美国保险市场非常成熟,不同保险领域的专业化程度极高,买对保险,选对公司显得异常重要。有粉丝近期留言说,实在搞不清楚“美国健康保险”和“美国人寿保险”之间的区别。在本文中,我将说明这些产品的不同之处。

- 美国“人寿保险”和“健康保险”的区别

- 美国“人寿保险公司”和“健康保险公司”的区别

- 如何选“对”的“人寿保险公司”和“健康保险公司”

人寿保险和健康保险的功能区别

健康保险属于“消费品”,有助于支付医疗费用,例如看医生,住院,药物治疗,检查和程序。这有助于确保人们负担得起医疗费用,并保持身体健康。

健康保险的理赔金,由保险公司以“报销”的形式,直接支付到医院或医生。

人寿保险具有“消费品”和“资产”的多重属性,具备多种功能。

人寿保险的“身故赔偿”是核心功能。如果不幸发生意外,人寿保险公司会向您的受益人——通常是家人——支付死亡理赔金。

人寿保险的理赔金,由保险公司以“单笔现金”的形式,直接支付给受益人自由支配。该资金通常用来弥补家庭未来损失的收入,并支付丧葬费,医疗费用和其他债务等未偿费用和债务——或为子女大学储蓄帐户或配偶退休金供款。这有助于使家庭的整个财务状况得以延续,不会恶化。

总结一下,健康保险保障个人,人寿保险保障家庭。

人寿保险公司和健康保险公司的区别

业务专一的人寿保险公司是一家“金融服务”公司。这类人寿保险公司通常提供人寿保险,退休年金保险,资产管理,证券投资等相关服务。

比如全球最大的保险集团——德国安联集团的北美安联人寿保险分公司,只专注提供“资产管理”型的保险服务。美国本土的万通互惠保险,曾掌控了著名的奥本海姆投资基金。纽约人寿则涉足房地产投资,以及证券的发行。

业务专一的健康保险公司,是“医疗消费品健保”的专业供应商。这类健康保险公司向社会公众专注提供健康类保险产品,包括个人,家庭,及企业的保障型消费产品。

一些知名的健康保险公司品牌包括Aetna,BlueShield / 蓝盾医疗保,United Healthcare /联合健保,Cigna,Humana等。

总结一下,根据个人或家庭的具体需要,寻求对应的专业化服务公司,是申购美国保险的重点。

如何区分专业的人寿保险公司和健康保险公司?

在现实中,一些人寿保险公司也经营健康类的保险产品。一些以健康保险为核心业务的保险集团也经营部分人寿保险产品,如Mutual of omaha,Humana等。

一些以传统”汽车保险“为主业的大型综合类保险集团,也会销售人寿保险产品,或部分健康保险产品,比如AAA,StateFarm等家喻户晓的综合性保险集团。

玲琅满目的市场环境,让消费者感到了困扰:面对美国上千家的保险公司,有什么办法可以快速区分出,哪些保险公司是专业的人寿保险公司,哪些是专业的健康保险公司呢?

