(美国人寿保险指南网 09/07/2022 讯)美国人寿保险市场数据监测机构WinK,在本周三公布了2022年第2季度的美国人寿保险品牌市场占有率排名,及热卖人寿保险产品数据。

通过对Q2季度数据的解读,TheLifeTank.Com将帮助投保人和投资者了解,选购不同人寿保险的主要原因是什么,每一份保单的平均保费是多少等常见问题的答案,也是个人,家庭及企业选购配置美国人寿保险的参考指标之一。

Q2人寿保险公司品牌排名和保险产品排名

在2022年第2季度里,非证券类的人寿保险市场,共产生了7.9亿美元的保费,相对于前一个季度来说保持了增长,以下是整体市场销量趋势图。

(2022Q2 非证券类人寿保险市场走势图 ©️Winkintel)

(2022Q2 非证券类人寿保险市场走势图 ©️Winkintel)

该人寿保险市场包括各类指数保险,万能保险,以及各类储蓄型保险,分红险保险。

上季度的公司品牌冠军——太平洋人寿保险的排名有所下滑,在本季度里,国家人寿保险公司旗下各类产品的综合市场占有率达到12.1%,综合上升至第一位。

在销量最高的人寿保险产品单品里,全美人寿发行的Financial Foundation IUL保险产品,继续排名单品销量第一。

【 Financial Foundation IUL 保险产品封面】 >【美国全美人寿保险 FFIUL 指数保险 |用户评价_产品手册_性能说明

>【美国全美人寿保险 FFIUL 指数保险 |用户评价_产品手册_性能说明

以下是按照不同保险市场的详细数据报告。

1. 指数保险:“保险理财”需求强劲

指数型保险,英文称为 Indexed Life,缩写为IUL。

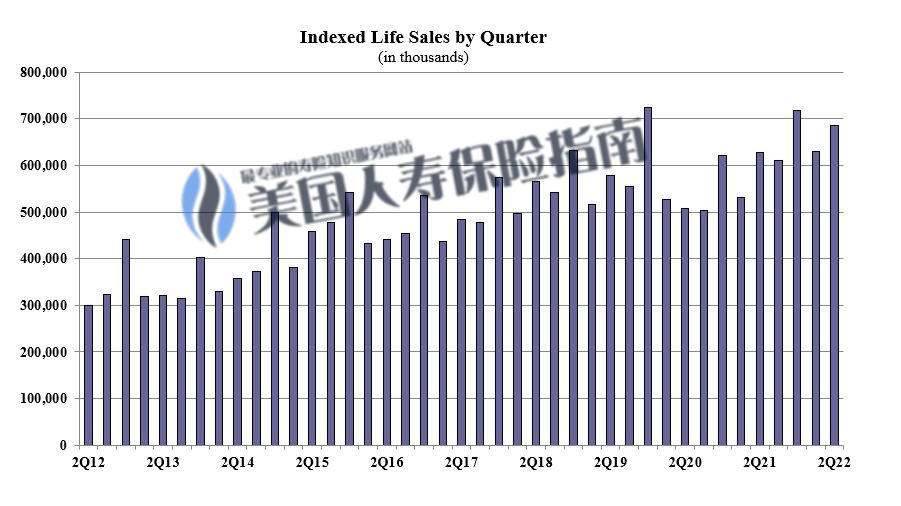

指数保险在2022年Q2的销量为6.8亿美元,环比增长了9%。与疫情期间的去年同期相比,销量上升了12%。历史市场走势如下图。

(2022Q2 IUL指数保险市场走势图 ©️Winkintel)

指数保险平均年缴存保费:

在2022年第2季度里,每张指数保单的年均目标保费为$12,138。

指数保险的主要目标市场:

80%的投保人寻求“现金值积累(Cash Accumulation)”这一目标而进行投保。

在指数保险市场领域里,国家人寿以综合旗下多款指数保险产品的销量优势,继续在本季度中整体销量排名第一。 全美人寿,太平洋人寿、全国人寿和Sammons保险集团紧随其后。

根据2022Q2市场占有率,以下是指数型人寿保险公司品牌Top5,以下是榜单具体内容。

2022Q2指数保险公司品牌排行榜Top5

- 🏆National Life Group / 国家人寿保险 (评测)

- Transamerica / 全美人寿保险 (评测)

- Pacific Life Companies / 太平洋人寿保险 (评测)

- Nationwide / 全国人寿保险 (评测)

- Sammons Financial Companies(评测*)

