VUL保险简介

VUL保险,英文称为 Variable Universal Life Insurance,中文全称是投资型万能人寿保险。

VUL保险,在中文世界也被翻译为“基金保险”,“可变/变额保险”,“投资型保险”,“投资连接保险”,或“投连险”。

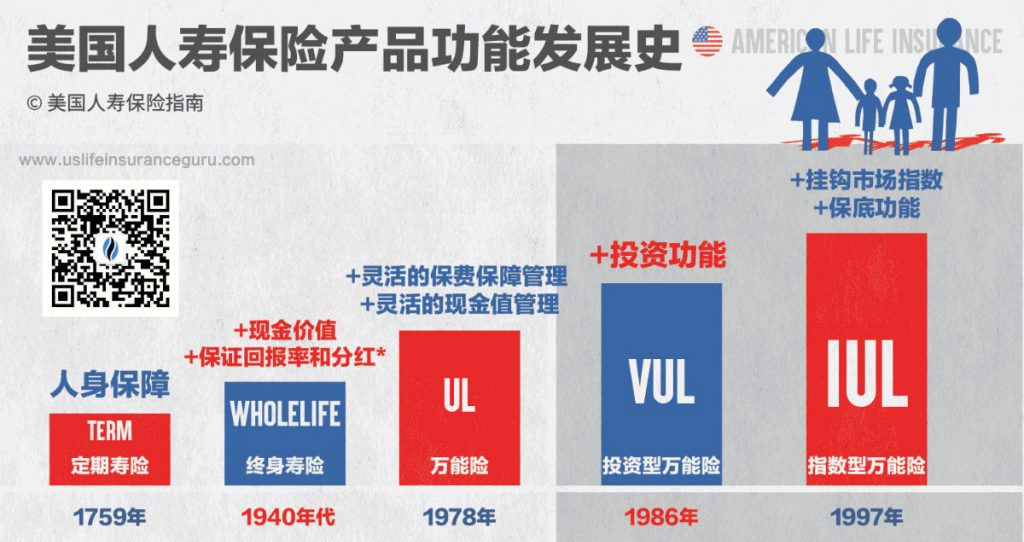

世界上第一款VUL保险出现在1986年。在市场行情持续向好及高通胀的经济周期,VUL保险受到了投保人和投资人的青睐。

根据TheLifeTank©️(美国人寿保险指南网)在2021年底的发布的数据报告,VUL保险占据了美国13%的行业市场份额。

(>>>相关阅读:数据|增长104%,美国VUL保险成为抗通胀大赢家 )

VUL保险是什么?

VUL保险(Variable Universal Life ),是一份投保人(即投资人)和保险公司签署的一份合同文件。

签署申请文件后,投保人就在保险公司开设了一个账户。同时,保险公司还提供了一笔死亡理赔金,支付给家人,或指定受益人。

VUL保险账户里的金额,被称为“现金价值”。账户里现金价值的多少,主要取决于存入了多少保费,每年的成本开销,每年的投资回报率这3个因素。

VUL保险如何运作?

VUL保险,即投资型万能人寿保险,是万能险的一个进化衍生产品,继承了万能险“灵活交保”等特点。

VUL保险属于人寿保险,和其他人寿保险一样,提供一个基本的死亡理赔功能。

在开设VUL保险账户后,我们得到了包含了“死亡理赔”和“现金值投资”两个部分的功能。

VUL保险如何运作:投保人需要向VUL保险账户里存入保费。在扣除了成本后,保单账户里多余的保费,进入到账户内建的投资选项中——通常是股票基金,债券基金,或货币基金,进行投资理财。

这些投资选项直接参与证券市场,在市场中投资,可能带来亏损,也可能带来可观的回报。

VUL保险账户里通常还会提供一个固定利率的定存选项,如果选择把现金值资金放入到这个投资选项中,保险公司每年将提供一个保证的收益率。(如3%)

随着市场激烈的竞争,少数VUL保险产品开始提供指数基金,组合基金的和更多附加的保险保障功能(附加长期护理保障,附加慢性疾病保障等等),您可以向您的人寿保险财务顾问询问,了解更多内容。