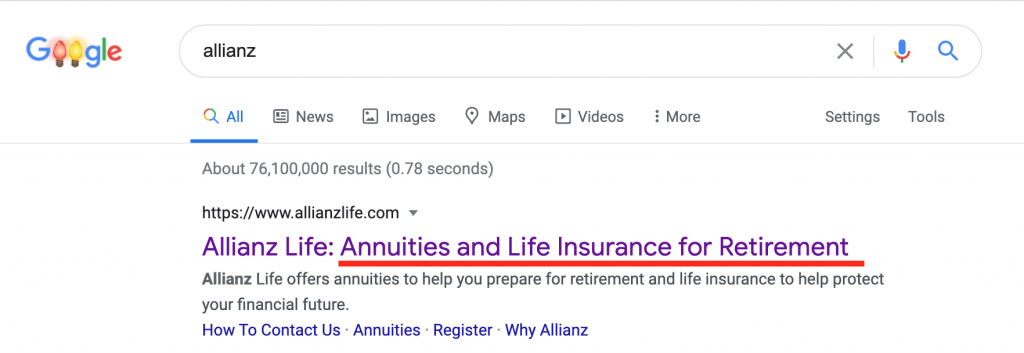

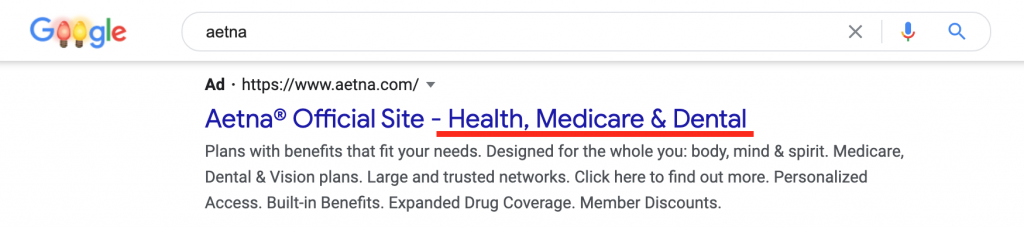

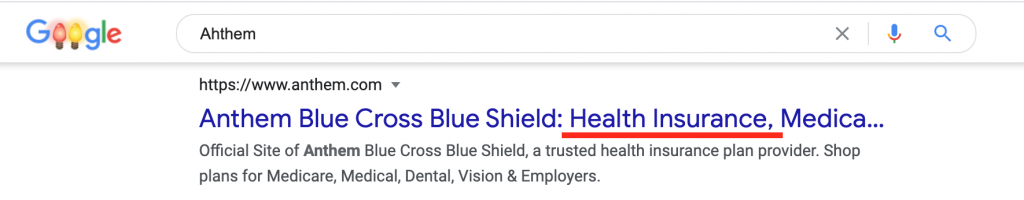

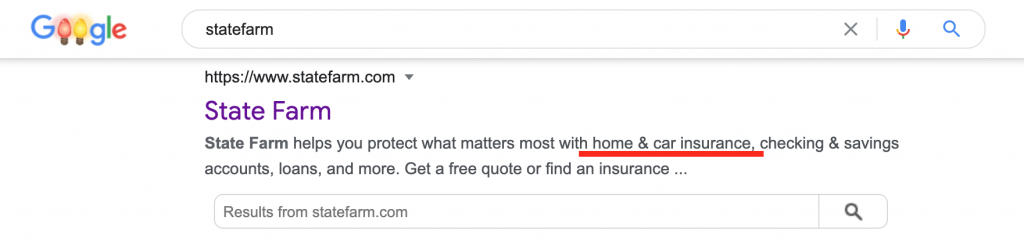

美国人寿保险指南©️提供一个最直接的分辨办法,就是在Google里输入保险公司名称,就可以直接了解到这家品牌或公司最擅长的业务领域。毕竟,保险公司它们自己,比我们更清楚他们的主营领域。

Aetna保险公司告诉公众,他们主营健康,65岁红蓝卡及牙科保险。

Anthem保险公司则强调主营业务是健康保险及65岁红蓝卡保险。

Anthem保险公司则强调主营业务是健康保险及65岁红蓝卡保险。

State Farm保险公司的主营业务,则是房屋&汽车保险。

AIG保险公司则强调了“人寿保险”和“全球承保”。

AIG保险公司则强调了“人寿保险”和“全球承保”。

Allianz保险公司的主营业务是年金和人寿保险,并注明了专注退休领域。

看到这里,相信我们聪明的投保人已经举一反三,掌握了如何选择和投保各类美国保险公司的小诀窍。

文章小结:健康保险和人寿保险应该选哪个更好?

现实情况是,有保险比没保险更好。在力所能及的情况下,保障越全面越好,这就好比对孩子的教育投入一样:量力而行,上不封顶。

对于健康保险来说,目前由于ACA法案的存在,美国政府鼓励每个人进行购买(部分州为强制要求)。这样的做法,让每个家庭有了财务上的兜底,不会因为突然的大病,导致整个家庭无法承担基本的医疗费用。

人寿保险属于商业保险,对于很多有家庭的人来说,家里的房贷,开销,子女的成长教育,都需要钱,如果家里主要收入来源不幸遭遇意外,或者遭遇重病的困扰,健康保险公司会向医疗机构支付治疗的费用,而人寿保险公司的理赔,则会帮助失去收入来源的家庭,度过接下来财务上的难关。

(>>>推荐阅读:对于癌症,心脏病等重大疾病,人寿保险理赔吗?)

“健康保险”对个人生命健康进行“托底”的保护,而“人寿保险”对家庭财务进行“托底”的保护。大多数美国家庭确实需要这两种保护,特别是如果有孩子,或者家里有全职的太太/先生这种情况。(全文完)

相关专题推荐: