“存入25万,利率1.x%,还有$1000的开户奖励“,这样的银行揽储广告,是不是经常看到,而且很心动?不管你心动不心动,反正我天天惦记着了。

直到后来,拿了好些年0.01%的银行利息后才知道,人寿保险公司发行的年金账户,利率通常更高,而且送起开户奖励来,一点也不含糊。

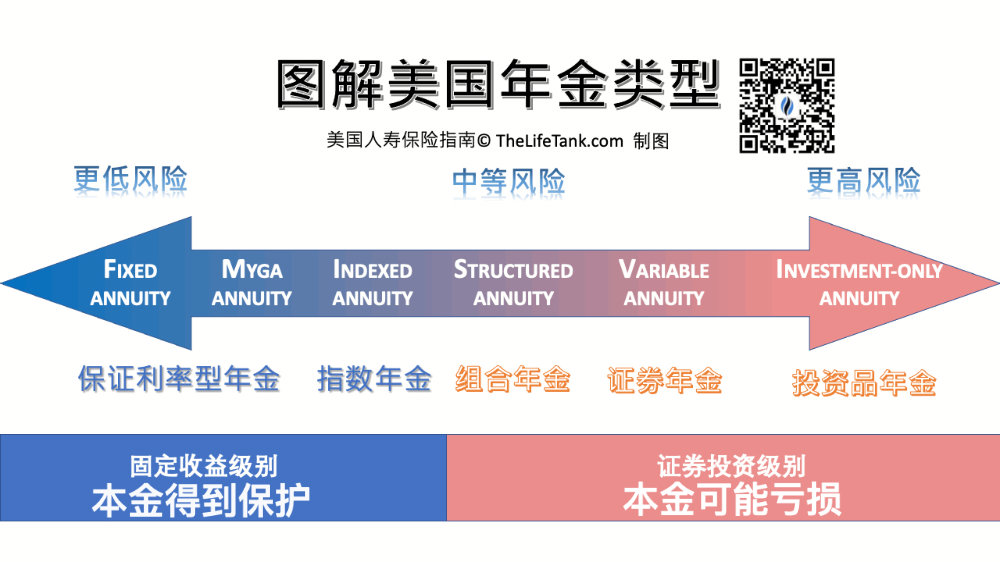

但美国市场上的年金账户的类型有很多种,具体到产品更是多如牛毛,在开始之前,我们得大概了解下,美国不同类型的年金,各自的“利率”到底意味着什么?利率是否指的收益率?以及怎么去找最优“利率”的年金保险产品。

1. 固定利率类年金的“利率”

固定利率类年金给出一个“固定“的利率。“X年期年金账户基本利率2.0%,额外Bonus奖励1%*”,这种就是常见的人寿保险公司吸纳储户的促销广告。

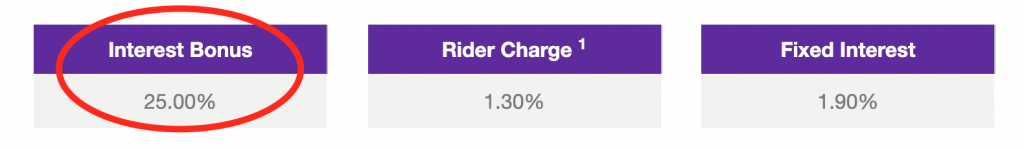

e.g. 某年金产品提供25%的收益奖励(2020/12/14)

e.g. 某年金产品提供25%的收益奖励(2020/12/14)

固定利率年金和银行的定期存款非常相似,利率就是成为主要的对比因素。

如果我们开设了固定利率类年金账户,账户的资金将按照约定的“年利率”,进行复利的增长。

在“固定利率年金保险(Fixed Annuity)是什么?”一文中,我们进行了详细的解释。

2. 指数类年金的“利率”

