/ Heather Xiong CPF®️ 保险专栏/ 保险,是日常生活中常见,且有效的风险管理工具。在每一个家庭的收支项目中,保险所占的比重虽然各不相同,但它必然是存在的。

在一个成熟的发达社会,大到车子,房子,生意;小到眼镜,电视,树木,都可以购买保险。

之所以人们会花今天的钱,去规避未来的风险,就是有足够理由相信,在未来实际遇到理赔事件的时候,可以减小损失。

基于这样的“信任”,投保人将现金,换成了未来的承诺。可是问题来了,每家公司都说它可以承诺,那我到底应该选择谁呢?

一句话的双面理解

通常,保险公司的产品资料,或者保单上的小字部分,都会有这么一行字。

“本产品的担保,以某某保险公司的财务实力和索赔支付能力为后盾“。

这句话听起来像是模棱两可。但对同一句话的解读,往往由于立场的不同,也会存在迥异的解读。

从一些投保人的主观角度,会认为,这是不是说,保险公司有一手遮天的裁决权利?

我想,没有人会满意这样的“承诺”。

而从保险公司的立场来看,这句话的分量,是非常重的,背后包含了整个行业,将近两百年来积累的财富,信用等软硬实力的总和。

很多现代保险公司的历史,通常长达100年以上,甚至超过150年。这些保险公司,兑现其保险承诺的信用历史,比一些现代国家政权的持续时间还要长久。

因此,商业化的保险公司,为现代国家社会的经济发展,进一步提供了基础和保障。

保险公司排名的困惑

在和客户实际沟通的过程当中,有不少客户会问到“哪家公司排名最好?哪家公司排第一?”

这个问题,其实没有一个确定的答案。

投保人可能为此感到奇怪,排名一二三,难道不是一件很清晰明了的事情吗?

答案却并非如此。

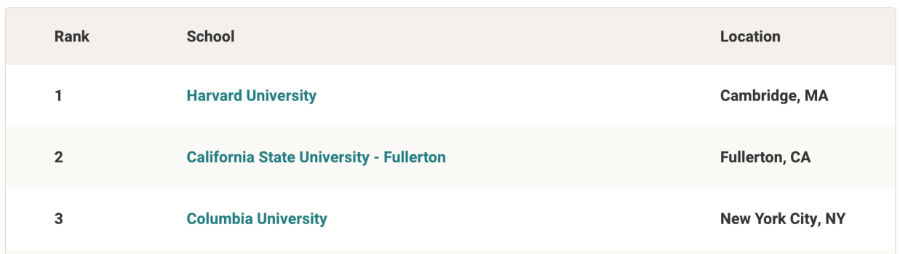

就拿大学排名,来做一个简单的类比。

比较常见的US News排名和Times排名,都会列出不同的筛选条件,同一所学校,在不同的榜单里的排名,也可能相差很远。

平心而论,普林斯顿,耶鲁和哈佛,就真的能排个一二三吗?

我相信,一个同时拿到这三所大学录取通知书的学生,自己心中自然有一个符合自己实际情况的选择标准。

这个最终的决定,绝不是按照排名的先后,而是更看重学校是否能够帮助我们实现长期目标,以及是否能够提供的附加价值。

同样的,保险公司的排名,所依据的指标也各不相同。

有按市场销量排的,有按照保险公司资产规模排的,更有细分到某一特定险种,在某一特定投保人群领域的排名。

而保险公司想要展示给投保人的,往往是自己最高的一项排名。

可以说,每一个保险品牌,在一个充满各类商业评测机构的发达社会里,也一定能拿得出来数一数二的排名成绩。

因此,保险公司的所展示的排名,对于投保人来说,仅仅具有一定的参考性,但绝对不应该是促成决定的唯一考虑标准。

最终,我们还是要从自身的实际情况发出,以目标为导向,选择到能真正实现家庭全面保障的保险产品及设计方案。(全文完)

(>>>相关阅读:为什么要对保险公司进行信用评级?了解信用评级对我们有什么好处?)