美国现金值人寿保险作为一个灵活多用的金融工具,已经超越了传统意义上消费者所能理解的消费型保险产品。

换一个角度来说,不管您是冲着“重大疾病”保障的角度来买保险,还是“财富传承”的需求来买保险——申购美国现金值人寿保险,本质都是在购买“金融解决方案”和“理财产品”。

但在申请保单的时候,投保人往往并没有被告之关于美国人寿保险的方方面面。美国人寿保险指南©️的专栏作者,蜂鸟人寿联合创始人 Heather,向我们分享了作为消费者和投资者,应该知道,但通常被忽略的7件关于人寿保险合同的事情。

#1: 犹豫期条款

既然是金融产品,买完发现货不对版怎么办?

所有人寿保单都有一条关于“犹豫期”,Free Look Period的条款。“犹豫期”,也称为“冷静期”,它给予了投保人,在保单申请下来后,无条件退款的权利。

保单的“犹豫期”通常是30天,具体会在保单合同里说明。如果保单合约内容不符合您的预期,您可以在这个时间段里仔细检查和评估。

#2 : 不可抗辩条款

保单申请时有一些情况没告诉保险公司,现在需要理赔,保险公司会赔吗?

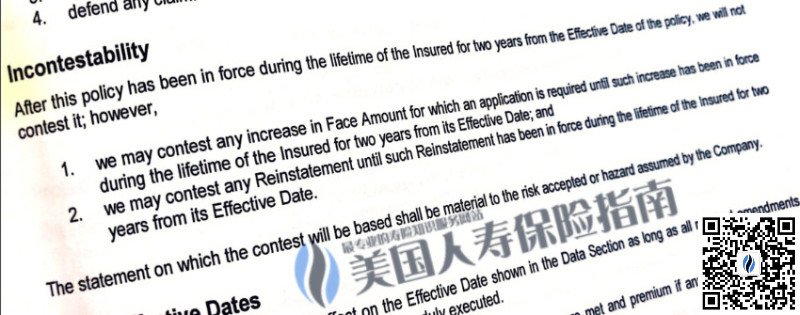

每一份人寿保险合同中,都有“不可抗辩条款”,英文称为Incontestability Clause。这个条款通常会指明,在多少年后,保险公司不得以“未如实陈述”为理由拒绝理赔的情况。

不可抗辩期通常是两年,具体需要查询不同公司的人寿保单合同。保险公司启动不可抗辩条款的情况,将会退还保费。而在不可抗辩期结束后,保险公司需要进行理赔。

值得注意的是,“未如实陈述”与“欺诈”之间存在一个边界。如果被认定为“欺诈”,在不可抗辩期结束后,保险公司可以拒绝理赔。

(>>>推荐阅读:美国人寿保险理赔难吗?保单合同中的“不可抗辩条款”对我有什么用?)

#3: 自杀条款

我们常说,美国人寿保险的理赔,是连自杀都理赔。这在严格意思上并不完全准确。

每一份人寿保单中,都包含了自杀条款,会声明,如果在投保后的头两年内自杀,保险公司将不会理赔。如果发送了这种情况,保险公司一般会退还保费。

在两年后,保险公司通常会对自杀进行理赔。查询保单的自杀条款,保险公司会列出具体的说明。

#4: 宽限期条款

忘记支付保费,或者支付迟了怎么办?

每一份人寿保单里,都包含了“宽限期”,英文称为Grace Period 的条款。

如果我们忘记存入保费,或者因为更换了银行,自动扣款失效等各种原因,人寿保单合同里的“宽限期”,会说明保险公司可以接受投保人延迟存入保费多少天。一般情况下,都是31天。

在这31天内,保险公司依然向投保人提供理赔的福利,也随时等待投保人存入晚付的保费。

#5: 如何支付保费的条款

人寿保单合约中,会写明投保人可以按照什么频率和具体金额来存入保费。

在人寿保险的保费条款中,通常会提供年付,半年付,季度付,月付这四种方式。保费支付的频率越低,我们就会省下越多的钱。年付的保单比月付的保单成本要更低一些。在现金值类型的人寿保险上,如指数型保险,年付保费的模式能显著增加现金值积累的潜力。

#6: 人寿保险附加条款

人寿保险附加条款,英文称为“Rider”。

美国人寿保险的各种理赔福利,就是由不同的“附加条款”来实现的。比如常见的重大疾病的理赔,长期护理的理赔,都是通过增加特定的附加条款的方式,被装进了一份人寿保险保单合约里。

在LifeTank©️之前的“什么是人寿保险附加条款?Rider是什么?”这一专栏中,我们进行了非常详细的说明。

了解您的人寿保单合约都包含哪些基本附加条款,提供了哪些额外的福利,这些附加条款的成本是否值得我们去选购。

#7: 保单的借贷利率条款

作为资产的现金值类人寿保险,都提供了从保单中借贷的条款。

从保单中借钱是自己向自己借钱,不用申报收入,但这样的借贷不是免费。人寿保险公司会收取一个借贷的利率,来满足相关的税务法规,让我们这种借钱的行为成为一个“合格合规”的借贷行为。

不同的借钱方式,有不同的借贷利率。一般情况下,我们为此支付的利息,要少于保险公司给予的分红或计息。

所有保单都明确写出了保单借贷的方式,和不同方式对应的利率相关条款。从保单借钱,会影响保单账户的长期积累效果。优秀的人寿保险产品,提供了有竞争力的借贷利率条款。

(>>>推荐阅读:向人寿保单借钱和向银行借钱有什么区别?)

文章小结

和所有的金融理财产品一样,明白自己在买什么,至关重要。对于有“退保等待期”,定位为“中长期财务规划”的美元现金值人寿保险来说,尤其如此。

如果在多年后,我们才发现对当初申购的人寿保单并不满意,或者并没有达到我们的目标,那么我们可能会面临进退两难的困境。如果这时候重新申请,保费必然会显著增长。

“在购买之前多学习” ,“Learn Before You Buy”- LBYB是美国人寿保险指南©️提倡的投保基本原则。作为投保人,您也可以通过访问LifeTank©️的“保单评测”栏目,了解不同的投保规划案例和投保经历作为参考。(全文完)

给作者留言

关于LifeTank©️ – LBYB

LBYB – Learn Before You Buy,是TheLifeTank.com – 美国人寿保险指南©️提出的一种个人及家庭进行寿险配置的指导理念。鉴于美国现金值人寿保险多样化的金融工具属性,在财富积累和传承领域的应用,已经超越了传统意义上消费者所能理解的消费型保险产品。缺乏相应的基础知识教育和片面教育的影响,可能在多年后会对您的权益造成伤害。在申请保单之前,美国人寿保险指南©️提倡消费者和投资人,事先学习和了解这类金融产品的基本运行原理和功能,从而得到真正能保护家庭及财富的方案。