人寿保险申请量增长5.2%

#新冠肺炎病毒疫情下,越来越多的家庭认识到了人寿保险所能构建的家庭安全网。

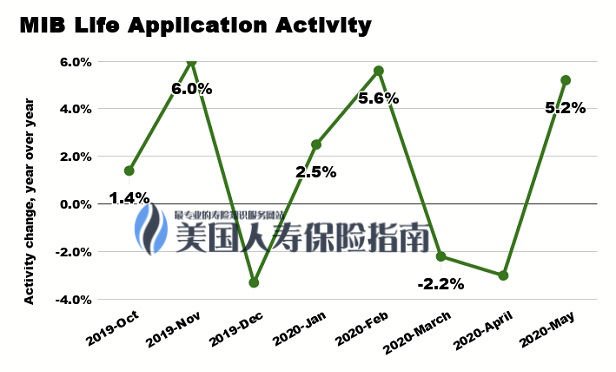

位于马萨诸塞州的MIB,为保险公司之间提供投保人的申请记录等各方面用于核保的信息共享服务。通过MIB对三个不同年龄段的数据监测显示,年轻的投保人群体的申请行为有明显的提高。

©Credit MIB/ThinkAdvisor

©Credit MIB/ThinkAdvisor

根据MIB人寿指数显示,在居家隔离期间,连续两个月的保单申请下滑后,2020年5月迎来了同比5.2%的增长和V字型的恢复。

Allstate保险公司大裁员

Allstate,又名全州保险,好事达保险,在2020年6月15日公布了裁员计划。

CEO全球总裁汤姆威尔逊在近期的视频电话会议中表示,为了降低公司成本,公司各个层面的“数千个工作”岗位将进行裁员。具体的裁员细节将在接下来的日期中公布。

Global Atlantic 再度调低Cap和illustration Rate

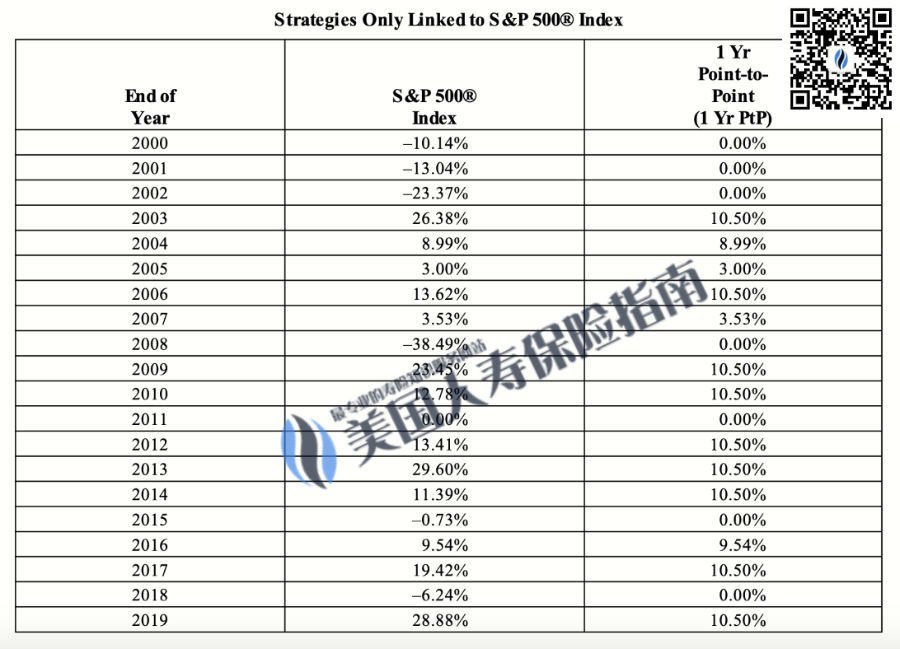

Global Atlantic(中文暂译:环球大西洋,评测)保险公司旗下主要针对外国人财富管理市场的指数保单产品 Global Accumulator IUL,在本年度再一次调低了展示利率1,至6.4%。

由于AG49前两个阶段的法规限制,产品展示利率的降低,就意味着该产品的指数封顶收益也进行了调整。

根据IMO机构提供的数据指出,截止发稿时,目前该产品的标准普尔500指数1年期点对点的收益封顶已降低至10.5%。在新指标下,20年期回看平均收益率为5.9x%。

行业评论

受Covid-19疫情等多方面因素影响,利率持续走低,部分保险公司在近期相继上涨了保费,或调整了产品的核心指标。而对于消费者来说,这不是一件希望看见的事情。

只有在潮水退去时,你才会知道谁一直在裸泳。

而从2018年起,一些在华人社区热销的保险公司,不同程度的调低了指数收益上限Cap(相关新闻)。这个指标的改变,将对保单现金值产生质的影响。

在现实中,消费者在最初的投保阶段,往往乐于看到保单设计方案上的“漂亮”数字——保险公司本身的历史渊源和财务强度,往往被投保人忽略或被保单销售人员一笔带过。

美国人寿保险指南的记者和一家位于加州的保险大盘代理机构进行了接触,就投保人到底该选择“好产品”,还是“好公司”的问题,提出了疑问。

公司负责人坦言,“有的产品是不错,当时能做出来的计划书也很好看,但是我们对发行产品的保险公司的财务存疑,因此也不主动售卖”。

“有的公司财务实力很强,受低利率的影响没有那么大。加上主要客户群体是美国本国客户,这是一件风险很小,也是保险公司最喜欢的客户群体。但是产品的性能可能很一般。”

好产品+普通公司,还是普通产品+好公司,你会怎么选?(完)