盖瑞(化名)是一名事业有成的生意人。他在好莱坞从事电影制片业,家里是社区人人羡慕的百万富翁。

2021年7月,他一纸诉状,将两名人寿保险经纪人告上了法庭,声称他和家人被保险经纪人误导,签下了$4000万的“免费”人寿保险保单。

“免费”的人寿保险是怎么回事?

“免费”的人寿保险保单,意味着投保人不需要自掏腰包付保费。

人寿保险经纪人和银行或贷款经纪人合作,向投保人提供一笔贷款来购买高额保单。

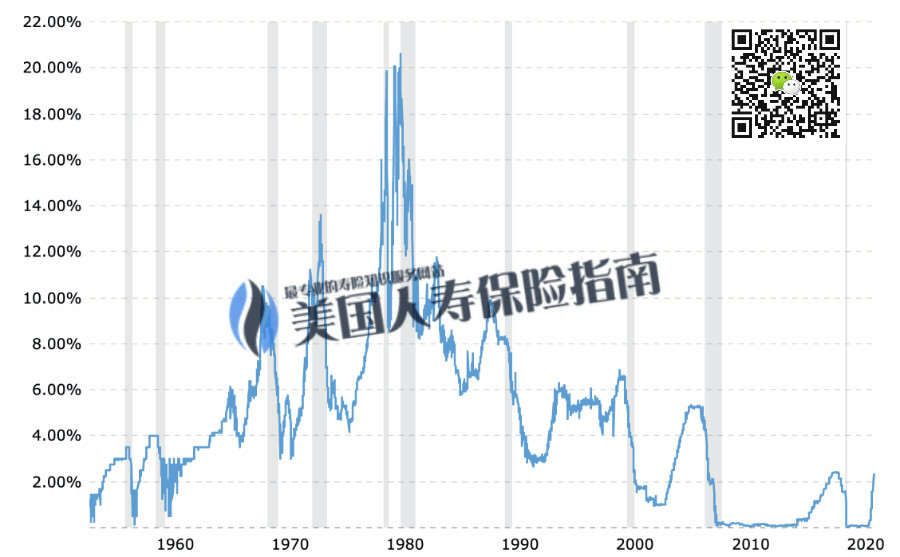

在连续多年历史低利率的市场环境下,这或许不会产生问题。

理论上,在保险资产利滚利十多年后,保险账户里的现金值将用来还清低息贷款,而多余的部分,将留给投保人。

这样算下来,投保人并不需要从腰包里掏出一分钱。

当保险销售人员在销售这类保单时,往往会配套使用人寿保险的“方案建议书(Illustration)”,上面的数字会显示给客户,他们确实会利用这个套利杠杆,大赚特赚。

假设每年的收益将如此之大,投保人简单地从保单账户中取钱出来,支付每月到期的贷款账单,多余的钱,成为了自己的免税退休金。

换句话说:一份本质上“完全免费”的,价值数百万美元的人寿保险。

(>>>相关阅读:我可以贷款买保险吗?保费贷款买保险是怎么一回事?)

美联储暴力加息捅破杠杆泡沫

从2022年起,一年期美元银行同业拆借利率,从2月份的不到1%,飙升到9月初的4.699%,投保人的私人浮动借贷利率,在短短半年内突破5%,而同期,保单收益为0%,历史罕见。

在没有使用借贷杠杆的情况下,加息对投保人的影响并不那么大,但这类保单已经进行了抵押配资加杠杆,所有权在银行或信托手上,投保人此时就显得相对被动。

一旦出现了任何预料之外的变化——如历史性的加息幅度和频率——事情就不那么好看了:人寿保险账户的现金值没有得到预期的增长,保险收益也没有达到年度预期,而借贷利息也在不断攀升,投保人就面临“Margin Call”和账单。

如果在最初的申购时——被“0元购”的设计方案所吸引,或者投保人参加了以“集资”方式贷款购买人寿保险(或者名为XX退休计划)的Program,没有个人名义的实际资产控制权,则很难再有挽回的空间。

这一切的关键问题都集中在两点,一是为了数字好看足够吸引人,保险经纪使用了高额的杠杆,造成了“免费”的诱惑;二在2022年上半年历史性的加息环境中,保险经纪也没有能力提供后续的解决方案。

虽然LIMRA并没有追踪和记录保费贷款配资的人寿保险销售情况,但人寿保险行业里的专家认为,在过去10年的低利率环境下,这类保费贷款配资的保单成指数级增长。部分人寿保险公司的主要保费来源,都是来自于贷款。

(>>>相关阅读:保险设计方案和方案建议书(Illustration)到底是什么?有什么看点和争议?)

寻求保险急救服务

保险急救服务,英文称为Policy Rescue。

它是由第三方专业人寿保险顾问推进,针对设计方案存在隐患,或处于高风险环境下的人寿保险账户的一套补救程序,主要作用,是用来降低或弥补投保人的资产损失,改善保险账户健康状况。

根据TheLifeTank.com的观察,市场上仍然流传着一些以“完全免费”为噱头卖点的保费贷款项目。这类保险的设计方案,通常在行业内部认为没有实际抗风险能力,仅通过了保单本身的单方面压力测试,无异于赌博。

一些在2022年前,加上了这类“免费”设计方案杠杆的家庭,已经这被这类合约套牢,无法脱身。

CEJ(Center for Economic Justice)财务正义中心总监Birney Birnbaum认为,一些保险经纪人,用模糊不清的语言,呈现给了客户过于乐观的保险方案建议书,保险经纪人也没有义务为客户的最大利益着想。

寻求专业保险顾问的保险急救服务,目前是这类投保家庭的唯一出路。(全文完)

(Updated 20220923)

(>>>相关阅读:金融杠杆是什么?人寿保险的杠杆又是什么?)

(>>>相关阅读:人寿保险方案设计PDA服务是什么?费用价格是多少?)