(美国人寿保险指南 insurGuru©️保险学院)在2016年8月,密歇根大学宣布修改其与足球主教练吉姆哈博的合同,包括一项创造性的使用现金价值人寿保险的延迟福利补偿方案。

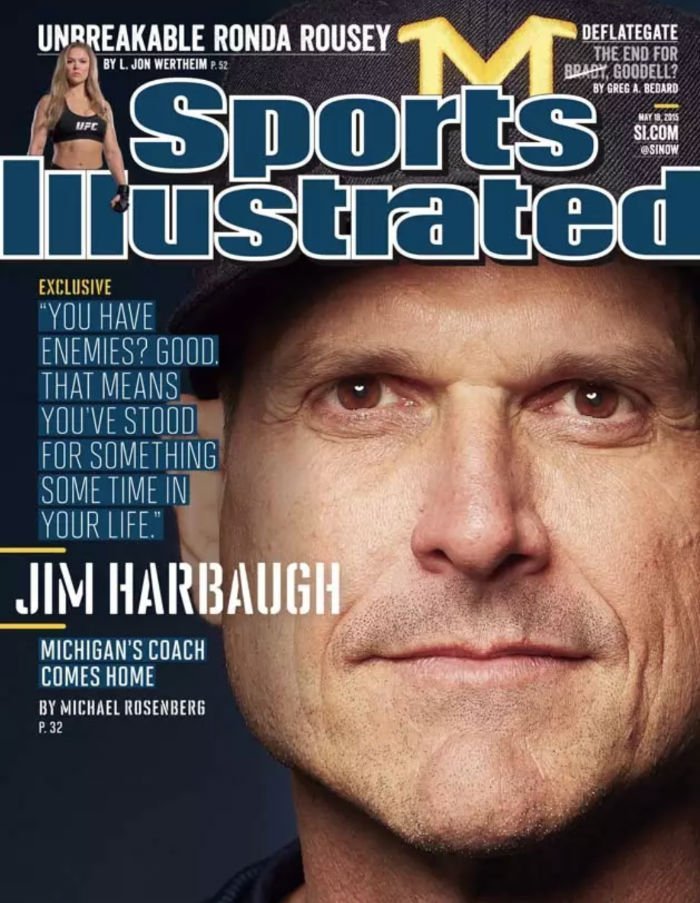

据“体育画报”报道,根据披露的这份协议计算,NCAA传统劲旅,密歇根大学狼獾队的吉姆哈博,成为了当年全美综合收入最高的大学橄榄球教练。

这种使用现金值人寿保单进行个人福利规划的策略,将为哈博和家人提供数百万美元的免税收入。 这种策略同样适用于符合条件的中小公司,个体或家庭。

吉姆哈博福利协议中的策略

密歇根大学最初聘用哈博时,双方同意在第一个赛季结束后来讨论建立递延的福利方案。然而,最终达成的协议可能更具价值。

远超过福利递延协议,哈博和密歇根大学签订了一项拆分补偿协议(Split-Dollar Loan Agreement )——密歇根大学同意支付7笔贷款预付款,每笔贷款额为200万美元,哈博将用这笔贷款,支付人寿保险合同的保费。

只要人寿保单还在生效状态,哈博就不需要偿还这笔贷款,等到哈博去世的时候,密歇根大学将从保险公司支付的身故赔偿里,收回最初的1400万美元投资,而哈博的后人将获得剩余的身故赔偿金。

与此同时,只要哈博能遵循一些使保单持续生效的条件,协议允许他从保单中以借贷(免税)的方式提取现金值。

该协议的其他细节并未对公众公开,这些细节还包括以下方面:

- 具体购买的人寿保险产品

- 从保单提取现金的计划

但是,从已知信息做出一些基本假设,可以粗略估计出,哈博可以从这份协议中获得的利益。

第三方人寿保险顾问的观点

美国人寿保险指南网使用了SchechterWealth的观点1,认为这是一款现金值指数型保险产品,经过严格的设计,用来达到最大化现金值增长的目标。事后,根据福布斯的文章2,哈博的福利协议中,使用的正是被称为指数型万能终身人寿保险,简称 IUL 的现金值保单产品。

假设作为NCAA运动员教练的哈博,身体一直很健康,得到了“Preferred”的评级,他能拿到一份初始身故赔偿金额在$3500万左右的保单,随着7笔保费全部支付完毕,保额将可能上升到$4900万左右。

对于哈博的好处:退休免税终身收入

按照这个保单情况的推算,我们预测哈博在66岁以后,可以每年从保单中取出$140万美元,免除个人收入所得税。这笔收入来源可以持续到98岁。

对于哈博子女继承人的好处:遗产传承

与此同时,如果哈博还没有开始从保单中取钱,在所有保费支付完毕后就不幸去世,那么哈博的子女继承人将获得一笔赔偿金。这笔身故赔偿金扣除欠密歇根大学贷款金额后,这笔理赔金仍然高达3530万美元,而且对于继承人来说,是免个人收入所得税。

如果哈博开始从保单中不断取出资金,那么身故赔偿金会逐渐减少,如果一直支取到98岁,在最后一次支取$140万美元后,哈博累计就从保单中提取了$4620万美元的免税收入,保额将会降至最低到130万美元。

成本和税收问题

在整个协议中,由于密歇根大学不向他收取贷款利息,哈博需要支付的唯一税费是根据美国国税局设定的最低利率计算的“估算贷款利息”纳税。这种估算的利率将随着每笔保费预付款的利率而变化,该利率将是当时支付该保费的月份的有效利率。

公司核心策略和个人财富管理方案

而人寿保险作为解决福利计划方案的应用,不光局限于高收入的橄榄球教练,也是个人规划退休收入,或公司企业绑定核心员工的一个重要策略。

以SchechterWealth提供的实际案例来说,一个55岁的公司高管每年收入$25万元,希望在退休后年每年领取10万美元的免税收入。那么使用这个策略来进行退休规划,将比使用延税的方式更加节约成本——延税的方式则每年需要支付$15万美元退休收入的规划成本——这种方式也加强了雇主和关键雇员的联系,鼓励雇员长期留在公司,直到退休。

这个策略同时也适用于个人进行退休规划,在福布斯的金融专栏:“如何使用人寿保险进行退休规划”2中指出,经过合理设计的人寿保险保单是退休计划的强大工具。

(全文完)

(>>>相关阅读:硅谷神秘买家购入2亿美金人寿保单,到底付了多少钱?)

(>>>相关阅读:车王舒马赫6年的长期看护花了多少钱?)

附录

01.”How Cash Value Life Insurance Made Jim Harbaugh a Top-Paid Coach”, SchechterWealth, 10.04.2017, https://bit.ly/2xpjTHL

02.”How To Use Life Insurance In Your Retirement Planning”, Forbes, 05.11.2017, https://bit.ly/2xpjTHL