VUL保险投资功能举例

我们申请开设了一份VUL保险账户,一次性存入了$10万美金。我们选择50%的资金($5万)去投资债券基金,另外50%的资金($5万)去投资股票基金。

一年以后,股票基金涨了10%,债券基金涨了5%。

这时,在扣除各项成本前,我们的VUL保险账户里就有了$107,500的现金值,年收益为7千500美元。

$50,000 x 10% + $50,000 x 5% = $7,500

VUL保险值不值得买?VUL保险的优点

“人身保障+收益潜力+税务优惠”,是VUL保险受到投保人青睐的核心优点:

1.提供人寿保险理赔金 – 如果不幸去世,我们的家人,或指定受益人,会得到一笔死亡理赔金。这笔资金往往比我们支付的保费要高很多。

2. 较高的收益潜力 – VUL保险账户的现金值直接参与市场,没有收益封顶利率(Cap)的限制。除了享受无上限的增值潜力外,VUL保险账户还可以享受到基金分红(Dividends),常被认为是对冲通货膨胀的人寿保险类型。

3. 投资享受延迟纳税 – 延迟纳税,英文称为Tax-Deferred,这是一种税务优惠政策。VUL保险账户里的投资收益(资本利得),无须缴纳相应税费。同时,在VUL保险账户里进行交易,也无需缴税。每年税季不会收到税单,这是和投保人自己理财相比,最大的优势。

4. 没有收入和资金量限制 – 不同于具有同样税务优惠条件的个人退休账户IRA或401K账户,VUL保险账户没有申请开户的收入限制,也不受年度$5,000/6,000,$20,500/$27,000的资金限制。投保人可以一次性存入任何资金量。

VUL保险的缺点

关于VUL保险缺点的批评和讨论,普遍认为有以下几点:

1. 投保人承担市场风险 – 通过投资子账户基金的选择,投保人直接参与了市场,收益直接和市场的涨跌直接挂钩。“风险”和“不确定性”是投保人需要管理的因素。

2. 相对更高的成本 – VUL保险,更像是一个主动型基金管理方式的保险, 所以它的收费,可能比传统万能险和IUL保险更高。

3. 部分VUL保单账户里,投资子账户的选择有限 – 一些传统VUL保单,或者传统保障型人寿保险公司所发行的VUL保单,功能往往比较单一,里面提供的投资子账户选择有限。

4. VUL保险更加复杂 – 由于引入了投资子账户选项的概念,投保人面临更多选择和学习的内容。每年的投资回报分析,取钱时的策略操作,都需要持有额外执照的专业保险财务顾问的协助。

根据WikiPedia的观点,关于VUL保险产品的批评,更多是集中在”销售方式“身上,最有争议的一个批评是:

- 人寿保险经纪人在销售保单时,使用最高的演示预测利率进行销售 – 人寿保险使用8%-12+%的预测年化收益率,向投保人展示保险设计方案(英文名:Illustration),而不向投保人展示其他情况的预测年化收益率,供投保人决策。

(>>>相关阅读: 评测|人寿保险Illustration保险设计方案的争议和看点:PPT大战?)

VUL保险的适用群体

如果投保人符合以下条件,可以考虑VUL保险:

- 需要人寿保险身故理赔保障

- 有一定投资经验的投保人

- 偏好主动型-半主动型的投资理念,希望完全参与和分享股市的上涨和分红潜力

- 接受市场的不确定性和由此带来的波动,波动包括可能亏损本金的情况,或达到远超预期投资回报的情况。

总的来说,VUL保险(投资型保险)适合于需要人寿保险保障,同时又寻求较高的收益潜力,同时还享受税务优惠的中长期理财产品的群体。(全文完)

附录:

*. “Variable Universal Life Insurance”, https://www.investor.gov/introduction-investing/investing-basics/investment-products/insurance-products/variable-annuities

*Disclaimer:*不同品牌的VUL保险产品的具体运作和表现情况,由不同寿险品牌的政策和附加条款具体约定,本文仅用于教育目的,不构成投保或投资建议.