网传的“加州长期护理税”和加州保险局针对性的通知,纽约州长期护理税法案(S9082)的提出到华州长期护理税的正式征收…一时间,长期护理,成为了近期保险财务规划社区一个绕不开的一个关键词话题。

长期护理保险,又称为长照险,长护险,英文称为 Long Term Care Insurance,简写为LTCi。

美国人寿保险指南©️(英文名TheLifeTank.com)邀请了保险财务专栏作家Heather Xiong CFP®️,开展了一场关于“长期护理保险怎么理赔”的对话,在文章的末尾,也通过问答的方式分享了一些帮助理赔的诀窍。

TheLifeTank.com:如果投保人需要长期护理理赔,具体需要准备些什么,怎么去理赔呢?

Heather Xiong CFP®️:第一步,当我们需要理赔了,这个时候基本上医生和医院已经出了诊断报告,需要联系护理机构或助理人员了;或者说,投保人已经在护理机构,或者家里接受护理服务了。这时候,我们可以通过【打电话】,或【网上理赔入口】联系保险公司进行理赔申请。

【编者注】保单文件上,以及保险公司品牌网站上,都会有“File a Claim”和理赔联系电话的入口。

理赔申请有点像申请旅游签证,你需要告诉对方,你是谁,具体发生了什么事情,你将要住在哪里,谁来提供服务,服务是什么类型等等。我提供了下面这个理赔清单:

- 投保人的保险保单号码;

- 投保人的姓名,地址,电话号码;

- 诊断医生的姓名,地址,电话号码;

- 长期护理服务提供方的名称,地址,电话号码;

- 长期护理的类型(养老院,家庭护理,还是辅助生活型护理等);

- 描述需要或正在接受的长期护理服务都有哪些;

- 长期护理服务开始的时间,或即将开始的时间;

Heather Xiong CFP®️:第2步,当我们提交了这些信息后,保险公司会指派一个理赔专员跟进这个理赔。理赔专员会直接根据提供的联系信息和投保人或委托人取得联系。

理赔专员首先会通过电话等方式确认您现在的情况,并根据您的具体护理情况,寄来相关的服务材料和需要完成的官方表格。投保人需要填写好规范的表格,寄回保险公司指定的地址。

Heather Xiong CFP®️:第3步是,等保险公司收到寄回的规范表格后,理赔专员将会确认是否符合理赔条件;

- 如果确认理赔,按照现金进行理赔的长期护理保险产品,理赔专员会确认理赔的金额;

- 按照实报实销的方式进行理赔的长期护理保险产品,理赔专员会联系提供长期护理服务的机构;

理赔专员在确认所有材料齐全后,通常会在3-5个工作日内做出是否理赔的判断,并通知投保人。

到这一步,理赔工作算是正式完成了。

TheLifeTank.com:如果投保人需要长期护理,意识也不清醒,没法自己去填写理赔文件,进行文件签字怎么办?

-Heather Xiong CFP®️:任何人都可以帮助投保人去填写理赔申请。如果委托了他人来处理这个事情,需要向保险公司提供财务决策委托授权书(Durable Financial Power of attorney);也可以直接向保险公司寻求帮助。

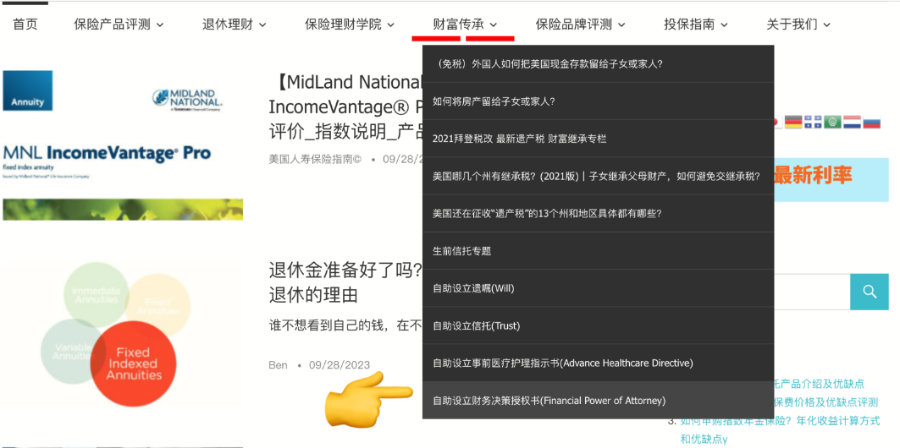

编者注:访问美国人寿保险指南©️网站的“财富传承”栏目,可以免费使用第三方机构Freewill®️提供了自助设立Durable Financial Power of attorney的工具(如下图所示)。

TheLifeTank.com:如果投保人需要长期护理,意识也不清醒,没法自己去填写理赔文件,进行文件签字怎么办?

-Heather Xiong CFP®️:任何人都可以帮助投保人去填写理赔申请。如果委托了他人来处理这个事情,需要向保险公司提供财务决策委托授权书(Durable Financial Power of attorney);也可以直接向保险公司寻求帮助。

TheLifeTank.com:在理赔这个过程中,有什么省时省力的诀窍呢?

-Heather Xiong CFP®️:服务质量水平直接关系着保险公司成本高低,“省时省力”这一部分的成本,值得投入。一些长期护理保险产品,会额外提供理赔礼宾服务(Concierge service),帮助投保人简化一些环节,并且会根据投保人的情况,提供实用的护理服务供应商信息,并帮助选购。保险公司礼宾服务会更专业,供参考的信息也多,这样减少了投保人家庭的负担。(全文完)

>>>LTC长期护理保险产品<<<

(>>>相关阅读:美国Long term care 长期护理保险保险险种介绍 价格 优缺点 理赔必读和购买年龄窗口)