在对比不同资产管理型保险公司的保单账户产品时,客户通常会和美国人寿保险指南社区里的保险顾问讨论说,“这个产品竞争力似乎不高”,“那个保险公司投资回报率好像不高”等疑问。于是自然而然就引出了,美国保险的资管“竞争力”到底是个什么东西?“回报率”这个数值我们是依靠什么媒介将它引入到我们脑海里的?这个代表“竞争力”的数值靠谱吗?我们到底应该关注什么?

保单的资管“竞争力”怎么来的?

保险公司通常是用投保人累计的保费资金池来赚取利润,这个盈利的原理我们用图表在“拒保,涨保费和暂停销售,美国新冠疫情的投保窗口正在关闭”一文中进行了具体的描述。

(自1980年来,连续40年利率不断走低)

(自1980年来,连续40年利率不断走低)

由于长期的低利率,传统的保险产品险种和曾经的业务已经不怎么能帮保险公司赚到钱了,美国人寿保险指南也在近两年里,报道了几家保险公司退出或转卖个人人寿保险业务的新闻。

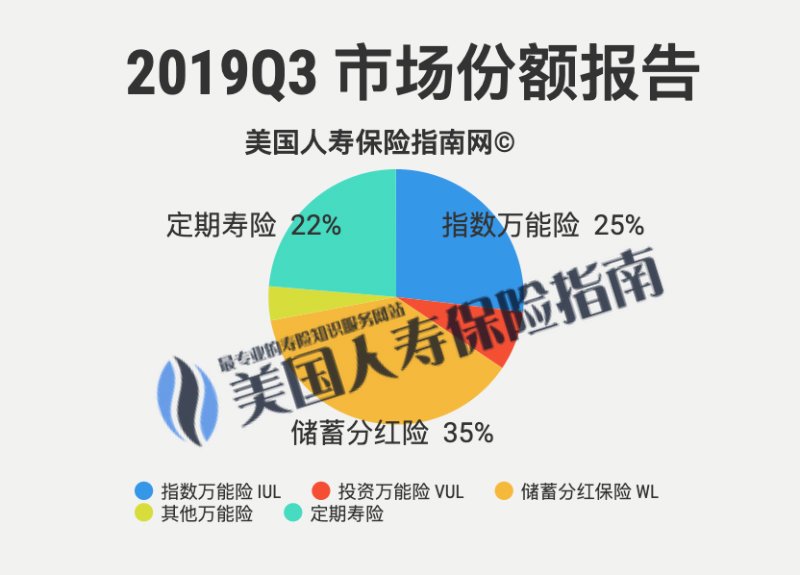

在这种情况下,一些保险公司开始逐步向“资产管理”这个理念方向转型。随后,投资型,指数型保险产品在2000年后的市场上开始涌现,并在短短20年间迅速崛起,逐渐攻占了美国个人人寿保险的主流市场。

到如今,“保险理财”的观念开始普及,“买保险”,就像买股票,买基金一样,成为我们很多人日常理财生活的一部分。

更像是“Passive Management”属性的指数型产品,复合叠加“保险”具备的传统优势,为家庭财富的积累,提供了一个强大的风险管理工具和基石。因此,指数产品相对于“Active Management”的保单产品,拥有更高的市场占有率。

理想中的“竞争力”是什么?

以最早出现的指数型保险产品为例,不考虑品牌溢价,如果保单的成本,对标的市场指数都是完全同样的理想情况,那么,谁家给出的收益封顶Cap越高,说明保险公司在分红和让利给投保人这个问题上,就越是大方。

这种情况往往也意味着对应保险产品的方案计划书上的数值更漂亮——说明这家保险公司在未来同等的市场走势下,相比较于其他保险产品,得到的现金值收益将会更多。因此,在当下的竞争力就越强。

