Covid新冠病毒疫情期间,美国大学新生入学率整体减少了13%,但大学学费却并没有减少。

最近一个热点新闻是,因为疫情期间的远程上课问题,哥伦比亚大学被学生告上了法庭,要求退学费。

在2020年春季,哥伦比亚大学宣布,全部转为线上授课。而学生认为,这和高昂的学费并不匹配,要求退还一部分学费。

在2021年11月,哥伦比亚大学承诺退还$856万美元学费,并和学生达成了和解协议。

美国大学学费高昂是共识,无论是自掏腰包,还是选择扛上教育贷款,都是一笔不小的家庭财务负担。

在学生告哥大一案中,哥伦比亚大学最终选择了部分退款,一定程度上将缓解每个学生家庭的财务压力。

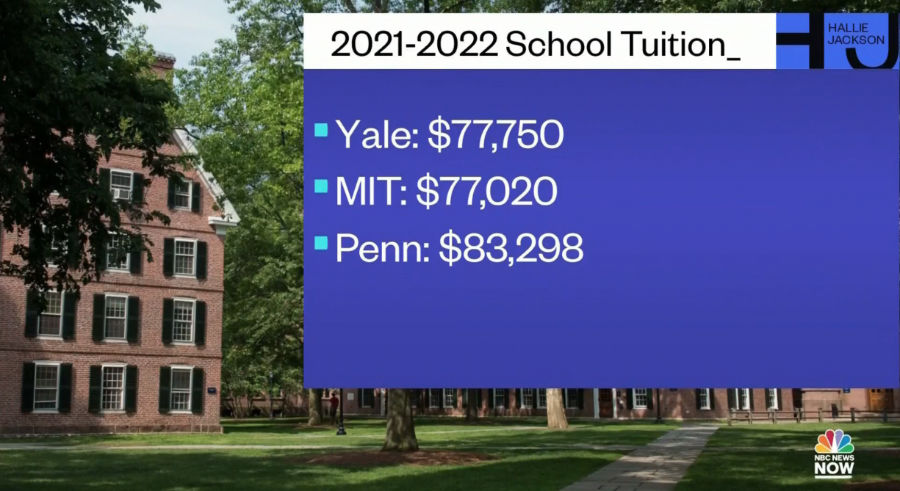

美国大学学费到底有多高?

根据USNews发布的大学学费排名,在2018-2019学年,州内公立大学的平均学费约为9,716美元,而普通私立大学的学费约为35,676美元,同时还根据通货膨胀指标逐年增长。

USNews统计了737家国家级私立大学(National Private University/College),有超过100所私立大学的学费,至少在50,000美元或以上。

学费高昂,当并不是说全部都得自掏腰包,我接下来会介绍一下每年都可以申请的学费补助,优点是无须偿还。

1.免费的学费补助(Financial aid)是什么?

大学学费补助,用来帮助学生支付教育相关费用,费用涵盖了如学费、食宿费、书籍和用品以及交通费等等。

在学费补助的类型中,有以下两种,是无须偿还的Free Money:助学金(Grants)、奖学金(Scholarships)。

这两笔免费的钱,申请条件并不苛刻,也不难申请。根据2020年的数据指出,48%的家庭,都申请到了助学金(Grants),平均每笔$6,030美元。

在2020年度里,58%的的家庭,都拿到了奖学金(Scholarsips),平均每笔$7,923元。

免费的学费补助,对于名校和私校的学费来说,可能远远不够。根据四年制公立大学学费调查报告指出,助学金和奖学金的补助,只占到4年大学开支总额的9%-12%。

为了填补中间这个学费差价,JPMorgan一句话就戳到了点子上,“别只存现金,投资去!”(Don’t Just Save, Invest!)

2. 529教育基金计划

最常见的教育投资理财方式,就是申请开设一个529教育基金账户,一次性,或按年,月往里面存钱理财。

关于529教育基金,最常见的误区是,认为需要攒够一笔钱,比如一万块,五万块,才能去开设账户。

这种做法确实很适合爷爷奶奶爸爸妈妈对子女的关爱一次性一步到位,最多一次性也可以放入超过30万美元。但这种家庭两代人一次性存满的方式非常罕见。

作为一种长期的教育理财储蓄,不少金融机构允许家庭每月至低存入100元的方式来进行投资。

除了爸爸妈妈以外,爷爷奶奶也可以每月往同一账户里存钱,因此,具有非常高的灵活性。

529教育基金账户的缺点是,对免费助学金的申请,有“小(Low Impacts)”的影响。

3. 成长型人寿保险计划

对于申请学费补助的影响几乎为零,同时为孩子提供了意外的人身保险,外国人也可以直接申请。这是开设人寿保险账户,来进行教育金理财的比较优势。

关于成长型人寿保险,最常见的误区是,认为人寿保险账户的投资理财效率不高。

通过简单对比过去10年的平均年化收益率,精选成长型人寿保险账户在指标上击败了不少529基金,15年年化收益率基本维持在同一水准。

使用成长型人寿保险账户进行教育储蓄理财的话,仅适合子女年龄偏小,或新生儿的家庭。在年龄阶段范围广度这一点上,优势不及529教育基金账户。

文章小结

“孩子的教育基金计划哪种好?” 我的答案是,都好。

时间和复利的作用下,越早开户投资理财,开始资金的积累,对自己越有利。

由于529教育基金和人寿保险的品牌,种类实在是太多太多了。我们可以在专业顾问的数据支持下,分析和对比不同理财账户方案的优缺点,最后,根据自己和家庭的喜好,来选择中意的方案。

也欢迎有需要的家庭和我联系,免费索取“2022年度大学教育家庭自助规划指南(最新)“。

(全文完)

* “Columbia University to pay $12.5 mln to settle COVID-19 refund claims”,11/24/2021, Reuters.

* “HowAmericaPaysforCollege”, 2020, SallieMae.

* Finaid.org. Based on full-time students at four-year colleges.