关于“储蓄分红型保险和指数型保险”哪个好的这个问题,美国人寿保险指南网社区内部也为此讨论了很久。最终,我们进行了下面几个方面的说明和评测:

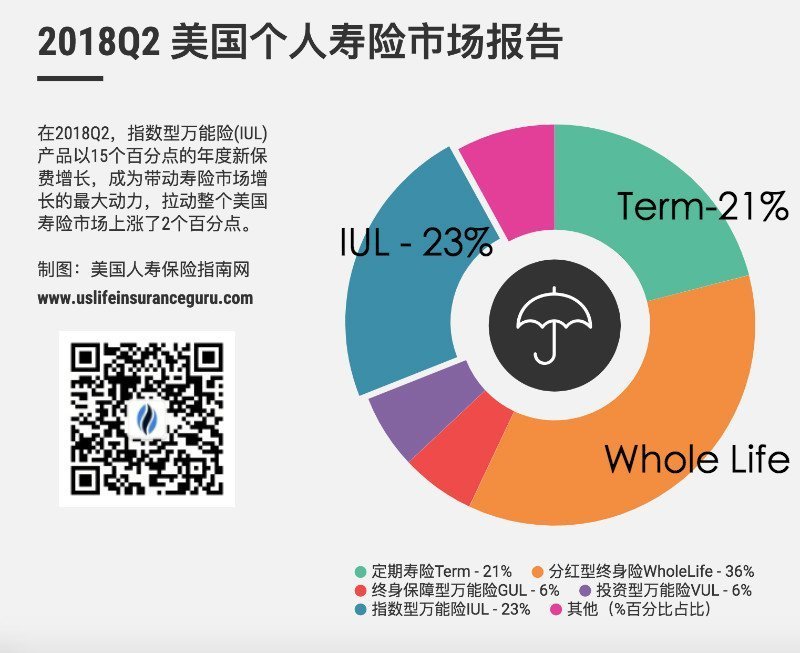

从历史发展和市场占有率来看

储蓄分红型保险(Whole Life )出现的时间更长占有市场时间更长——将近80年的历史——随之带来的市场占有率也更高:36%,是当之无愧的老前辈。

指数型保险( IUL )出现的时间较短——自1997年诞生在美国后,有将近20多年的历史。在不到前者1/4的历史寿命里,指数型保险占领了23%的市场,是备受瞩目的后起之秀。

从保险产品核心特点来对比:

从保险产品核心特点来对比:

指数型保险IUL的核心竞争力是,提供保底(Floor)的同时,提供了更强的现金值增长“能力”。选择指数型保险,由基于信任这种由过往历史市场表现带来的能力预期。

储蓄分红保险的核心竞争力是,保证给定的现金值和身故赔偿。保证的部分,不随市场波动。

保单产品评测对比

本文选择了美国人寿保险指南评选出来的,一流的储蓄型保险公司产品,和一流的指数型保险产品,进行王牌对王牌的评测,帮助投保人了解这种“保证”和“能力”的特点。

客户情况:Elizabeth,女性,32岁。她打算从现在起连续存10年钱到保单账户里,每年存大约$5万美元。在60岁到80岁时,由保单账户提供稳定的美元退休收入。不同的险种保险的具体表现怎么样?到底每年能提出多少退休收入?我们将接下来开始进行评测。

如何选品

在“美国人寿保险保险投保误区(三)”中,美国人寿保险指南指出,每家保险公司的专精领域不同,即使是同一家保险公司,旗下各个产品的使用场景也各不相同,因此,专业的选品和严谨克制的方案设计,才能真正实现我们的需求*。

经过评测编辑和保险公司代理经纪商的沟通,结合案例中投保人的实际需求,我们选择了两款特别注重现金值增长的美国保险产品,分别代表储蓄分红型保险——Whole Life,和指数型保险——Indexed Universal Life,进行一场比较PK。

储蓄分红保险方案评测部分

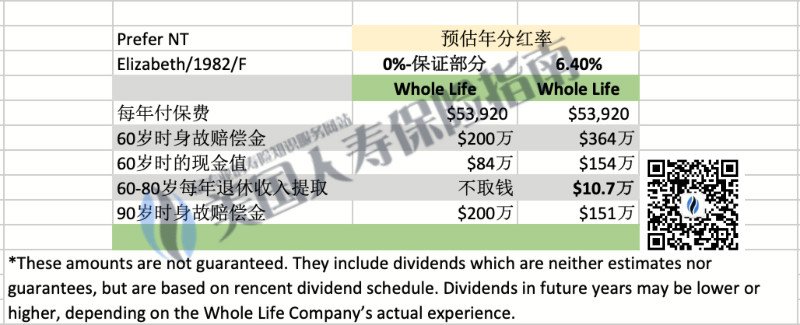

上图是美国人寿保险指南选取的一款2019分红率为6.4%*的储蓄分红型产品,使用Paid-Up Additions的红利方案。

“0%保证部分”这一列体现了这款储蓄分红保险的核心竞争力:“保证”部分。这部分的意思是,只要Elizabeth“保证”每年存入“保证”的保费金额:$53,920元,“保证”不间断地存满10年。那么不管外界股市是涨是跌,她的保单账户在60岁时“保证”会有$84万的余额。如果她在60岁发生人身意外离世,保险公司“保证”会赔偿$200万。Elizabeth在60岁-80岁期间,“保证”不取钱的话,等到了90岁时,如果发生人身意外离世,保险公司“保证”会赔偿$200万。