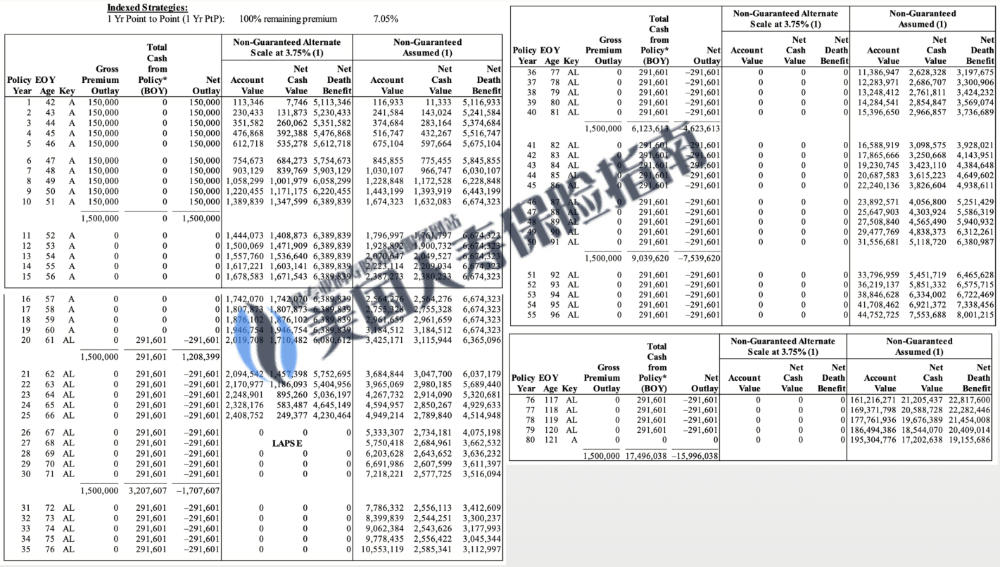

(范例:一家高封顶Cap的保险公司的“方案建议表”演示。本图不构成投保的建议,也不是保证的结果)

(范例:一家高封顶Cap的保险公司的“方案建议表”演示。本图不构成投保的建议,也不是保证的结果)

道理虽然是这样,但是现实世界中,并不存在这样简单的一个判断准绳和理想的对比环境。这是因为,每家优秀的保险公司都有不同的专业市场领域,在保单成本核算和福利保障上千差万别,根本不可能存在一个准绳,可以用来进行完全公平的比较。

此外,指数型保险产品已经随着市场的竞争和发展,从最早一代的产品,升级成了第二代的产品,这两者在市场上并存,并存在明显的产品差异。后者计划方案上更加漂亮的数值,能以一种全然不同的计算方式得出,直接绕开了初代指数产品的“封顶收益Cap”决定论。

“竞争力”不是什么

但是诸多的营销和噱头,都将我们的注意力引向了保单设计方案上的“数值”。然而,“数值”从来都不是中立的。保险公司更深知这一点,在用于展示的演算系统上也是下足了功夫。

回到5年以前,保监会AG49法规还没正式出台——以当时华人财富管理市场的当红炸子鸡某V保险公司为例,旗下保单账户的规划方案,或产品计划书上的数字,可以做得让后浪的晚辈们瞠目结舌。

如果只看数字,这绝对是一个有“竞争力”的产品。

但在多年后,最先感受到有苦说不出的,不是客户,也不是投保人,而是当时同样认定这是有“竞争力”的产品,跟着投入签字的部分从业人员。

而原保险集团的高管被解雇掉后,掉头进入另一家金融集团,重新操盘建立了人寿保险业务,通过收购,买入“公司历史”,以新的名义和确实漂亮的数值计划展示表再次出现——深入一点思考,这种做大资金盘的操作,会不会再次带来同样的市场轮回?作为行业观察者,对于这类的保险公司,我们始终保持怀疑。

最后,从专业的角度来讲,保单方案计划书从来只是一个参考。从保单签字生效的那一刻起,没有任何保单账户会完全按照计划书的期望方式自动运行。如果仅仅按照一个不具有法律效应的参考范本上的参考数值,来判断一个产品是否具有“竞争力”,从而并做出财务决定,可能值得商榷。

(>>>推荐阅读:专业贴|美国人寿保险的建议书(Illustration)是什么?有什么争议和看点?)

这也是为什么我们强调,保单生效后对这类保单账户的长达10年,20年的打理,保险公司是否提供了更多的管理工具和拿出现金的选择,保险公司整体业务的专一度和管理团队的性质背景,可能更胜过关注保单方案设计上数值展示的重要程度,这才是真真正正体现“保单长期平均收益率高不高”的基础。

在接下来的专栏,我们将继续分享,2020年储蓄分红保险账户 & IUL指数保单账户申请的几个重要法则。

1.怎么判断这家保险公司到底靠谱不靠谱?

2.为什么说,选保险顾问和经纪人,而不是选保险公司。

3.明确自己想要的是什么,或者不想要的是什么。

4.怎么可以从保单拿钱出来?有哪些选择及对应的成本?

(>>>推荐阅读:2018年 选购 IUL 指数保险的4个黄金法则 )