外国人如何买美国的人寿保险呢?今天我们就来讨论一下这个问题。

美国人买人寿保险很多,有的公司还会给员工投保最低金额的寿保,当然很高的也有,比如谷歌为员工买的高额寿保都上过新闻。那么如果没有绿卡,外国人如何买美国的人寿保险呢?今天我们就来讨论一下这个问题。

在美国的居民(US Person) 一般分为五大类︰

公民、绿卡、无绿卡有合法签证的居民(resident alien,一年有一半以上时间呆在美国的外籍人士)非居民外国人(non-resident alien,短期呆在美国的外籍人士)以及非法移民。

绿卡没有选举权和犯罪后会被遣返,其他的公民和绿卡基本没有多大差别,保险公司在审核时基本上是一视同仁。

如果是绿卡持有人,有些公司会要绿卡复印件,有的公司会要求另外填一张表,问是否经常去外国旅行。 如果是短期休假探亲,一般都不会有问题。 当然如果你在申请过程中,说要去某些不太平的地方,比如利比亚,保险公司可能会把你的申请先放起来(suspend),等你平安回来后再说。

如果没有绿卡,但短期在美居留的人士,或者长期在美国工作学习的认识,有合法身份,有社保号码,一般也能买到人寿保险,但保费一般会比公民和绿卡人士稍贵一些。 至于非法移民,没有合法身份,一般很难买到人寿保险。

一般外国人买保险要有以下要求:

第一,投保人必须持有效护照和签证,合法进入美国; 第二,在美国填写人寿保险申请表,并在美国进行身体检查(主要是抽血、验尿、量身高体重、做简单的心电图等)。第三,投保人必须提供以往病历数据,可以是中文,保险公司会找人翻译。 第四,投保金额必须是100万以上,只受永久性保险,不接受定期保险(term life)。外国人买美国保险的具体流程图,请点击这里查看。

第四点是外国人买保险要求的,如果外国人在美国持有效签证工作,公司的人寿保险选择很多,一般没有金额100万的要求。具体情况可以咨询各大保险公司。

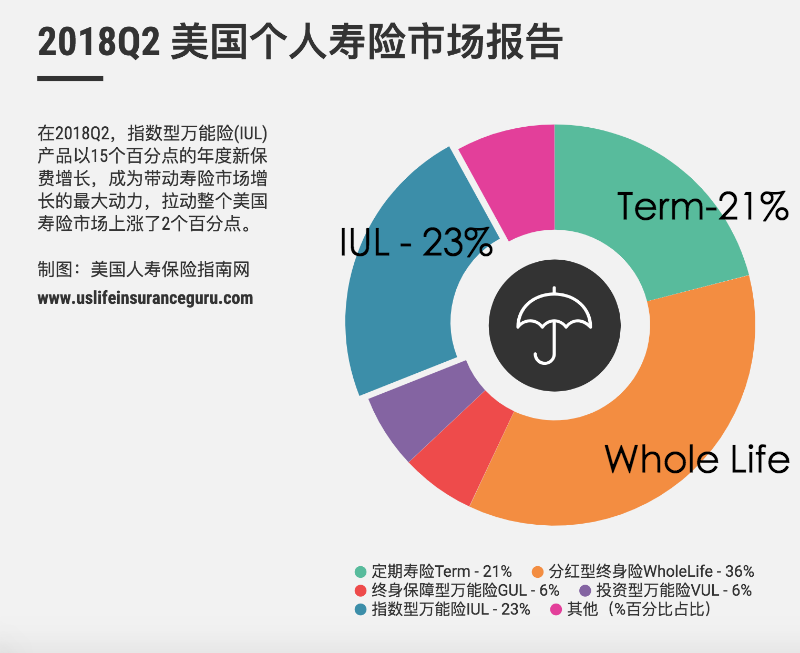

人寿保险分类

人寿保险在美国历史很长,从1762年美国第一张保单发出后,人寿保险在美国获得长足发展。目前,美国保险公司提供的人寿保险种类众多。

《简明人寿保险》(LifeInsuranceMadeE-Z)一书把人寿保险分为四大类。保险业人士称,人寿保险没有绝对的好与坏,只有合适与不合适。

1、定期保险(termlifeinsurance)

顾名思义,这类保险只保一定的期限,如10年、15年、20年和30年。这种保险属于暂时保险, 主要提供死亡赔偿金。如果投保人在期限之内死亡,赔偿金可以支付。但如果投保人在期限到期以后死亡,通常保险就过期了。最大的缺点是等term到期了,保险人的年纪也大了,再买其他保险会很贵。适合需要获得短期保障和预算比较有限的人。

