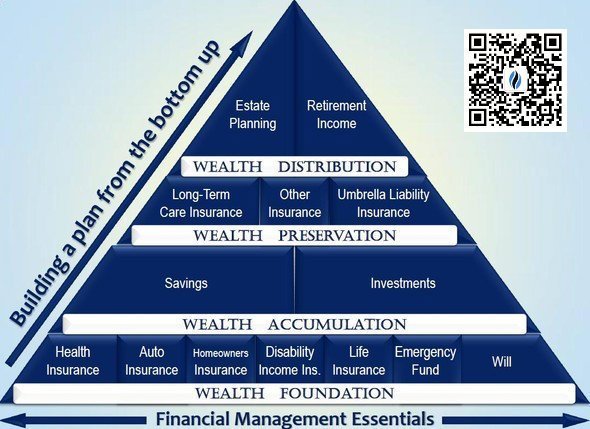

人寿保险是家庭积累财富的基石。insurGuru™️保险学院一直强调,在每一个家庭走向财富积累的道路上,都需要正确配置人寿保险。

人寿保险, Life Insurance,是财富的基石

人寿保险, Life Insurance,是财富的基石

同时,美国的人寿保险又是一个能实现各种 “万能”功能的瑞士军刀,但功能的多样性,又会给大众带来困惑,甚至引起质疑。

正是由于人寿保险的功能多样些,导致了市场存在各种不同的说辞,引起投保人的困惑。如果我们通过正确的渠道,了解到了专业的知识和经验分享,“Learn Before You Buy”,那么我们就能将这个决策过程化繁为简,从而为自己和家人选购到能达成自己目标的合理方案。

为帮助更多的华人读者全面了解美国人寿保险,本文将分享7条投保人不可不知的小贴士。

1.人寿保险分为“定期型”和“终身型”两大类。

定期型人寿保险,简单易懂和便宜。消费者购买10年期,20年期,30年期的定期寿险,按固定的金额按时支付保费,换取指定时长的保障。我们当然不希望用到这笔钱,但是当保单合同到期的时候,我们那时的年龄已经偏大了,如要这个时候选择续保,保费将变得高昂。如果确实预算有限,定期寿险也是一个好的开始。我们会建议您选择带有生前福利的定期寿险产品。

终身型人寿保险,提供保障终身的能力,还多了一个存款功能。这个存款功能,通常被称为保单的“现金值”,用来支撑保单在停止交保费之后继续运转下去。

最早的“现金值”保险是储蓄分红险,这种产品有一个类似买债券或定存的功能。后来出现的投资型人寿保险更像是一个共同基金投资账户,没有保底同时有更高的增长可能性。而最新一代的万能险则是一类给出一个收益上限,加上保底锁利的保障,同时提供价格优势和灵活缴费的终身型保险。

终身型人寿保险发展至今变得越来越专业化和细分。对于高净值人群的遗产规划,以及商业规划来说,终身型人寿保险是唯一的解决方案。

在某些情况下,经过精心规划设计的终身型人寿保单能以获得极大税收优惠的同时,获得最大化的现金价值增长的可能。 但是,这种设计方案必须在专业人员的规划和长久的监控下执行,也仅适用于部分人群,并且仍然依赖其他众多的外在因素来按预期方式工作。

2.人寿保险不仅仅是对人生命的一个货币估值。

相反,它更多是来帮助因为发生重大变故后产生的不可避免的财务后果。在现实中,它可以帮助我们的遗孀支付处理后事费用,偿还债务和贷款,支付子女的教育费用以及生活开销。但最重要的是,在发生意外身故后,人寿保险可以极大的减轻幸存家庭成员面临的财务负担。因此,对于家中收入来源较单一的家庭,人寿保险就像是一颗定心丸。

3.人寿保险是风险管理工具,而非投资品。

虽然一些人寿保险险种和设计方案确实让保单看起来很像一份不错的具有税务优势的“投资”,但人寿保险的初衷并非是成为最佳投资渠道。

对于普通美国家庭来说,在储备好家庭紧急备用金,付清除了房贷以外的所有贷款,放满401(k)或Roth IRA之前,不建议考虑带有“投资”功能的人寿保险产品。

4.如果您是家庭收入顶梁柱,那么您确实需要人寿保险。

如果您是家里财政收入的唯一或核心来源,对于你的配偶,子女或需要照顾的人来说,为您申请人寿保险可是说是一件不容置疑的事情。同时,如果您是公司的重要职员,或者生意合伙人,你也可能需要人寿保险。如果您已经稳定退休,并且财务已经完全独立,能独立支付将面临的所有事务,也没有人依靠您,那您可能不需要人寿保险了。但是,您可能需要考虑将人寿保险作为长期规划的财务工具。

5.找到一名可以信赖的经纪人比什么都重要

一名知识全面,富有经验的经纪人能帮助梳理清晰我们每个人不同的实际情况,并在不同保险公司中进行专业的评估和比较,从而给出有价值的产品和方案建议。

更多的选择权,是一名值得信赖的保险经纪人所能回报给投保人的福利之一。

同时,拥有专业认证和得到保险公司额外认证的专业保险人员,不但可以开展某些特定群体/领域(如全球高净值客户群体 )的服务, 也能代表每一个投保人直接和保险公司进行承保谈判,并在核保过程中争取到更多权益,从而为客户带来卓越的体验。

因此,找到一名可以信赖的,专业从事寿险领域的经纪人,是进行保单财务规划的核心要素。

6.人寿保险是一份合同文件

一份人寿保险,我们通常称为保单,它是我们和保险公司之间的一份合同文件。粗暴一点来说,保险的原理就是收一百个人的钱放在一个池子里,一个人需要理赔的时候,就用这个现金池里的钱进行赔付。

7.人寿保险中有4个重要角色

一份保单里的这四个角色分别是:承保人,保单持有人,被保人,以及受益人。

承保人是指保险公司,负责在面临理赔时进行赔付;保单持有人是指负责向保险公司支付保费的角色;被保人是整个保单来进行保障的对象。而受益人可以是一个自然人,信托,或者一个其他实体,用来接受理赔金。

举例来说,美国人寿保险指南网的编辑J向某保险公司申请了一份保单,J既是保单的持有人,也是被保人,J的先生是保单的受益人。如果J生故,她的先生会拿到理赔金。

文章小结

美国人寿保险,特别是现金值终身型保险,除了提供更全面保障以外,已经进化成为了财富积累和传承的多功能金融工具,但是我们却很少会和朋友谈论和分享关于人寿保险的故事。为此我们并不感到惊讶。

但是,正如我们前一篇文章分析的那样,开诚布公的和家里人讨论财务状况,提前做好一定的专业规划,最终将帮助我们在财富积累的道路上,走得更远。