2022Q2销量最高指数保险产品

🏆销售冠军单品 – Transamerica Foundation IUL

全美人寿 (公司评价)发行的FFIUL产品(产品评测),继续成为本季度IUL市场领域销量最高的指数保险产品。

2. 万能寿险(UL):保证的终身保障

传统万能人寿保险,也称为固定利率万能人寿保险,英文称为 Universal Life。

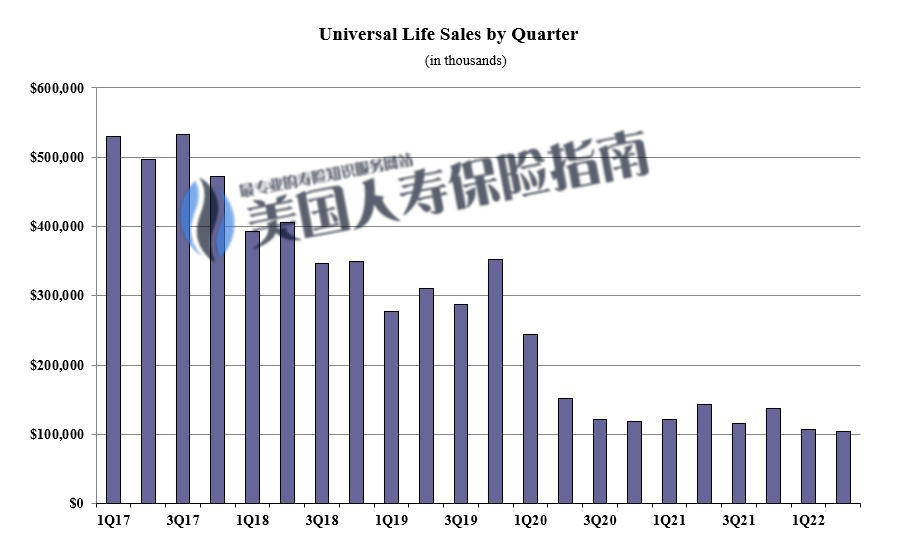

(2022Q2 UL万能寿险销量趋势图 ©️Winkintel)

(2022Q2 UL万能寿险销量趋势图 ©️Winkintel)

万能险在2022年Q1的销售额约为1亿美元,环比下降了3%。和去年同期相比,下滑了27%。

万能险平均年保费:

2022Q2里,每张UL保单的年均目标保费为$5,145。

UL万能险的主要目标市场:

57%的投保人选择“保证不断保(No Lapse Guarantee)”,作为购买这类保单的主要理由。

3. 分红型保险:

分红型保险,又被称为储蓄分红险,英文称为 Whole Life。

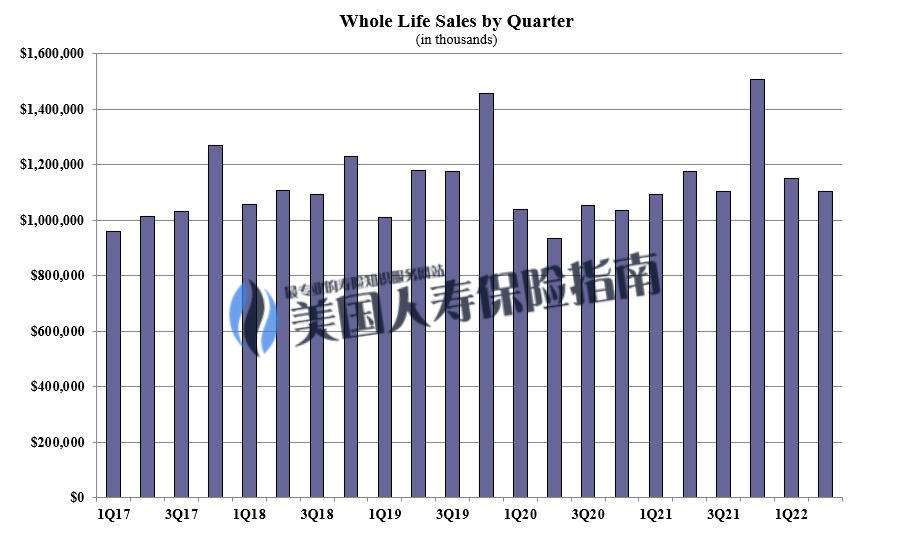

Whole Life(分红险)2022年Q2的销售额约为11亿美元,环比下降了4%。跟疫情期间的去年同期相比,销量下滑了6%。

(2022Q2 分红型寿险销量走势 ©️Winkintel)

(2022Q2 分红型寿险销量走势 ©️Winkintel)

分红型保险的平均年保费:

在2022第二季度里,每张保单的年平均保费为$3,513。

分红型保险的主要目标市场:

56%的投保人以考虑“生命末期的相关费用(Final Expense)”这一目标进行申购。

(全文完)

(>>>相关阅读:数据|2022Q3美国最畅销保险产品和人寿保险品牌及排行榜Top5)

(>>>相关阅读:数据|2022Q1美国人寿保险品牌及产品市场销量排行榜Top5)

(>>>相关阅读:数据|2021Q2美国人寿保险品牌及产品市场销量排行榜Top5 )

(>>>相关阅读:数据|2021Q1美国人寿保险品牌及产品市场销量排行榜Top5 )

(>>>相关阅读:数据| 2019Q4美国人寿保险市场排行Top5 及投保数据报告 )

(>>>相关阅读:数据|2020Q4美国指数人寿保险市场排名Top5 )

(>>> 推荐阅读:评测|收益增多$186万,专业设计规划 Vs 错误的投保方式 )

(>>>相关阅读:数据|2021Q3哪些美国年金保险最畅销?美国年金保险公司排名榜单 )

(>>>推荐阅读:数据|2021Q4美国最畅销年金保险品牌排名Top5 )

(>>>推荐阅读:数据|2022Q1美国最畅销退休年金保险产品排名榜单 )