2、终身保险(whole life insurance)

有时也称为永久寿险(permanent life)。这类保险有延税功能,随着时间的延长,保险内的现金值 (cash value)就会增加。保险公司会根据公司的盈利情况定期派发红利,但是红利的发放与否与金额都是不保证的。随着时间的延长,保险内的现金值就会增加。如果投保人想提前取消保险,将只能取回一部分的现金值。缺乏透明度是这类产品最大的问题。

3.万能人寿保险(universal life insurance,简称 UL)

这种保险比较灵活,保单所有人可以在任何时间缴费,费用可多可少,但要达到最低的交费水平。它也有现金值,即所交费用和获利减去保险费用和收费。 此类保险可保证理赔金,但现金值不能保证。

万能险的收益一般和利率市场挂钩,如果是低利率大环境,万能寿险的投资回报率一般都过低,投保人需要投入更高的保费来支付保险成本,才能维持保险的有效性。

4、投资万能保险(variable universal life insurance)

此类保险提供死亡赔偿和现金值,但金额根据投资股票和债券基金的结果而不同。这些基金由人寿保险公司自己管理,保单持有人可以选择投资种类。由于有投资风险, 因此理赔金可能增加,也可能减少,现金值也不能保证。如果现金账户在金融市场亏损过大,那么投保人就可以需要追加更多的现金来维持保险有效性。对客户/经纪人自身的投资水平要求比较高。

除了上面四种,在1997年以后,由于经历了1994债市危机,又出现了一种万能险的升级保险:指数型万能险(Indexed Universal Life):

它是万能险的一个变种,可以挂钩三大指数——美国标普500、香港恒生指数、德国30DAX指数,投资收益和这些指数走势挂钩,并且现金值是保本的,就算是指数跌了,现金值也可以得到2%左右的收益。相对来说,这一收益水平要好于仅投资债券市场类的保险品种的3%至4%的回报。除了同样具备避收益税和遗产税的功能之外,客户还可以随时从现金值里借钱出来,最多可以拿到现金值的80%,几乎是零利率而且同样不需要交税。

点击查看 insurGuru©️学院:人寿保险有哪几种,产品详细介绍和优缺点分析

人寿保险涉及到的方方面面

当一个人寿保险单签署时,它要涉及到几个方面。不用说,保险公司是其中之一。如果投保人死亡,保险公司就要赔偿。同时,在投保人方面,共有四个方面要被涉及。

1、拥有人(owner)

拥有人的权力最大,可以改变受益人。保险公司通常只和拥有人说话。

2、投保人(insured)

投保人不能改变,根据其年龄、身体状况和风险决定保费的多少。

3、付款人(payor)

付款人支付保费。

4、受益人(beneficiary)

如果投保人去世,受益人就能够获得理赔金。

前三个角色可能是同一人,拥有人也可能是受益人。如果付款人和拥有人不是同一人,每年的付费超过1万2000元,就要缴纳礼品税。如果拥有人要申请政府福利,如医疗补助(Medicaid),就有可能要放弃拥有人的资格。

如何选择保险公司

目前,美国有一千多家保险公司,其中大多数提供人寿保险,有的公司提供多种人寿保险计画。在这众多的公司中,如何选择合适的公司和合适的计画是一门学问。

如果仅要求死后拿一笔钱,许多人寿保险公司都能做到。美国有一个专门评价保险公司的公司,叫A.M.BestCompany,他家从财务方面,评价各保险公司的支付能力。如果能够排在该公司的前20名以内,赔偿能力都没有问题。

随着人寿命的延长,保险的费用也在降低。例如,过去七年间,保险费用(costofinsur- ance)下降了3%到4%。

在美国没有人寿保险是不负责任的行为,没有保险就意味着没有可以珍惜的对象。购买保险的时候,可以按照需要,在一家公司购买几种产品。

点击查看本站专题“美国人寿保险公司保险吗?”

如果很难确定什么样的人寿保险最合适自己。那么如果经济上不是很宽裕的时候,不妨考虑先从数量小的保单开始,随着经济状况好转再追加。

在购买保险的时候,要注意保单上的肯定(guarantee)和假设(as-sumption)的不同。前者是确保的,后者就不一定了。保险储蓄和银行储蓄是两回事,银行储蓄能拿回全额存款和利息,但人寿保险不同,如果提前中止,可能只拿回所缴保费的一部分。

向您推荐阅读:“购买美国保险的4大优势,以及外国人购买美国保险的办法(2018年9月更新)”

“外国人购买美国保险的步骤是什么?有什么核心注意事项?”

(本文转载和整理编译自网络,如有反馈请留言联系我们)