“6.4%分红部分”这一列是一个“不保证的对未来的预期”。它表示,在“保证部分”的基础上,如果按照保险公司的账本,每年都给投保人6.4%的分红,那么在这种假设情况下,Elizabeth在60岁开始到80岁,每年可以从保单里提取$10.7万作为退休收入,90岁时,如果发生人身意外离世,身故赔偿金额是$151万。

评测关键点:“保证”二字,在储蓄分红保单中频繁出现,它不是保险公司当方面的,也需要投保人参与。分红率,是储蓄分红保单的不确定因素——每年给不给分红,分红给多少,是0%,还是6.4%,还是其他数值,由保险公司内部自行决定的。

指数型保险方案评测部分

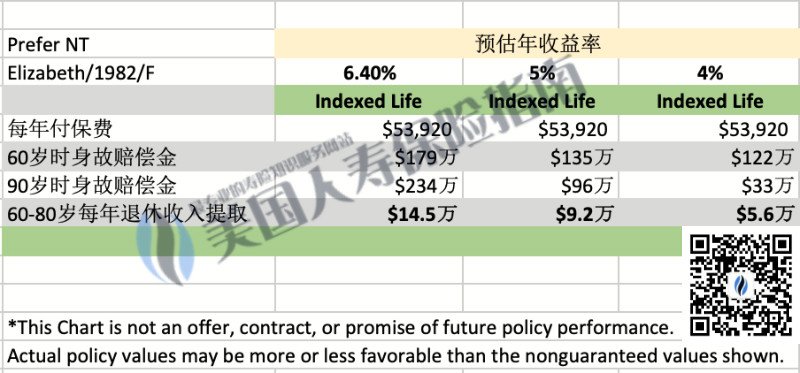

上图是美国人寿保险指南选取的一款注重现金值增长的指数型保险产品,并使用了不同的市场利率方案来进行对比。

“6.40%”这一竖列是指,在预期未来的市场平均年收益率为6.40%的展望下,“指数保单的表现能力”。在这种假设情况下,Elizabeth到了60岁准备退休的时候,保单账户有$179万的理赔金。从60岁到80岁,她每年可以从保单里提取$14.5万作为退休收入,90岁时,如果发生人身意外离世,身故赔偿金额是$234万。

而“5%”这一竖列是指,如果预期未来市场的平均收益率是5%,那么在这种假设的情况下,Elizabeth在60岁开始到80岁,每年可以从保单里提取$9.2万作为退休收入,90岁时,如果发生人身意外离世,身故赔偿金额是$96万。

此外,我们还计算了4%这个情况。美国人寿保险指南不采用超过 7%的演示利率。

评测关键点:预期年收益率,是指数型保单的核心,也是无法在当前确定下来的因素——4%,5%,6.4%,甚至10%,这个数值,由未来现实市场的公开走势决定。

文章小结

从上面的对比中,我们可以看出,不管是储蓄分红保险,还是指数型保险,投保人最终实际的退休收入情况和身故赔偿金,很大程度上都是由未来还没发生的一个表现因子来确定。

insurGuru©️保险学院认为,在一个不确定的参考因素下,两者根本没有可比性。这两者的关系,好比一个是苹果,一个是香蕉。有的人喜欢苹果,有的人则喜欢香蕉,两者各有自己的受众群体。对于不同的投保人,在不同的人生阶段,不同的财务状况,不同的风险承受能力,我们会有不同的想法和选择。

通过本文的对比评测,美国人寿保险指南希望投保人了解到 :不管是苹果,还是香蕉,我们都需要根据我们的实际需求,管理好合理的预期,并在专业的规划人员的帮助下,做到正确选品下。在退休规划这项重要的人生决定上,坚决避开“问题”产品,找到真正能更好实现我们需求的产品和方案。

美国人寿保险指南网创办的宗旨:“帮助华人全面了解美国人寿保险知识,从而获得能真正保障自己和亲人所需的保险。”(全文完)

(>>>推荐阅读:专栏|两份保险价差50%+,千万美元保单保费横向对比评测 )

(>>>推荐阅读:评测|王牌对王牌,储蓄分红保险Vs指数保险终极评测大公开 )

(>>>推荐阅读:评测|$100万美元的保单要花多少钱?分红保险 , 指数保险, 万能险价格PK )

(>>>推荐阅读:攻略|人寿保险投保时的Illustration(设计方案)是什么?有什么争议和看点?)

Disclaimer:

*为遵守美国金融保险业法律规定和保险行业合规,在征询律师建议后,我们不能在面向公众的评测文章中提及具体的保险公司名称和具体的哪一款产品的名称。如果对此感到不理解,可以联系我们询问原委。

*文章出现的数字,金额仅仅作为教育和信息分享交流之用途,并非保单实际的合同内容,不具有任何法律效应。实际情况以英文保单内文为准。

*分红利率(Dividend Interest Rate ,DIR)并非保单回报率、保单收益率,或保单现金值收益率。 它是根据金融保险公司的财务情况,由保险公司单方面按年份来决定的。分红收益率可以改变,并不保证是否有分红,分红有多少。