离职后,原公司的401K怎么办?

如何处理我们在旧公司401k退休账户的资金,这是一个重要的问题。选择和操作正确,能顺利帮助我们继续完成退休账户的积累,对我们的退休收入,产生巨大的影响。

当我们离职时,有4种处理旧公司401k退休账户的办法,分别是:

1.留在旧公司401k账户上不动

离职,换工作,或裁员后,我们可以不着急做决定,其实也没有什么损失。将旧公司的401k账户资金,放在原有的金融服务机构里,可以继续让退休金继续保持复利的积累。

例外情况,如果我们收到了管理公司退休账户的金融机构,发来的明确要求转移资金的信件,那么我们必须要转出。通常这种情况较罕见,意味着旧雇主有较大的变动。

2.转到新的雇主公司账户

换工作后,如果新的雇主公司也提供了401k公司退休账户,我们可以将旧公司的退休账户的钱转入到新的公司退休金账户。

3.转到个人退休账户或年金账户

除了公司,学校,政府提供的退休账户外,我们还可以开设个人退休账户(IRAs)和年金账户。我们可以将旧公司的退休账户的钱转入到个人退休账户,或在临近退休或已经退休时,转入退休年金账户。

3.现金提取

离职换工作,我们最后一种选择是将公司退休金401k账户直接提现。这种做法简单粗暴,但是缺点和后续影响却最为严重。我们在下面的离职后处理401k公司退休金账户的方式优缺点对比中进行了详细说明。

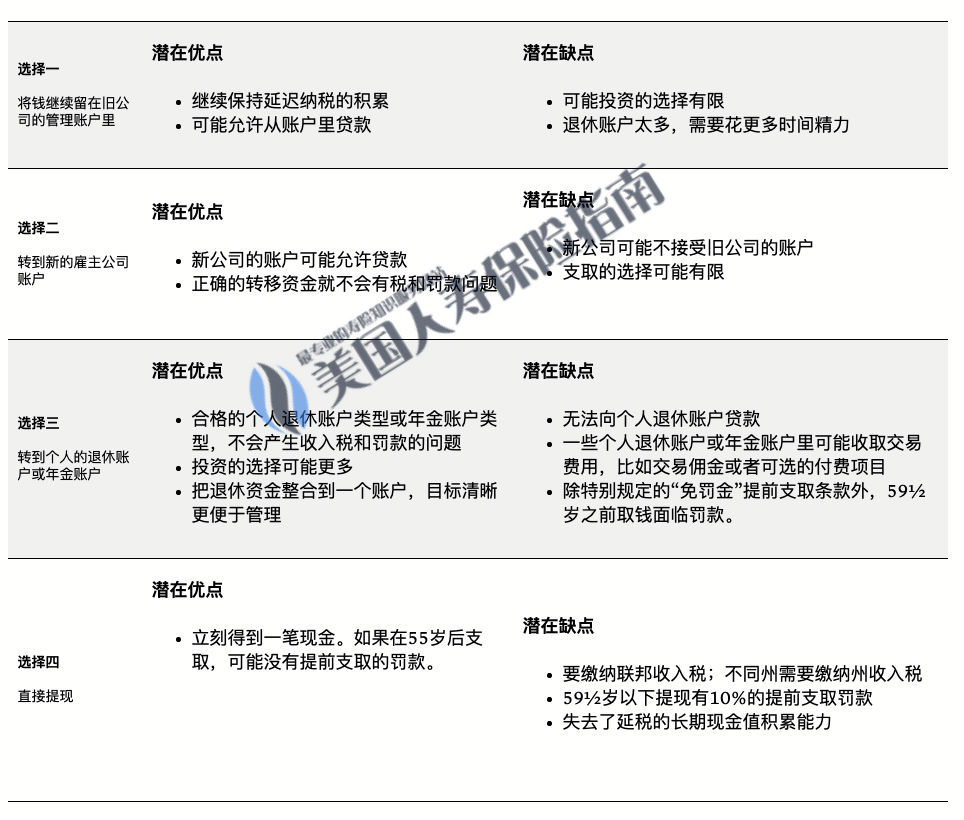

离职后处理401K的4个方式优缺点对比

离职后如何正确转移旧公司401k退休账户

- 开户。寻找合格退休账户经纪或年金保险经纪,在线上或线下申请开设对应账户,服务机构会提供详细的服务说明。转移到新的公司退休账户,联系HR,得到新公司退休账户权限。

- 充值。按照经纪人的说明或者说明,将资金从旧公司401k退休账户中转移到新的个人退休金账户,年金保险账户,或新公司的退休账户中。(支票方式或者金融机构之间转账)

- 投资。在新账户中选择适合自己的投资选项,或年金提取方式。

- 管理。登入您的新退休账户或年金账户,打理您的退休金。

换工作处理401k公司退休账户的最大问题

当决定转移旧401k账户时,最简单有效的办法是,让新账户的开户机构,帮您完成所有手续和直接转账。我们没有必要在这个问题上折腾,惹出下面的这个大麻烦:

如果我们选择了先收支票,然后再决定转账的话,那么我们就需要承担对应的责任:如果60天内没有完成新旧账户的转移,那么我们将可能面临罚金和扣税。(全文完)

(>>>推荐阅读:专栏|如何利用IRA和401k购买退休年金?避税策略全解析 )

(点击进入:美元退休金账户自助报价)

(点击进入:美元退休金账户自助报价)

(>>>推荐阅读:比较|指数年金和基金年金,哪一款年金账户更好?)