全世界的保险业,都是围绕保护资产的需求而建立的。想想我们的汽车、房屋,游艇,甚至私人物品,我们已经习惯了把它们作为需要保护的资产。

因此,对于这些消费类的汽车保险、房屋保险,游艇保险,我们会毫不犹豫地购买对应的保险产品,以面在灾难发生时,保护这些资产的价值。

那么问题来了,我们的现金,投资组合,难道不应该也被当作需要保护的资产吗?

为什么要进行资产保护?

一个家庭的资产组合通常由个股,ETFs,和债券构成。我们长期持有这类资产组合,是因为我们认为,随着时间的流逝,我们的财富也会对应累积。

我们之所以这么因为,是因为我们身边的媒体,朋友,都这么说,这也通常被认为是“常识”。但从数据*上,自 1928 年以来,标准普尔 500 指数(S&P500)已连续 42 次下跌超过 10%,其中 20 次的跌幅幅度超过 20%。

最近的例子是 56.8% 的崩盘,始于 2007 年,并在 2009 年触底。而始于2022年的下跌,又一次超过了20%。

如果知道这些“灾难”性的市场事件,我们当然会提前反应进行投保。

但绝大多数人总是希望反弹在上涨周期中跑赢大盘,忽略了巴菲特一再强调的“绝不亏钱”基本原则,以及长期稳定盈利的复利增长策略。

(>>>相关阅读:“绝不亏钱”,资产型人寿保险的FLOOR核心功能是什么意思?)

(>>>推荐阅读:(图)401K退休金账户平均亏损20%,今年成为退休最坏的一年?)

风险显著增加的新保护机制

考虑到过去沸沸扬扬的中美贸易战,英国脱欧,俄罗斯地缘政治风险,及近期发生的英国政要辞职,日本前首选遇袭,以及美联储的加息举措带来的经济硬着陆风险,对资产进行保护的时机已经刻不容缓了。

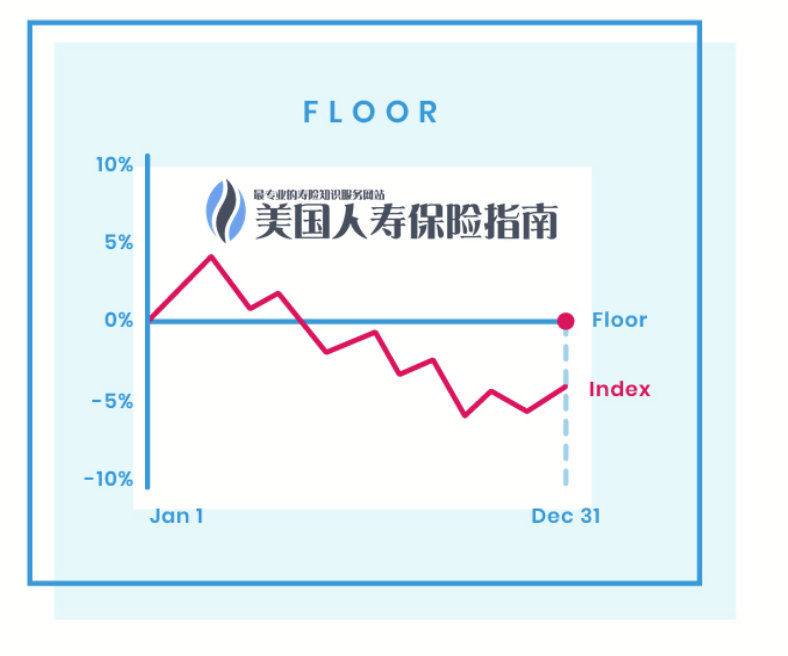

传统上我们知道,保险公司会对标普500指数(S&P 500),道琼斯工业指数和纳斯达克100指数提供资产保护策略,保证保单账户里的资金,在暴跌的市场环境下,给予0%的托底收益保护,即上图所展示的FLOOR策略。

