人寿保险账单除了记录资产情况,也还记录了投保人及受益人信息。对于每一个持有家庭来说,人寿保险账单是一份非常私密的资产文件。在中文互联网社区里,也鲜见到美国现金值人寿保单年度对账单的分享。

为了帮助华语公众了解“人寿保险账单账单是什么,长什么样”,“人寿保险账单会告诉我们哪些重要信息“,美国人寿保险指南网得到了社区成员机构的协助。

在共同征得一位投保人的授权同意后,北美蜂鸟人寿提供了一份实际运行的人寿保单账户文件。美国人寿保险指南©️对此进行了编辑和解读,用于在中文社区进行公众保险理财教育的目的。

/ 美国人寿保险年度账单是什么 /

(一份指数保险账户的年度账单文件Sample,共8页,双面印刷)

(一份指数保险账户的年度账单文件Sample,共8页,双面印刷)

在开设了美国现金值类型的人寿保险账户后,保险公司须依照法规,至少每年寄送一次年度保险对账单给投保人。

不同的现金值保险产品,账单文件的格式和排版会各不相同。但总体都会标明保险账户的各种关键信息,包括投保人信息,受益人信息,涉及此账户的各种数值信息。

根据人寿保险对账单提供的信息,专业的保险规划顾问能解读和判断出:

- 保险账户的表现是否符合投保规划时的预期?

- 保险账户当前是否运行在健康状况?

- 保险账户当前的理财分红或计息策略?

- 保险账户当前的保费策略及金额限制?

- 更多…

/ 保险账户的收益及策略 /

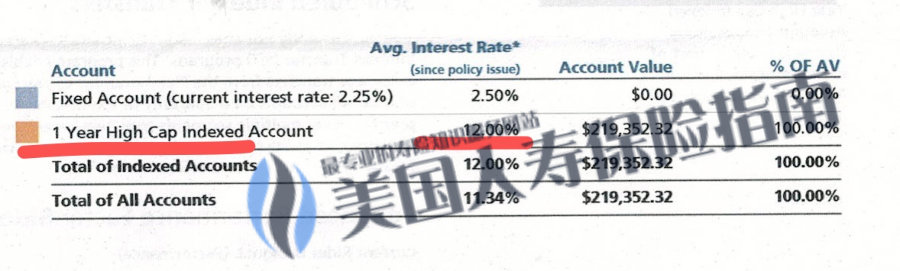

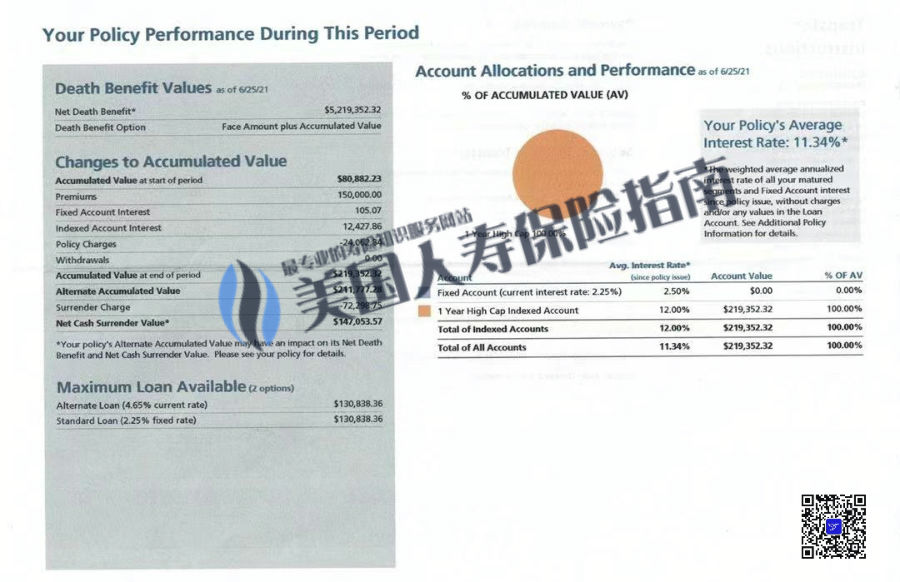

在收到人寿保险账户对账单以后,投保人可以从账户概况这一页,了解到账户的综合信息。以美国人寿保险指南网评测的这份指数保险账户对账单为例,如下图所示。

( 保险账户价值综合信息表 )

( 保险账户价值综合信息表 )

保险的年化收益率是多少?

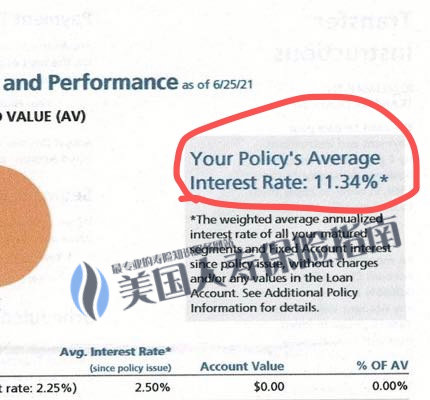

作为以“资产管理”为设计和管理目标的保单账户,平均年化收益率是一个评测核心指标。

这是一份目标明确的“资产管理型”保险,从上图中的部分,我们可以看到从保单生效以来,到当前账单日的年化收益率情况。

保险的理财策略是什么?

每张保单的收益,和不同理财策略的选择和比重分配息息相关。

同一款保险产品,经过专业维护和管理,和放着不管这两种情况,在时间和复利的作用下,最终会让保单账户收益产生不小的差距。

这也解答了一些投保人感到纳闷的问题:“为什么我和先生买同一份保险产品,付同样多保费,过去这几年,我们的保单账户收益却不一样?”

(>>>相关阅读:评测|收益少了$186万!您的保单买对了吗?)

从上面的账单图片文件中,我们标红了该保单账户的理财计息策略和数值。

账单文件显示,保单的理财计息策略是“1 Year High Cap Indexed Account”,使用此策略的资金比重是100%。

根据上图,我们可以看到,自保单指数账户设立以来,该理财计息策略创造了平均12%的收益率。

(>>>相关阅读:科普贴|美国保险最常见的4种指数理财策略是什么? )

保险评测小结和后记

对于寻求美元资产配置和美元资产理财的家庭,美国金融型人寿保险资产,可以是构成家庭财富框架的一个重要组成部分。

但美国人寿保险的申请和通过,仅仅是完成了投保工作的第一步。对人寿保险账户的年度健康审查,以及对管理方案的调控,更是一个“长期”和“专业化”的过程。

通过和专业人寿保险规划顾问的沟通和合作,可以帮助我们正确了解保单账户的运行健康状态,制定不同阶段的调整方案,及风险防控应对措施。

(>>>推荐阅读:评测|年度收益13.75%,解读2022Q1保险账户对账单的2大常见问题(图))

(>>>相关阅读:评测|2022 Q1年度指数策略回报率及保险品牌排行榜 )

/ 致谢 /

美国人寿保险指南©️评测组再次向这位愿意分享保险理财账户文件的投保人,以及提供协助的北美蜂鸟人寿致谢。

同时,我们也非常期待这张保单在2021-2022的年度收益计息表现。在获得接下来的授权和账单文件后,美国人寿保险指南©️也将进一步跟踪解读该账户表现。(全文完)

(>>>相关阅读:专访|“我以为小数点(回报率)写错了”,投保人晒出2020投保账单 )

(>>>相关阅读:评测|快60岁了还能投入美国保险吗?每年保费需要多少钱?)