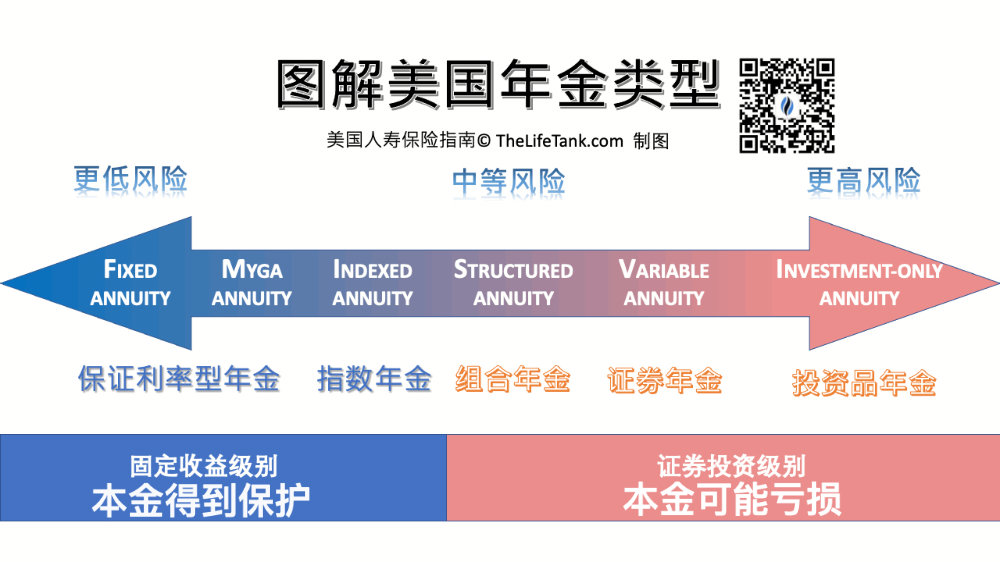

美国年金保险账户,主要由人寿保险公司发行和管理。美国人寿保险指南©️的2021年Q3数据报道里指出,下面两类年金理财保险账户,是美国年金理财市场的绝对主流。

- 基金型年金保险账户 ( Varible Annuities,又名证券型年金/ 占比36.0% )

- 指数型年金保险账户 ( Indexed Annuities /占比29.0% )

对于投保人,或者投资者来说,哪一种类型的年金保险账户会更好?

在本文里,美国人寿保险指南©️和社区机构成员Humming Life(北美蜂鸟人寿)携手合作,以一份10年期的年金保险账户为例,通过具体图例和历史数据的比较,向公众说明这两种年金保险账户的优缺点,从而帮助投资者了解不同年金保险类型的风险及回报预期,做出最优的退休资产配置决策。