除此之外,一些以“资产管理”为核心业务的保险集团,提供了更多低波动性量化策略和独特的资产保护专利机制。

(>>>相关阅读:评测|2022年最佳低波动指数账户及保险品牌排行榜 )

新选择:排除资产收益为“零”的可能性

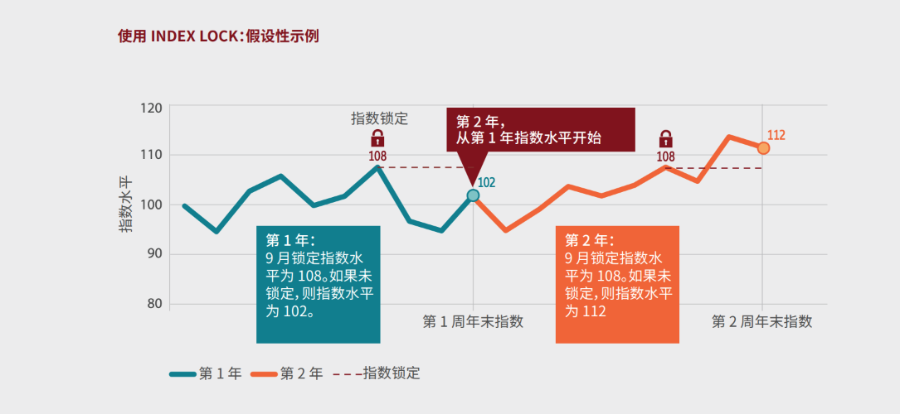

但以“资产管理”闻名遐迩的顶级保险公司,对于保单账户里的资产,不光提供了0%的FLOOR保底承诺,还提供了“指数收益锁定”的加强型功能,或将帮助投保人在波动的市场环境里,通过主动控制保单账户,锁定市场短期反弹内的收益,从而排除了资产收益为“零”的可能性。

(©️安联保险 指数收益锁定 公众消费者M-7391手册)

(©️安联保险 指数收益锁定 公众消费者M-7391手册)

这类能实现主动管理的资产保护保险品牌,相应地对投资人和投保人家庭也有更严格的筛选和准入机制,通常主要服务于全球高净值家庭。

想想我们买卖房子的情况

如果10年前,您买了一栋价值$350,000的房子,现在以$400,000的价格卖了出去,然后我们会告诉亲朋好友,我卖了一栋房子,赚了$50,000快,净收益是 14.2%。

而实际情况是什么样子呢?可能在过去的10年里,我们累积支付的房屋保险,可能远超过1万元。扣除房屋保险的成本后,我们的的实际收益是$40,000块,净收益位11%左右。

理论上来说,我们可以不买房屋保险,来降低我们的成本,对不对?但是现实中几乎看不到任何人会这么做。

(>>>推荐阅读: 年度晒帐单:股市下跌我赚钱?|指数保险账户的保证最低收益是什么?)

文章小结

为我们家庭的资金和投资组合找到合适的保险并不难,所有的资源和产品一直都摆在那里。

只不过对于大多数从事投资理财的家庭来说,要让我们放弃投资组合的增长潜力,是一件有点违反本能的事情,我们也一直自信满满能跑赢大盘。

但当一次又一次灾难性的资产价格暴跌到来时,当我们的股票和资产账户大幅缩水的时候,我们才会重新审视这个问题。直到人生的阅历和财富的积累到达了一个新阶段,我们可能才会采取行动。

然后,我们的一生中,又有多多少个10年呢?(全文完)

(>>>相关阅读: 选购资产型保险?和保险顾问讨论的3个核心问题是什么?)

(>>>推荐阅读:赚$100万难吗?掌握这20个好习惯,您最终会成为百万富翁)

附录 * “Stock Market Briefing: S&P 500 Bull & Bear Market Tables”, Yardeni Research, Inc. 2022, https://www.yardeni.com/pub/sp500corrbeartables.pdf