虽然2020年底美股市场涨势如虹,但以20年,或者更长的时间尺度来看,有涨必有跌,如果在我们退休的年份,遇到股市不景气,退休规划型保单既可以增加退休储蓄,又可以弥补缺口。

退休时如果遭遇股市大跌,这时候如果再从传统的个人退休账户里取钱出来作为退休生活费,会有一种“雪上加霜”的感受。

(>>>推荐阅读:评测| 投资理财账户 VS 现金值人寿保单账户,优缺点对比和选择攻略)

而这时选择从保单账户中领取,最大的损失和风险是可控可量化的,这是使用现金值类人寿保险进行补充退休收入规划的一大优势,因而得到了不少投保人的青睐。

美国人寿保险指南网的编辑在本周也收到了一位读者的邮件,提出了关于退休规划型保单的一些疑问。为此,我们邀请了来自HummingLife的寿险专栏作者 Heather,就“常见提问”和“常见误区”两部分在本文中进行分享,来帮助投保人了解人寿保险退休规划的一些细节。

常见提问:投资一份人寿保险退休规划,需要花多少钱?

为了等到退休那一天,保单账户里能积累起足够的现金余额,我们通常需要每月存入远高于所需保费的方式,来为保单账户“充值”。

举例来说,假设我们准备开设一份100万美金保额的现金值型人寿保单账户,假设保险公司允许每年最少支付$8000的保费,最多支付$20,000的保费,那么支付$20,000这种方式将显著降低风险,并提高现金值的积累能力。

这里也是让一些投保人感到最困惑的问题,为什么$8000就能买到的东西,为什么要花$20,000呢?

如果我们转化为“投资理财”的思维模式,这种问题就迎刃而解了:我们并非在花钱购买一份标准的消费品,而是在进行理财产品的选择,投入的金额越多,本金利滚利的增长可能性就越多,潜在的回报也就越高。

因此,为了在退休时多拿钱,那么在存钱阶段多存钱,就是一个合理的做法。

这种存保费的方式,被成为OverFund。多出的保费会直接进入保单账户,并会进行延税的增长。

(>>>推荐阅读:投保人必读!不可触犯的6条投保军规 )

常见误区:人寿保险退休账户只此一家

一些投保人以为,”只要是人寿保险,就可以做补充退休账户“,或者是认为,“市场上只有一家人寿保险公司,可以做这样的规划。“

这是一个最常见的误区,将会为我们带来资金的潜在损失。

”人寿保险“只是一个泛指的名词,如同”车“这个名词一样。

自行车是车,越野四驱车是车,F1方程式也是车,但是能用在赛道上,实现竞速目标的,最好是用F1方程式这种类型的车。

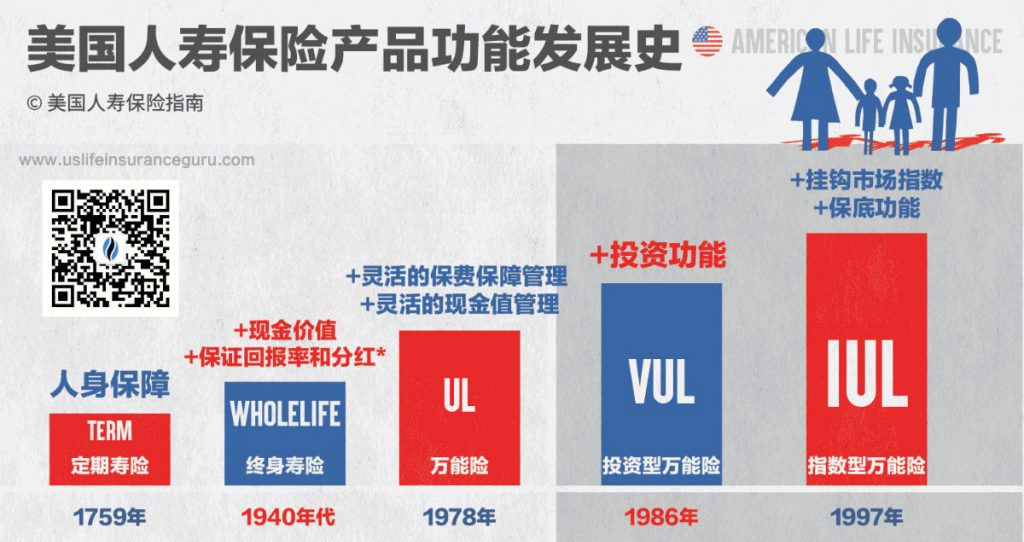

同理,随着上百年发展出来的“人寿保险”,也有几大类型。而不同的类型,分别适用于不同的生活领域,比如:

- 定期型人寿保险,短期内家庭财务的保护方案。

- 储蓄分红型人寿保险(Whole Life),可适用于多种生活场景。

- 保证赔付型人寿保险(GUL),可适用于多种生活场景。

- 证券型人寿保险(VUL),可适用于多种生活场景。

- 指数型人寿保险(IUL),可适用于多种生活场景。

不管是最早出现的“定期寿险”,还是升级换代的“指数型人寿保险”,它们也并不是一个具体的产品名词——这就好比”F1方程式赛车“这个词一样,大家都叫”F1方程式赛车”,但市场上却有很多厂商车队在生产和竞争,比如法拉利,本田,雷诺等。

同理,以指数保险(IUL)这一类型为例,美国市场上也有很多不同的人寿保险公司,都在生产和发行具体的指数保险产品(详细请查阅“美国人寿保险公司及产品评测”栏目)。

以具体的产品为基础,再加上专业的方案设计和维护管理——通过这样的使用方式,人寿保险最终完成了适用于不同生活领域的功能目的。

总结一下,用“人寿保险补充退休收入的规划”,它并非一个具体产品,也并非某个保险公司的专利,而是指的一种理财的策略和方法。

使用人寿保险,来进行补充退休收入规划的关键,就在于和金融类寿险专家的沟通和合作,通过选择性能更好的具体产品,达成更加专业化的目标导向型设计方案,来帮助我们实现更多的退休收入潜力。(全文完)