一款传统的指数年金保险账户

50岁Lee女士(化名),现居住在纽约。考虑到临近退休,传统退休账户无法存下更多的钱,于是Lee女士考虑使用开设退休年金账户。

Lee女士准备每年存2万美金,从50岁存到59岁,累计10年。Lee女士较为保守,日常仅仅和银行打过交道,因此,Lee女士选择了开设指数年金账户来储蓄。

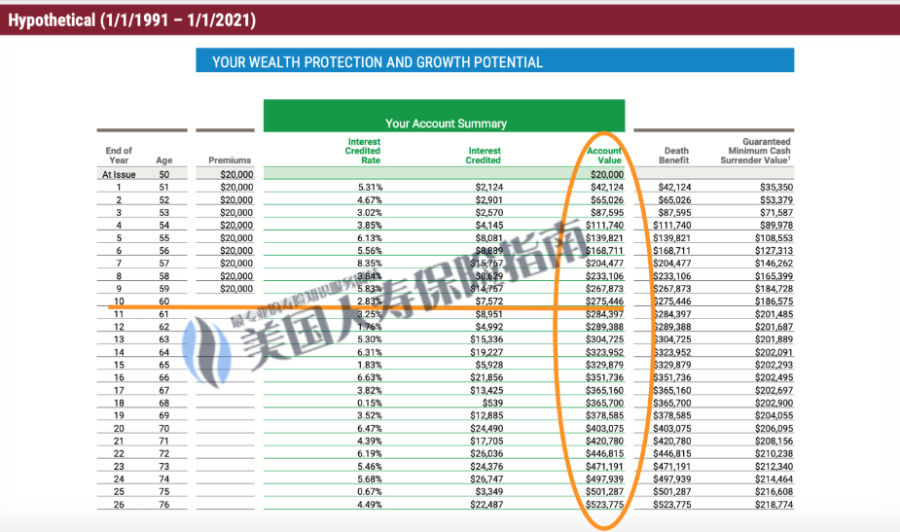

下图的计算表格,在左侧第二列展示了Lee女士从50岁到60岁,每年存入2万美金的情况。

©️TheLifeTank.com This is not an offer or illustration for an insurance product. For Educational purposes only. 本图例并非保险合同或投保合约,仅用于教育目的。

©️TheLifeTank.com This is not an offer or illustration for an insurance product. For Educational purposes only. 本图例并非保险合同或投保合约,仅用于教育目的。

从上图我们可以看到,橙色横线部分是10年后,Lee女士60岁时,年金保险账户里资金情况,约为$27.5万左右。

25年里,Lee女士的年金账户里,最高年度收益是8.35%,最低年度收益是0.15%。

这正是指数型年金保险的最大优点,保险公司对指数年金账户给予了最低0%的托底收益率,不会亏损本金。因此,无论lee女士遭遇了2000年互联网泡沫破裂,还是2008年的金融危机,从上图的椭圆框中,我们都可以看到,她的年金账户里的钱,始终是保持了增长,并未出现减少。

这款传统指数型年金保险的优点,也正是它的缺点,保险公司在给予最低0%的保底收益率的同时,也会给出一个最高封顶收益率(Cap),不同保险公司给出的封顶收益率也各不相同。在经济繁荣,市场稳定上涨的周期里,指数型年金保险账户无法分享市场的更多成果。

一个典型的说明,在2011-2021年经济繁荣的黄金10年里,这一款指数年金账户的最高年度收益,未超过7%。

为了克服这一上限,市场上目前推出了收益不封顶的另类指数年金产品。根据2023年9月的利率,该类增强型产品的过去10年回看最高年度计息,达到了40+%。

下面的对比,将进一步展示两种不同年金账户的优缺点。

基金年金保险账户

同样是在50岁时,Lee女士回顾了自己的投资经验,对自己的风险承受水平充分评估认识,开设了一个基金型年金账户(又名:证券投资型年金)。

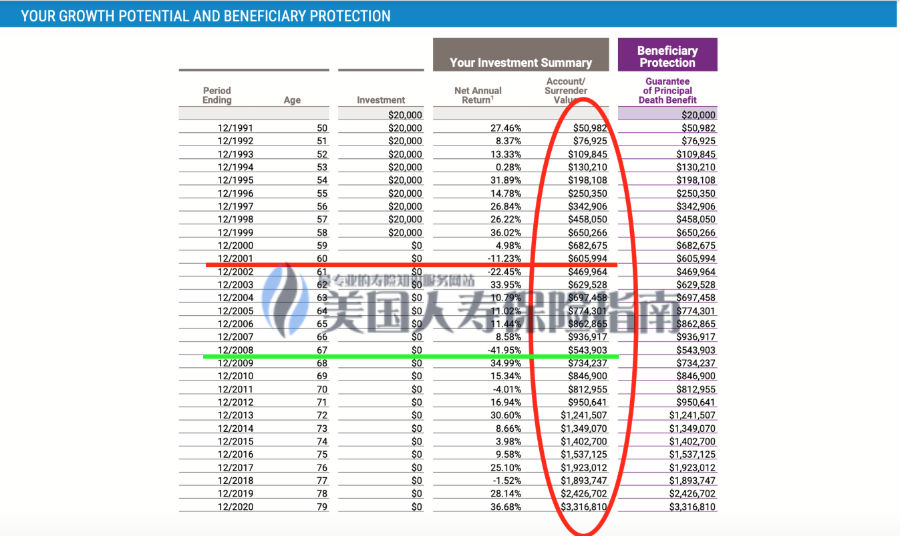

Lee女士每年向基金型年金账户存入2万美元,连续存入10年,如下图左侧所示。

©️TheLifeTank.com This is not an offer or illustration for an insurance product. For Educational purposes only. 本图例并非保险合同或投保合约,仅用于教育目的。

