当我们想到退休的时候,可能首先会想到,我有没有足够的退休金?

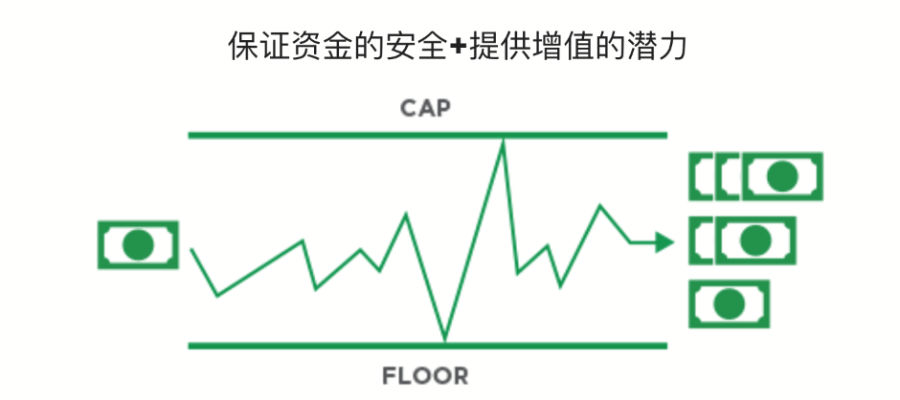

人人都想要一个简单、安全且能让钱增值的方案,而指数年金保险(Fixed Indexed Annuity,缩写为 FIA),就是其中一个选项。它不仅保护本金,还能让钱为我们工作。

如果下面这6个理由,让您觉得足够充分合理,那申购指数年金保险可能复合您的风险偏好和财务预期。

1. 保护你的钱免受市场的喜怒无常

我们都知道,股市有时候就像一个过山车,有时候上上下下让人心惊胆战。就算是新闻里播报的股市行情一片大好,不少人其实也在闷声亏钱。

但是,指数年金保险可以保护你的钱不受市场波动的影响。它的设计初衷就是为了保护你的投资。即使市场下跌,你的本金也是安全无虞的。这就像是给你的钱穿上了一件防弹背心,让它在风雨飘摇的市场中依然坚固。

2. 让你的钱悄悄增长

谁不想看到自己的钱在不知不觉中变得越来越多呢?

指数年金保险有个好处,就是它能让我们的钱,在不受税收影响的情况下增长。这就像是钱在合法合理地悄悄变多,同时又没有年度申报税表的烦恼,税务官员对这笔资产的增值情况一无所知。

这种合法的税延增长优势,意味着我们的钱能够更快地增长,为未来提供更多的保障。

3. 跟着指数赚钱

投资总是伴随着风险,但是指数年金保险提供了一种相对安全的赚钱方式。

通过指数年金保险,如果市场指数表现良好,你的钱也能跟着赚。这就像是你的钱也在为你加班,即使你在睡觉或者享受假期,你的钱也在努力工作,为你赚取更多的收入。

(>>>相关阅读:知识贴|指数年金保险的工作原理是什么?退休理财如何运行)

4. 定制你的增长方案

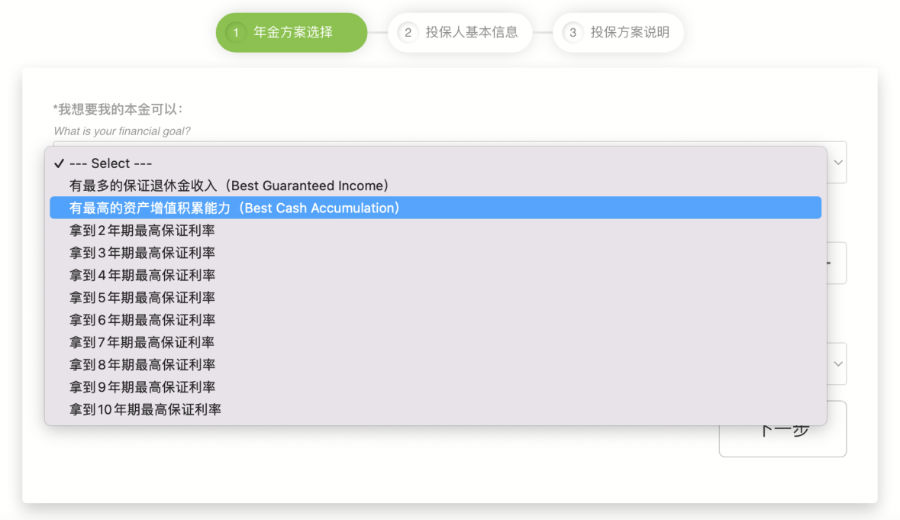

我们每个人的财务需求和风险承受能力都是不同的。指数年金保险提供了多种选项,让你可以根据自己的需求和风险承受能力来选择。

在指数年金保险账户里,会为我们的本金定制不同的理财方案,能够以我们选择的方式去工作。我们可以选择不同的分配比例和增长方案,确保资金能够满足我们的长期和短期财务目标。

5. 确保退休后有钱花

退休,意味着我们的收入来源会发生变化。

很多指数年金保险产品提供了一种选择,可以让你的年金合同金额,转换为一笔保证的终身收入退休金。这样,即使退休了,每个月还有固定的收入,让你不用担心“人活着,钱却没有了”的问题。

这种终身收入的选项为你的退休生活提供了一个强有力的财务支柱,让你能够享受你应得的舒适生活。

(>>>相关阅读:科普贴|保证退休收入的保险附加条款是什么?选购的诀窍是什么?)

6. 为家人留下保障

我们都希望子女和家人在我们不在时,能够得到良好的照顾。

你的指数年金保险还能保护你的家人不受财务困扰。

在申购开设账户时,可以指定一个受益人,确保你的爱人和孩子在你不在时,仍然得到照顾。

这种有确定性的安心的感觉是无价的。

文章小结

股市的黄金时代兴许已经过去了,在一个经济趋于平缓的新世界格局下,执意追求高风险的理财产品,显得尤为不适合为退休进行储蓄,已经,或正在进入退休年龄的群体。

伴随着美联储保持加息或维持利率的节奏,固定利率类的退休年金保险,可能是一个相对更加稳妥的选择。

无论是多年期保证利息的储蓄年金产品(MYGA),还是指数年金产品(FIA),都得益于当前的市场环境,各项产品利率和指标达到了近年来的高点。

简称为FIA的指数年金保险,不仅为你的钱提供了一个安全的港湾,还能让它为你不断增值。也许是时候抓住当前的利率环境,采取行动,为未来做好准备了。

TheLifeTank©️在行业里率先提出了LBYB©️ – Learn Before You Buy 的投保教育理念,并提供了年金保险方案的自助服务系统,通过和专业机构的合作,实时监控美国年金保险市场上百款产品的最新利率报价。

0-49岁的群体,请选择“Best Cash Accumulation”,获取当前利率下的最佳资产增值方案说明;50岁以上的群体,也可以选择”Best Guaranteed Income“,了解终身退休金收入的保证领取金额说明。(全文完)