一些投保人有时会问:保险公司可靠吗?会不会倒闭?如果倒闭了怎么办?也有些人问,保险公司的保单和合同会不会赖帐不算数?

2008年金融危机以后,几乎每个人都对保险公司有疑问,担心它们倒闭或不履行合同。消费者有这些疑问是很正常的,今天的文章就这些问题做较详尽的解释。

对保险公司专业的信用评级

在美国有些独立的机构对保险公司的财务实力和理赔能力进行评估和打分,可以作为消费者的参考。最大的3家信誉评估机构是Stand & Poor标准普尔, Moody’s穆迪和Fitch惠誉,被称为 Big3,前2家都是完全的美国公司,Fitch曾经部分有英国股份,但现在也完全是美资公司。

在美国有些独立的机构对保险公司的财务实力和理赔能力进行评估和打分,可以作为消费者的参考。最大的3家信誉评估机构是Stand & Poor标准普尔, Moody’s穆迪和Fitch惠誉,被称为 Big3,前2家都是完全的美国公司,Fitch曾经部分有英国股份,但现在也完全是美资公司。

它们根据公司的资产负债、过往历史、今后展望等因素来评估公司的还债能力和理赔能力,再分别打分,分别以字母A、B、C、D (Moody’s 只到C)来代表,每一个字母代表一个等级。

(推荐阅读:美国保险公司如何进行评级和排名?详细如何解读公司评级?了解评级对我又什么帮助?)

A代表风险较小,B表示有一定风险,而C则意味着风险极大、D则是已经破产。每一个等级里再细分,如AAA到A-又分了七档,B则分了9档。如果拿到最高级的AAA,一般认为没有风险或风险极低。一般任为如果该保险公司获得了A级评分,则比较可靠,不容易倒闭;如果该公司的评分在BB或以上,则表示有些风险,要谨慎行事,B或B-的公司则最好不要碰,C或D则更要躲的远远的。

想了解各大保险公司的评级情况,请查看美国人寿保险指南网的各公司排名及品牌评级。除了评估一家一家公司外,这3家评估机构也评估各国政府的国债,他们的威力巨大,每次调整都能影响一个国家,甚至全球的金融市场。

保险公司和银行面临金融危机的区别

在金融危机后,再没有任何一家公司敢夸口自己一定不会倒,即使它敢这么说,也没人相信,毕竟有100多年历史的华尔街金融翘楚雷曼兄弟说倒就倒了。但稍加分析就会得知,保险公司比银行更可靠、更不容易倒闭。在银行存钱,一有风吹草动人们就想把银行的存款提出来,这就形成挤兑。

如果挤兑成风,超过银行的应急储备,银行就会倒闭,因为银行吸纳你的存款,除了少部分留着日常流动,满足联储会的要求外,大部分是用于比较长期的投资,如房屋贷款、工商贷款等,这些投资都有一定的期限,不能随时抽出来。所以如果发生大规模的挤兑,银行只有倒闭,由联储会接管。

但保险公司就不一样。保险公司主要产品有人寿保险、年金、长期护理保险等,这些产品都没法挤兑。你买了100万人寿保险,人不死保险公司不会赔50万;中途取消保险,通常会有很大损失,不适合以短线投资为目的购买。

绝大部分年金也有若干年不等的surrender period(退保期),不到期如果取消合同,会有surrender charge(退保费用)。买了长期护理保险或伤残收入保险,也没办法把保单退掉,把钱拿回来。这样看来,几乎没有向保险公司挤兑的现象,零星的理赔对保险公司无伤筋骨,因为死亡概率是稳定、且逐步下降的,保险公司按规定必须保留最少25%的现金应对理赔之需。而取消保险或年金受损失的只是客户,保险公司并不会收到影响。

导致保险公司倒闭的最大可能是投资失败。2008年金融风暴时,AIG面临赔付危机,也不是旗下的人寿保险公司经营不佳,而是投资部门押宝次贷失误——AIG所经营的CDS产品为雷曼兄弟住房抵押贷款债券(CDS)提供信用担保合约净损失78亿美元,连带影响到整个AIG。