©️TheLifeTank.com This is not an offer or illustration for an insurance product. For Educational purposes only. 本图例并非保险合同或投保合约,仅用于教育目的。

从上图我们可以看到,红色横线部分标注出10年后,在Lee女士60岁时,年金保险账户里资金,积累到$60.5万左右,是同期指数型年金账户的2.5倍。

25年间,Lee女士的年金账户里,最高年度收益是36.68%。

这指出了基金型年金保险的最大优点——在市场稳定,持续上涨的经济繁荣期,基金型年金账户直接参与并分享市场的上涨成果,复利效果惊人。

任何事情,都有两面性。由于直接参与市场,证券投资型年金保险的最大优点,也是它的缺点——当股市下跌的时候,投保人将承担风险,账户资金会对应形成亏损,账户金额会面临相对更大的波动情况。

一个典型的说明(上图绿色横线部分),在2008年金融危机时,该资金账户下跌了41.95%,账户余额从上一年的$93.6万,降低到$54.3万。

指数年金和基金年金对比

根据相同历史市场数据,我们汇总下两款年金保险的账户金额对比情况,

| *模拟1991年-2020年 不同类型的年金账户余额对比 | ||

| 年龄 | 指数年金账户金额 | 基金年金账户金额 |

| 55岁 | $139,821 | $250,350 |

| 60岁 | $275,446 | $605,994 |

| 65岁 | $329,879 | $862,865 |

| 70岁 | $403,075 | $812,955 |

| 75岁 | $501,287 | $1,537,125 |

©️TheLifeTank.com This is not an offer or illustration for an insurance product. For Educational purposes only. 本图例并非保险合同或投保合约,仅用于教育目的。

我们的总结

指数型年金保险和证券投资型年金保险,这两者并没有谁“更好”或“更坏”一说。

指数型年金牺牲了上涨的潜力,换来了资金的托底保护。而基金型年金则放弃了资金托底保护,换来了最高的增长潜力。

每个投保人都需要结合自己的年龄阶段,风险承受能力,以及理财的目标,来选择适合自己年金账户。

在实际的运行中,指数型年金保险账户,和证券投资型年金保险账户也并非铁板一块。

如果需要管理和降低资产风险,可以在专业保险财务顾问的帮助下,将证券投资型年金账户的资金,转入到波动更小的指数年金保险账户中;

同理,如果市场环境繁荣,追求更高的收益潜力,也可以将指数年金账户里的资金,转入到证券投资型年金账户中,或转入专用于资产积累的新型指数年金产品中。

美国人寿保险指南©️一贯提倡LBYB – “Learn Before You Buy”,购买之前多学习的理念,并提供了关于选购年金保险的险种说明和优缺点详细介绍等专栏供参考。

在最终决定申请开设个人退休年金账户时,可以在专业金融保险顾问的帮助下,通过对自身综合条件的评估,找到真正适合自己的年金保险产品,从而最大限度的呵护好我们的资产。(全文完)

(>>>推荐阅读:小工具|哪一款具体的指数年金保险适合我?最新的利率指标是多少?)

(>>>推荐阅读:数据|2021Q4美国最畅销年金保险品牌排名Top5 )

(>>>推荐阅读:投保攻略|如何迈出第一步?详解和保险顾问必须讨论的4个常见话题)

(>>>推荐阅读:(图)美元人寿保险的年度对账单是什么?每年保单收益计息怎么看?)

(>>>推荐阅读:买房3部曲 vs 买保险3部曲,我们为什么需要投保PDA服务)