美国房地产市场的“拐点”是否来临,我们不得而知。但是,不少家庭选择在高位卖房套现,开始为退休收入做准备。

高位套现,手持一笔现金,想要退休的人,或临近退休的人,最常问的一个问题就是,“我有一笔钱,怎么来让这笔钱,产生一辈子的终身月收入?每月到底可以领多少钱?”

在本文中,TheLifeTank©️在社区机构HummingLife(蜂鸟人寿)的案例数据分享帮助下,将帮助退休规划或F.I.R.E一族回答了下面两个热点话题:

- 两种最常见的终身收入现金流方案

- 两种终身收入现金流方案的对比

/ 案例说明 /

在具体的案例中,一名近60岁的男性居民高先生,在近期将位于加州的投资房产卖出,扣除所有成本和税费后,净所得约$100万美元。

高先生表示,他希望在疫情结束彻底退休,和家人环游世界。他明确表示并不希望在60岁后,还像过去一样花时间和精力去应付租客,修缮和维护这套投资房。

那高先生有什么理财选择,可以让$100万美元的资产,来为他提供一辈子的收入呢?

一. 退休方案一:退休4%法则

在TheLifeTank的退休储蓄专栏中,美国人寿保险指南网©️以专栏的形式,介绍了常见的“在美国退休下来到底需要多少钱?退休4%法则是什么?”

对于高先生来说,4%法则,是财务顾问最常推荐的一种打理退休资产的方式。

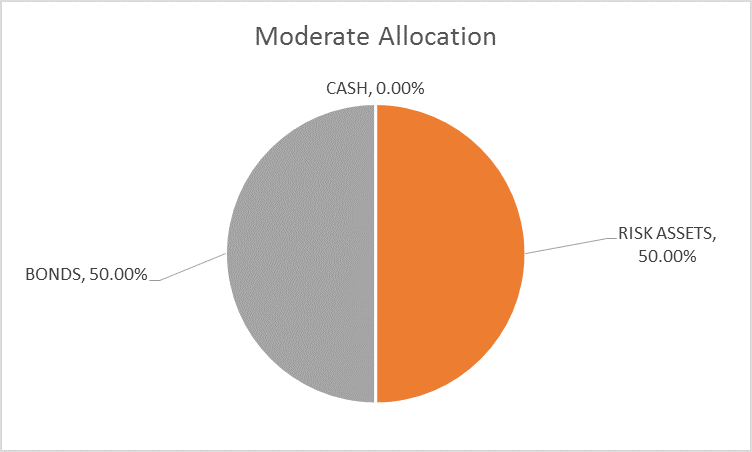

退休4%法则具体是指,根据对历史数据的研究发现,只要退休资产——本文指卖房赚得的一笔钱——50%放在股票里,50%放在债券里,那么平均下来,每年提取初始资金的4%,这笔资金就可以为我们提供一辈子的终身退休收入。

(©️Investing.com 4%法则对应的50/50资产组合)

(©️Investing.com 4%法则对应的50/50资产组合)

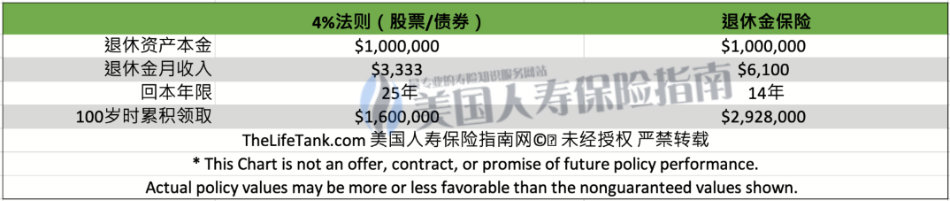

退休4%法则:每月领$3,333

100万的卖房款,使用50/50的法则,一名60岁的投资人,每年可以领取4万美金,平均到每月的收入,是$3,333美元的月收入。

按照这个算法,领取85岁时,刚好领取了$100万美元,也就是说,在25年,当高先生85岁时,提领回了本金。这种方式将会继续供款,直到本金耗尽。

(>>>相关阅读:通货膨胀冲击退休4%法则,100万退休资产每年缩水多少钱?)

二. 退休方案二:终身收入保险

对于大多数持有退休账户积蓄的美国家庭来说,另一种主要的方式,就是使用收入年金保险。

收入年金,是指,投保人将一笔钱,如卖房后得到的钱,一次性投入给保险公司。之后,保险公司以年金合约的形式,按月或按年,定期向投保人支付退休金。这类似于“整存领取”的概念,可以领取一辈子。

这也是大众熟悉的“商业养老保险”,它专门用来为退休一族,提供保证的退休金收入的保险产品。

商业养老保险:每月领$6,100

这笔卖房款用于收入保险后,每月能领取多少钱,和保险公司品牌并没有直接关系,而主要取决于以下两点:

- 市场当前基准利率

- 保险公司的资产管理水平和收益能力预期

一般认为,资产管理型人寿保险公司的退休金保险,收入要高于保障型人寿保险公司的退休金保险。 ——Heather Xiong CFP®️

在采用A+级信用评级的保险公司方案后,一名60岁的男性投资人,100万的卖房款,购置收入年金保险,每年可领取7万3千美金,平均到每月的收入,是$6,100美元左右的月收入。

按照这个利率,领取74岁的时候,刚好领取了$100万美元,也就是说,高先生领取了14年后,在他年满74岁时,提领回了本金。这种方式将会继续供款,直到高先生去世。

两种退休理财方式总结对比

*该图标仅用于工作教育说明,并非保险合同要约和报价。本数据来自于HummingLife 2022/05/15 市场利率数值,实际收入变化情况请咨询专业人寿保险财务顾问)

*该图标仅用于工作教育说明,并非保险合同要约和报价。本数据来自于HummingLife 2022/05/15 市场利率数值,实际收入变化情况请咨询专业人寿保险财务顾问)

文章小结

在本文中,美国人寿保险指南网©️从具体案例分析的角度,展示了不同退休理财方案的收入情况对比。

然而,数字虽然客观理性,但对于“房子”情节根植于血脉的传统家庭来说,可能更像是接受一场思维和理念上的主观挑战。

看得见的砖头水泥,和看不见的虚拟金融资产,这两者,区别并非“厚重感”,”流动性“和“效率”这么简单几个词就可以概括。

在本文的对比中,不同的理财选择方式,也带来完全不同的收入金额。

TheLifeTank.com专栏的目的,旨在介绍美国社会不同的退休理财方式,以及对应的数据支持。所有的这些方式,都没有好坏之分。

“心安即是归处”,选择让您和家人觉得心里踏实,舒服的退休理财方式,享受每一天悠闲的退休生活,才是每一个家庭退休理财的最终目标。(全文完)

(>>>推荐阅读:美国人都去哪里养老?美国10个物价宜居退休城市排行榜 及房租价格 )

(>>>推荐阅读:如何用人寿保险来给我们增加退休后的收入?)

(>>>推荐阅读:退休养老金的“水桶策略”具体是什么?它是不是最好的退休取钱策略?)