这类年金账户的开户促销广告通常是,“存入$10,000,保证增值到$20,000*”,“开户奖励本金的10%*”等等。

指数年金的增值“利率”,分为一个保底利率和封顶利率,每年的收益,是不固定的。年金账户里的实际收益率,不会低于保底利率,也不会高于封顶利率。

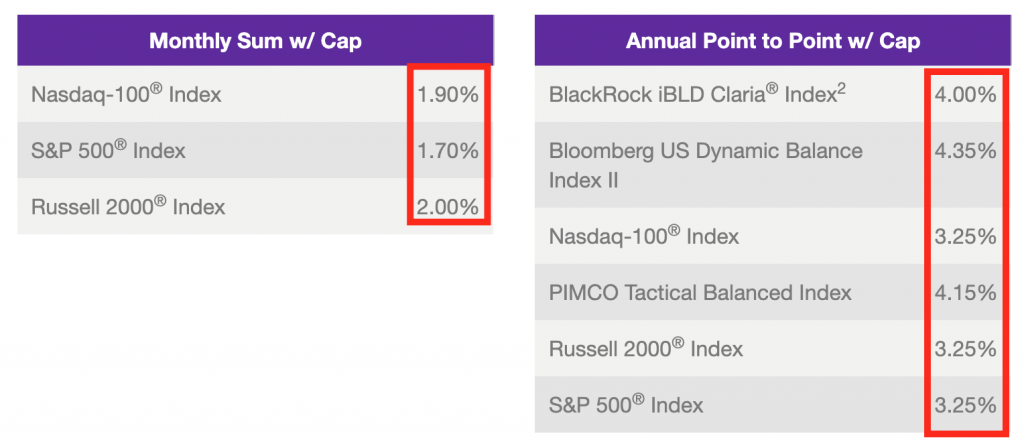

e.g. 某指数年金产品里不同的封顶收益率情况(2020/12/14)

e.g. 某指数年金产品里不同的封顶收益率情况(2020/12/14)

简单的说,就是我们交易了部分收益潜力,换来保险公司承担股市下跌的所有风险。

根据保险公司及保险产品的不同,保底利率和封顶利率之间的利差通常在2%到5%之间。截止2022年1月,挂钩SP500的指数型年金账户,市场平均的封顶收益率是3.5%。

如果希望得到更好的利率区间,一些保险公司则允许我们付出成本,来购买这种更高的收益可能性。

3. 证券投资类年金的利率

这类年金账户属于证券衍生产品,受金融监管局和保险局双重监管。

由于我们的保费直接进入了股市,因此,证券投资类年金无法提供保证的收益率。这类年金账户每年的收益率,是直接跟证券市场标的的走势和年度实际回报来决定的。

这类年金账户通常会购买共同基金,这也是证券投资型年金又被称为“基金保险”,“基金年金”的原因。账户收益,跟当前市场的起伏而涨涨跌跌,每年账户里的实际的收益率,跟我们在年金账户里选择的投资对象直接关联。

由于这样的特点,当我们收到一份证券投资类年金账户的开户报价和建议书时,文件上面的数值会回顾过去的“年度”收益情况,并根据历史市场表现,预测出来的可能的回报情况,供投保人做参考。

(>>>推荐阅读:美国年金保险产品类型比较 价格及优缺点对比(2021版))

4. 即期年金(收入年金)的利率

对于立刻开始取钱的即期收入年金,它的利率,是根据投保人当时的年龄,性别,和选择的领钱周期来决定的。虽然我们立刻开始领钱,但是也会得到一部分利息收益。

选择即期收入年金的话,背后隐含的利率不是我们考虑的核心因素,关键是看每年能领多少钱。

一般认为,在更高利率环境下,即期年金会提供更高的收入。

(>>>推荐小工具|哪一款具体的固收年金保险适合我?最新的利率指标是多少?)

文章小结

这四类年金产品,分别对应了投保人不同的投资风险承受能力,和不同的使用场景,“高风险,高收益预期”的原理同样适用于年金保险。

“固定利率”类年金的风险最低,但是收益率也最低,它的收益率指的是,我们存到年金里的钱,会以一个固定的“利息”继续复利增值。因此常用于资产避险。

“指数”型年金的风险居中,通常认为,收益率高于“固定利率”年金。它的利率指的是,我们的账户资金会根据市场指数的涨幅,计算出来增值的速度,利率不固定,但是收益率保证为0%以上,通常每年的实际收益率,最低在0%,最高根据不同产品的功能来确定,收益不确定。

“证券投资”型年金的风险偏高,通常也认为具有最高的收益潜力。它的收益计息利率,指的是,我们的资金直接进入选择的证券基金,跟随市场波动涨跌对应而来的收益率,因此本金有亏损的可能,收益不确定。

根据自己的年龄,资产组合,以及风险承受能力,我们可以确定哪一类年金类型更适合自己。随后,通过对比和了解不同信用级别的保险公司,发行的这一类年金账户的利率,最终将帮助我们找到合适自己及家人的年金产品。(全文完)

(>>>推荐阅读:专栏|购买美国年金保险必读!您最关心的8个常见问题及误区 )

(>>>推荐阅读:知识贴|美国年金保险怎么买?每年领2万需要多少钱?)

(>>>推荐阅读:比较|指数年金和基金年金,哪一款年金保险更好?(2022版))

*营销广告是口语化的说明,并非实际的承诺,具体的年金存款奖励制度,请查阅保险公司各个产品的具体英文说明。