配偶终身受益信托SLAT是什么?

SLAT信托,英文全称为:Spousal Lifetime Access Trust,中文译为配偶终身受益信托。

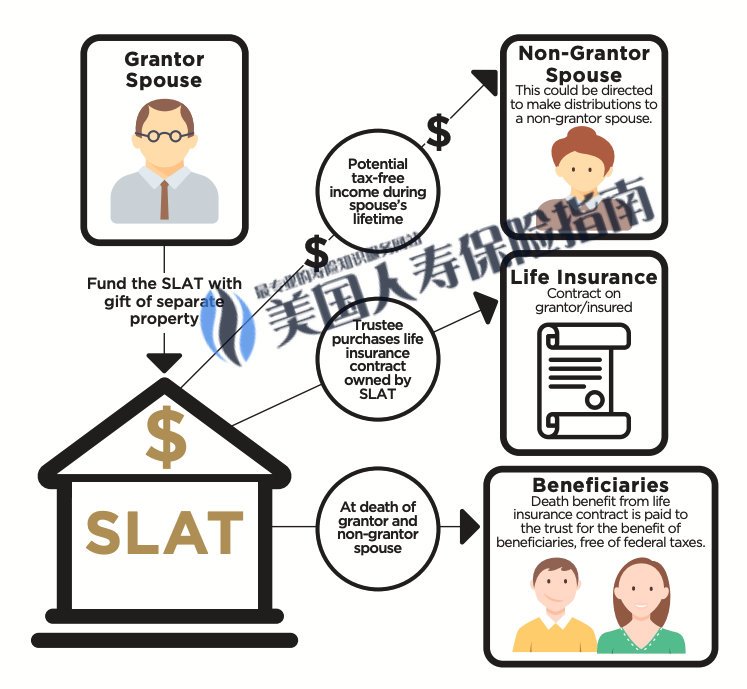

SLAT是一种针对夫妻特别设计的不可撤销信托。它最基本的功能原理是,夫妻中的一方,将资产以“赠予”的方式,放到一个专为夫妻另一方受益而设立的不可撤销信托的名下。

当我们结合SLAT和人寿保险进行财富传承规划时,我们将人寿保单放到这种信托里,具有两大优势,一是人寿保单的理赔金不会计入夫妻任意一方的遗产,同时,受益配偶这一方还能分配人寿保单的现金价值账户。

©️MERCURY FINANCIAL GROUP

©️MERCURY FINANCIAL GROUP

在SLAT信托的受益配偶这一方去世后,SLAT信托里面的资产也可以分配给诸如孩子,孙子这样的受益人。

配偶终身受益信托能帮我们做什么?

设立配偶终身受益信托的目的,是将设立人的资产,放到SLAT信托名下,而不是放到配偶的名下。

通过合理的架构,不但可以让配偶得到终身的资金,并实际得到财产的分配,还能帮助配偶免于债权人对财产的追索,最后,信托资产也不会包括在配偶的应税遗产中。

作为遗产规划的重要组成部分,配偶终身受益信托主要用作资产保护,而且成本不高。

除了上面三大优势以外,配偶终身受益信托也具有一定缺点,第一个缺点是,当作为受益人的配偶一方先过世时面临的问题,其次,另外一个缺点是,解决不了离婚带来的意料之外的问题。

配偶终身受益信托适合哪一类人?

配偶终身受益信托对于下面这类的夫妻关系,配合大额人寿保单,将是一个非常理想的解决方案:

– 夫妻关系非常紧密,不可能离婚;

– 家庭资产预计在$600-$3000万之间,面临潜在的遗产税问题;

– 至少40岁;

– 信托设立人的身体状况具有可保性;

– 有在夫妻之间进行财富转移的共识;

您的评价?请点击星标评分

[总票数: 3 平均分: 5]