身为母亲的Lucy,想给孩子留一笔钱。

Lucy听说美国的人寿保险可以用最高的杠杆实现财富的传承,于是考虑申请一份终身型人寿保单。Lucy买保险的想法比较简单,就是想在过世后,用保险公司的理赔金,给子女留下一份$100万的财富,让孩子在成长过程中,免于经济上困扰。

但是当Lucy真正开始选购时,才发现美国市场上的产品五花八门,每个理财公司或经纪人都说自己的产品最适合,方案最合理,让她完全不知道如何下手。这可如何是好?

在美国人寿保险投保必读指南(一)中,我们指出,美国是一个市场竞争充分的国家,成熟商业社会带来的商品选择极大丰富,投保人面临的真正问题,不是“买不买得到”的问题,而是能否找到“对”的产品的问题。

今天,美国人寿保险指南网评测小组在IMO机构和BH Financial的支持下,用数据说话,对多款主流人寿保险险种进行了评测,在帮助Lucy找到“对”产品的同时,也帮助我们的读者了解应该如何去寻找适合自己的“对”的产品。

参赛评测险种是哪些?

Whole Life保险

分红型终身人寿保险,英文名 Whole Life。该产品的特点是提供多项保证。美国人寿保险指南评测小组选中了分红能力连续10年排名第一的这家保险公司的产品。

IUL 指数型保险

指数型保险,英文名 IUL。该产品的特点是,使用市场的杠杆撬动保额,拥有最强的现金值增长潜力。评测小组选择了由2019 InterBrand全球保险业品牌排名评选出的,全球排名第一位的这家人寿保险公司的产品。

GUL 保证型万能险

保证型万能险,英文名 GUL。该产品的特点是,缴费完成后,不管市场走势如何,都会得到保证的身故赔偿。美国人寿保险指南选择了目前美国市场上,市场占有率和保险成本性价比都排名Top Tier的一家人寿保险公司的产品。

*由于某些保险公司的致函,为遵守相关要求,美国人寿保险指南网不能在面向公众的页面里,使用具体产品名称和提及保险公司的名称进行对比评测。

分红保险 vs 指数保险 vs 保证万能险数据评测

Lucy的目标是为孩子留下$100万美元的财富,用人寿保险作为工具来完成这个财富传承的过程。因此,我们选择这三款产品,分别生成一份$100万保额的保单,10年付清方案,看看为了达到这一个目标,55岁,身体健康的Lucy需要付给每一家保险公司多少钱。

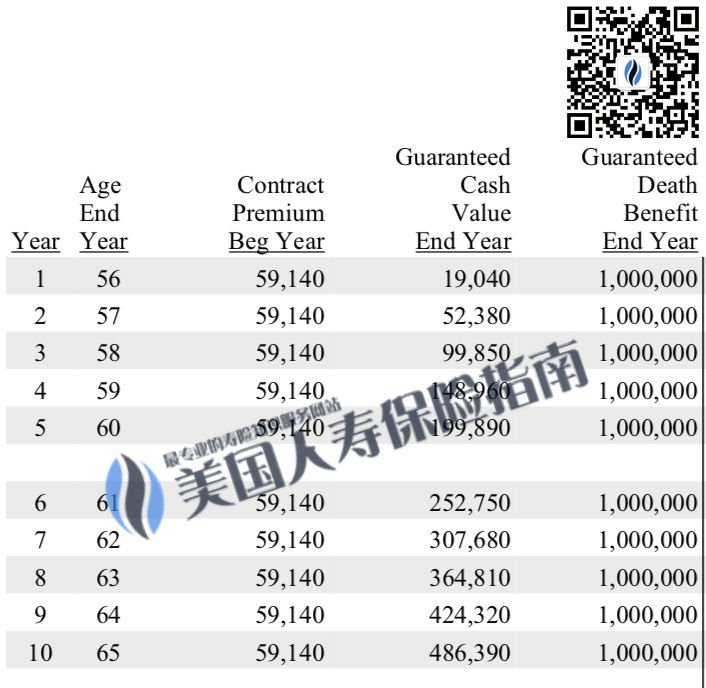

Whole Life(分红型保险)10 年付方案

分红型保险是出现历史最长的终身寿险险种,目前市场占有率在30%+以上,Lucy如果使用这个险种,她的成本会是多少?

上图是来自一家Top储蓄分红型保险公司的10年付清的储蓄分红型保险方案,最左一列是保单的运行年份,第二列是投保人的年龄,第三列是每年需要存入的保费,最后一列是保证的$100万身故赔偿金。

从这个保单设计方案我们可以看出,Lucy使用储蓄分红型终身保单作为工具,要达到这个目标,每年需要存入$59,140的保费,10年累计约60万美金。

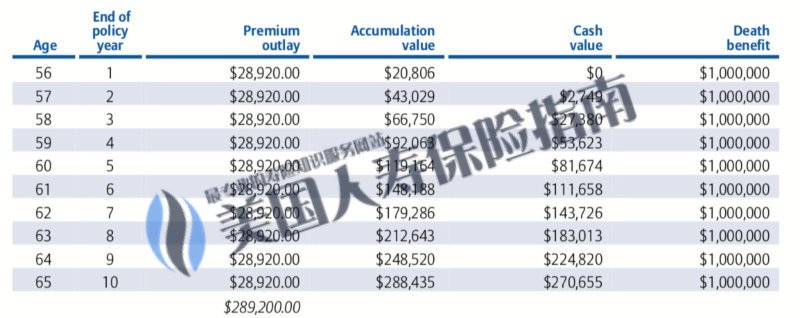

Index Life(指数型保险) 10年付方案

指数型保险,通常简称为IUL,其设计和运行方式和储蓄分红型保险完全不同,保单方案设计具有巨大的灵活性。Lucy如果使用这个险种,她的成本会是多少?