随后,美国政府采取了850亿美金的援助行动, 这笔援助储备金达到了850亿美元,美联储也接管了 AIG 公司的79.9%的股权。这在美国金融历史上,第一次出现了政府直接持有的金融保险公司(国有企业)的情况。

和银行不同,保险公司是在各州层面接受监管,由各州保险担保协会IGA对投保人提供再保险。当保险公司违约或资不抵债时,由各州担保基金SGA投保人进行赔偿。

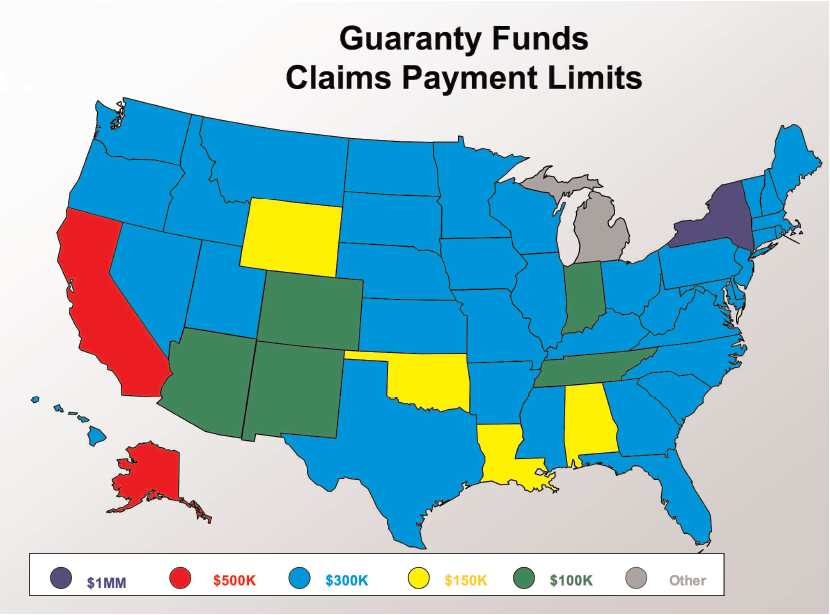

(各州保险保证金协会将对投保人的保险账户进行再保险和理赔,上图为各州理赔上限©️insurancejournal)

(各州保险保证金协会将对投保人的保险账户进行再保险和理赔,上图为各州理赔上限©️insurancejournal)

保险公司由政府监管参与再保险

当然不容易倒并不意味着一定不会倒,为减少和避免保险公司倒闭给客户带来的损失,给社会带来的冲击,政府监管机构要求所有的保险公司必须参加再保险(re-insurance),用买再保险所缴的保费在每一个州建立一个担保基金(Guarantee fund)。如果某保险公司要倒闭了,再保险机构会指定另外一家保险公司接管,由担保基金负责担保。

有人问为什么不是FDIC担保,这就牵涉到银行和保险业的监管权限。银行主要由联邦兼管,所以银行的保险叫FDIC,其全称Federal Deposit Insurance Corporation, 主要是给银行存款提供担保。FDIC不是免费午餐,银行也是要交保费才能得到FDIC的担保,前几年因银行倒闭大增,FDIC的资金不足,而大涨银行保费。

与银行不同,保险公司主要受州法管制,形式上没有全国性(联邦)的监管机构,它的担保机构也不叫联邦再保险,而是由各个州管理自己的担保基金。只要保险公司在某一个州出售保单就要向这个州去买再保险,用买再保险的钱建立各个州的担保基金。

综上所述,从安全性来讲,保险公司无疑比银行更可靠,保险公司倒闭的风险很小,而且有再保险的担保,所以并不用太担心它们会倒闭。

(>>>相关阅读:军工巨头Lockheed的退休金选择:49亿美元年金保险 )