(insurGuru©️保险学院 专栏)在申购人寿保险的过程中,我们往往特别关心,美国保险理赔难吗?美国保险公司会不会拒绝理赔?这个时候,专业经纪人通常会拿出保单合约中“不可抗辩条款”进行分析。今天美国人寿保险指南网©️的这篇专栏文章就将介绍,美国保险合同中的“不可抗辩条款”具体“长”什么样,是什么意思?对我们投保人有什么用?为什么说它解决了保险“理赔难”的问题。

“不可抗辩条款”是什么?

不可抗辩条款,英文称为 “Incontestability Clause”。 该条款是绝大多数美国人寿保险合同里面都有的一个条款,用来避免因为在投保时“未如实陈述(Misstatement)”,保险公司在几年后以此为理由拒绝理赔的情况。

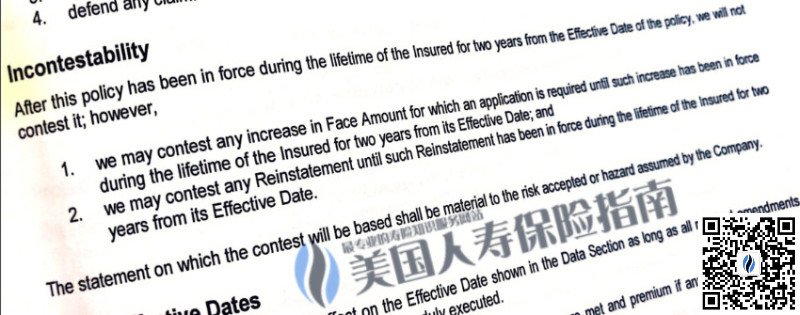

“不可抗辩条款”长什么样?

不可抗辩条款的主要作用是保护投保人。在美国人寿保险指南网©️编辑提供的一份终身保单文件的截图中,展示了该条款的具体内容。一份典型的不可抗辩条款会指明,在2年或者3年时间后,保险公司不得因为“未如实陈述(Misstatement)”,而拒绝理赔。

在上面这个案例中,该条款帮我们解决的是,因为投保时“未如实陈述”,两年后发生理赔的情况,保险公司不得以此为理由,拒绝理赔的的问题。

那我们不禁要问,为什么会有这样的条款出现呢?美国人寿保险指南网©️认为,要回答这个问题,则要从欧洲人寿保险行业的发展历史回顾起。

拒绝赔付引发信任危机

19世纪初,英国的人寿保险市场,经常保险公司拒绝赔付的情况,理由是投保人在投保时有不如实告知的事项,类似的合同纠纷层出不穷。

保险公司当时甚至被戏虐为“伟大的拒付者”。这种现象也直接导致了保险公司的信任危机,威胁到了保险公司的生存发展。

推出不可抗辩条款挽回信用

1848年,英国伦敦寿险公司出售的产品中首次应用了不可抗辩条款。即合同生效一定时期之后,保险公司就不得以投保人误告、漏告等为理由拒绝赔付。不可抗辩条款推出后,就受到了市场的普遍欢迎,并极大地改善了保险公司与投保人的关系,为保险公司赢得了信任。

到了1930年,不可抗辩条款首次成为法定条款,由美国纽约州保险监督管理部门在该州保险法例中加以规定,要求所有人寿保险保单必须包含此条款,以约束保险人的行为,保护保单持有人的利益,防止保险公司不当得利,最终保护整个保险业的健康发展。其后,不可抗辩条款通过立法的形式,美国人寿保险合同中的一条固定条款。

“不可抗辩条款”的不适用情况

值得注意的是,“不可抗辩条款”是对“未如实陈述(Misstatement)”条件下的描述,如果被保险公司认定是“欺诈(Fraud)”,则不受该条款的保护。同时,“自杀”赔付情况也通常不在该条款的适用范围内。

“抗辩期”两年内发生理赔的情况

如果“未如实陈述(Misstatement)”,在保单合约约定的两年内,就出现了理赔情况,那么可能出现三种情况:退还保费;不退保费;按条款理赔。这三种情况中前两种情况都会影响到我们的权益,还可能出现无休止的官司。

购买美国人寿保险,是为了发生意外时,有保险公司在经济上的进行兜底,从而让心里踏实。但如果我们以“未如实陈述”的方式买了保险,可能连睡觉都会在想着:两年内遇事后到底赔不赔?这种长期的内心不踏实,其实又是一种折磨。那这不是在买保险,而是以“侥幸”心理,购买了一份新的风险,并给自己带来麻烦。

因此,美国人寿保险指南网©️提醒投保人,尽管有“不可抗辩条款”的存在,但为了彻底转移我们自身的风险,如实陈述和申请非常重要的,而且一定要如实告知。

文章小结

从人寿保险行业的法规发展历史我们可以了解到,“不可抗辩条款”的诞生是源于欧洲早期保险行业的“信用”危机,最后发展成了以“保护保险消费者合法权益”为主要功用的行业标准,这个走向健全的历史进程足足经历了近200年。

因此,有了写入合同的具有法律效益的条款作为保障,相信读者已经对美国保险理赔难吗?保险公司会不会不赔?这个问题有了自己的答案。

附录

01. “美国保险法中不可抗辩条款规定及其启示”, 04.2018, 中国保险报, https://bit.ly/2o7PMnv