在销售市场上,7702保险,7702保险计划,7702退休计划,7702税务规划,各种新名词在近期层出不穷。在本文中,美国人寿保险指南网将帮助读者了解,所谓的“7702保险”到底是个什么东西,“7702保险”对我们好不好?

在文章的末尾,我们也会解答,为什么“7702保险”这个词,会在2021年频繁出现的原因。

“7702 保险”这种说法怎么来的?

不管是“7702保险”,“7702退休计划”,还是“7702税务规划”,都离不开一个7702。

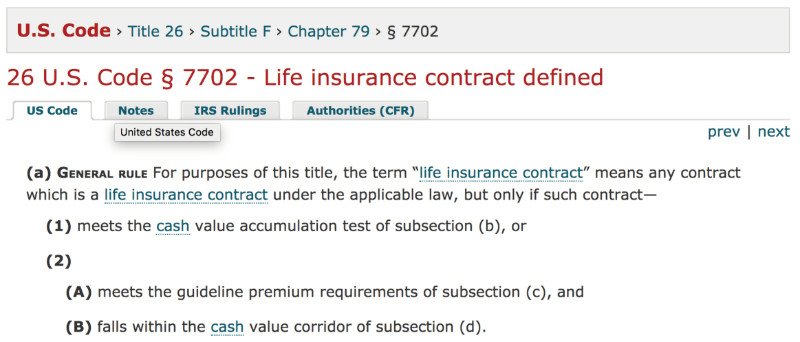

而“7702”这个数字,最终源自税典§ 7702 条款。

- U.S. Code, Title 26, Subtitle F, Chapter 79, § 7702 -人寿保险合同的定义:

7702条款具体内容

7702条款是干嘛的?

简单的说,7702条款,是关于“什么是人寿保险合同”这个问题的法律解释。

符合7702标准的,就可以被视为“人寿保险产品”。

美国国税局7702条款定义了联邦政府可以承认的人寿保险合同以及如何征税。 7702条款对于身故赔偿金额和保单福利总金额进行了限制,并在联邦税收目的的框架下定义了可以被视为“人寿保险”产品的标准。 它适用于1985年以后签发的人寿保险合同。

因此,不管是“7702保险”,“7702退休计划”,还是“7702税务规划”,还是更多闻所未闻的名字,都指的是:人寿保险。

为什么近期频繁出现“7702保险”这样的词语?

为了重整新冠疫情对美国经济的冲击,拜登政府推行了对各个行业的经济刺激政策“大礼包”。这个大礼包也涉及到对人寿保险行业的扶持,其中就涉及到修改原有的7702条款。

由于7702条款政策的扶持,绝大多数人寿保险公司自然会选择停售旧有产品,发布更新版本的人寿保险产品,并开始向市场传递这样的信息。

于是,“7702保险”的说法,在近期频繁的出现在市场中。

7702对我有什么影响?

修订后的7702条款,对2020年12月31日以后签发的人寿保险保单,启用了新的标准。

我们作为普通投保人或者投资人,并不需要了解具体的修订计算细节,但必须知道的是,在新修订的7702法规下的新款人寿保险产品账户里,允许投保人或投资者,存入比之前更多的保费资金。

在行业专家的横行评测意见中指出,一些新的人寿保险产品,不光允许投保人存入更多资金,并通过降低佣金等成本支出,双向大幅提高了保单账户的现金值增长潜力。

对于考虑在2021年申请或投资7702新法规下的现金值人寿保单的读者,您可以联系人寿保险公司,或专业的人寿保险经纪顾问,了解不同人寿保险公司新产品的发布进度和情况,配置到适合自己需求的产品。

文章小结

通过本文的分析,我们可以学习到,不管是7702保险,还是7702退休,还是其他名字,指的都是人寿保险产品。

需要牢记,不管是消费,投资还是投保,第一原则永远是,要清楚地知道我们到底买的是什么东西。

美国人寿保险指南©️提供了人寿保险学院,投保指南,投保人保单评测等多个栏目供读者参考,提出了LBYB – Learn Before You Buy的美国人寿保险投保原则。

在申请保单之前,美国人寿保险指南©️提倡消费者和投资人,事先学习和了解这类金融产品的基本运行原理和功能,从而得到真正能保护家庭及财富的方案。(全文完)

(>>>相关阅读:评测|保费涨价翻倍,新老保险产品到底选哪个好?(202111))

“7702”相关阅读:

01.看完省下$30万!购买非美国人寿保险产品前请三思(投保前必读)

02.美国人寿保险真的免税吗?