上图是来自一家Top1指数型保险公司的10年付清的IUL保单方案,最左一列是投保人的年龄,第二列是保单的运行年份,第三列是每年需要存入的保费,第五列是当年退保,能拿回的钱,最后一列是保证的$100万身故赔偿金。

从这个保单设计方案我们可以看出,Lucy使用指数型终身保单作为工具,要达到这个目标,每年需要存入$29,920的保费,10年累计约不到30万美金。

这个时候,我们不禁要提问:为什么同样是用于$100万财富传承的需求,一个60万,一个30万,指数型保险居然比分红型保险便宜了一半近30万美金,这是为什么?

美国人寿保险指南网的insurGuru©️保险学院的“储蓄分红保险和指数型保险到底哪个好?王牌对王牌的美国保险评测”一文中,我们进行了多方面的解释。

而关于这个问题的最通俗的回答,来自于美国人寿保险指南网的一名专业读者的颇有深度的留言:一个是刘备,一个是关羽,到底哪个比较帅?

当了解了上面的知识后,我们可能会问,既然众说纷纭,但我为人非常保守,但又嫌刘备太贵了,那还有没有其他选择,既有刘备的特点,也有关羽的优势呢?接下来我们就看一下Lucy可以选择的下一个方案。

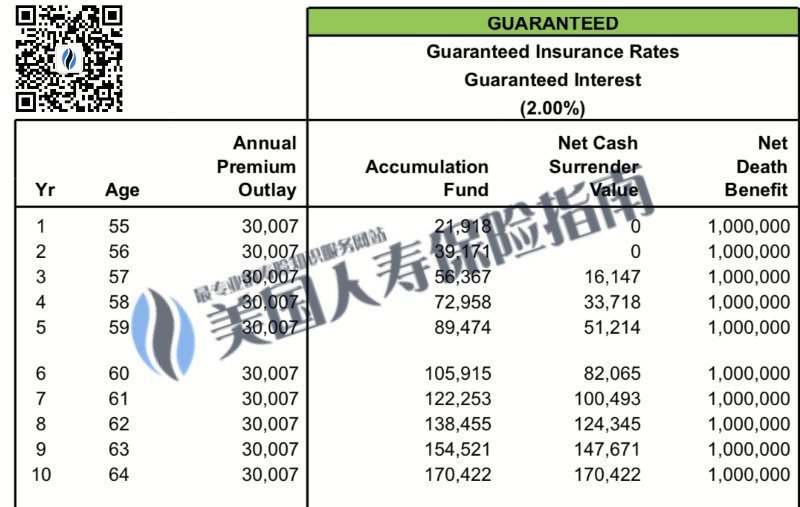

Guaranteed Universal Life(保证型保险) 10年付方案

在insurGuru©️保险学院中,我们介绍了 GUL 保证型保险,接下来评测小组来看看$100万的财富传承需求,GUL需要多少钱。

上图展示了实现Lucy财富传承的10年付清的GUL保单方案。图标最左一列是保单的运行年份,第二列是投保人的年龄,第三列是每年需要存入的保费,最后一列是保证的$100万身故赔偿金。

从这个保单设计方案我们可以看出,Lucy使用保证型终身保单作为工具,要达到这个目标,每年需要存入$30,007的保费,10年累计正好30万美金。

优缺点对比:保证的能力和现金价值

从上面的价格评测我们可以看出,分红型保险要花60万,保证型保险只花30万,指数型保险要花29万,分红型保险和后面两者的差距有足足30万,后两者相差约1万。

为什么差了足足30万?关于分红型保险和指数型保险的优缺点对比,美国人寿保险指南在“储蓄分红保险和指数型保险到底哪个好?王牌对王牌的美国保险评测”一文有了详细说明。

而在这个评测中,30万的GUL产品的优点是:保证理赔$100万,到120岁。但对应的缺点也很明显,保单几乎没有现金值。

由于Lucy的需求非常明确——给孩子留钱,同时预算也不打算超过40万美元,而且不愿意承担任何市场风险,那么,GUL保单似乎就是一个适合她的解决方案。

评测小结

从本文的评测中,美国人寿保险指南指出,价格的高低只是投保过程中考虑的一个因素,更重要的是,我们能在专业人士的帮助下,理清我们的需求,了解到我们真正想要的是什么,只有目的明确后,才能最大化的保障投保人自身的利益。

而如果预算充足,更好的做法是,灵活搭配不同险种的保单,采用多元化的资产配置方式来分散风险,同时最大限度的获得增长的潜力。

如果您是Lucy,您会选择什么样的方案呢?(全文完)

(>>>相关阅读:评测|保费涨价翻倍,新老保险产品到底选哪个好?(202111))

(>>>推荐阅读:专栏|两份保险价差50%+,千万美元保单保费横向对比评测 )

(>>>推荐阅读:评测|王牌对王牌,储蓄分红保险Vs指数保险终极评测大公开 )

(>>>推荐阅读:评测|$100万美元的保单要花多少钱?分红保险 , 指数保险, 万能险价格PK )

(>>>推荐阅读:攻略|人寿保险投保时的Illustration(设计方案)是什么?有什么争议和看点?)

Disclaimer:

*文章出现的数字,金额仅仅作为教育和信息分享交流之用途,并非保单实际的合同内容,也不是保证的回报数值,不具有任何法律效应。实际情况以英文保单内文为准。