什么要执行“低保额高保费”策略的问题。

这是因为,对于以“财富积累”和为10年20年后的家庭生活“准备补充退休收入”为主要目的的资产管理型需求,大保额面值,意味着“高成本‘,这会显著拖累扣除成本以外的资金增值速度,并不是一个“值得赞同”的交作业行为。

把握好当前年龄,面值,保费之间的动态平衡关系,以5年,10年,15年为期,匹配不同事情不同投保人家庭的情况,动态监测和调整,才能达到量身定制的退休被动收入目标。

(全文完 ©️美国人寿保险指南 未经授权,严禁转载)

Disclaimer:

*本文内容是对公众进行一个既有市场策略的说明,用于学习和教育的目的。所使用的图表,数值,假设情况并不保证,也可能随时更改。现实的实际结果可能比文中描述情况更有利或更不利。*本文并不构成美国人寿保险指南网及作者的投资建议,及对相关策略方案的拥护,也不构成美国人寿保险指南网及作者对随之而来的税务后果的保证。*本文内容不作为税务或法律建议。在对本文内容中包含的任何信息采取行动之前,请咨询您的律师或会计师。*长期看护赔付附加条款视不同保险公司,投保人所在的国家,地区或美国不同的州而定,具体赔付条件需以保险公司及保险局的规定文件为准。