在中国和香港等地区,“信托”二字通常跟“家族信托基金”,“信托投资”等混在一起,在市场上还能以申购的方式进行交易,更像是一个投资产品。

但“信托”二字,在美国的含义则截然不同。如果我们接受了其他国家或地区的市场对一个事物的定义,那么就将形成思维定式。这时,当我们在另一个社会基础制度截然不同的国家里,遇到同样称谓的事物时——如“保险”,“信托”,就会以旧有的方式进行思考和理解——这种认知模式极易错失诸多机会,让我们陷入认知矛盾和冲突,也非常不利于在新市场环境下维护和最大化自我的利益。

在本文中,insurGuru©️财富学院将结合加州律师公会发布的,关于最常见的”生前信托“的公众教育手册,介绍美国的生前信托是什么,受托人是什么意思,设立信托的目的,设立信托的费用,以及如何找到专业的美国信托律师服务。

生前信托是什么?

生前信托,英文名叫:Living Trust。它是一种常见的,可部分替代遗嘱的书面法律文件。

我们可以把成立生前信托,等同为开了一家虚拟的公司。信托的税号,就是您个人的社会安全号码。

撰写了生前信托后,您可将个人资产(如房产、股票,人寿保单等)交付给信托,由受托人在您生前,为您管理这些资产,并在您去世后转让予您的受益人。

大多数人会指定自己为管理信托资产的受托人。

采取这种作法的好处是,即使资产已交付信托,我们仍然能在生前100%掌控自己的资产;我们也可另外任命继任受托人(个人或机构),以便在我们无法或无意自行管理这个信托时,负责管理我们的资产。

本文介绍的“生前信托”,是可撤销生前信託 (Revocable Inter Vivos Trust,又称授与人信托), 可由设定人(一般通称委托人、授与人或财产授与人)在其仍有行事能力时,随时加以修订或撤销。

受托人是什么意思?

受托人为受托付的管理人之意,可以理解为聘用的公司管理人员。在信赖与信任的关系下,不仅担负重大责任,更需遵守极高标准,例如,若无我们的明确许可,受托人不得为个人用途或利益而使用信托里的资产。

相反的,受托人只能为信托受益人的利益保管及使用信托里的资产。

生前信托的作用

我们的生前信托契约有下列特色:

• 赋予受托人管理及掌控信托资产的法律授权。

• 明示受托人在我们生前为我们的利益管理信托里的资产。

• 指定在我们去世后继承信托资产的受益人(个人或慈善机构)。

• 指导受托人如何管理及分配信托资产,并赋予受托人管理及分配信托资产的特定权力与权限。

生前信托是遗产规划非常重要的一环,在许多情况下生前信托更是占有最为重要的地位。

设立生前信托最常见的目的

在美国社会设立生前信托,最常见的目的有两个:

1.规避遗产认证程序

2.保护继承人是未成年子女的情况

美国生前信托的费用和价格

设立生前信托的费用,特别是家庭信托的费用,往往根据需要管理的资产的多少,管理的复杂程度,受托方的服务品质等多方面因素来决定,并没有一个固定的价格。

我们可以购买专业的信托软件或自己购买指导书籍,一台电脑或者一张纸和笔就可以完成生前信托的设立,费用支出不会超过$100元。但是,这种DIY的情况并不适用于大多数人。

TLT(TheLifeTank.com 美国人寿保险指南)在网站上方的“财富传承”栏目导航中,为公众提供了在线自助设立遗嘱,自助设立生前信托的专业化第三方服务,该服务由知名非盈利型遗产服务机构FreeWill免费提供。

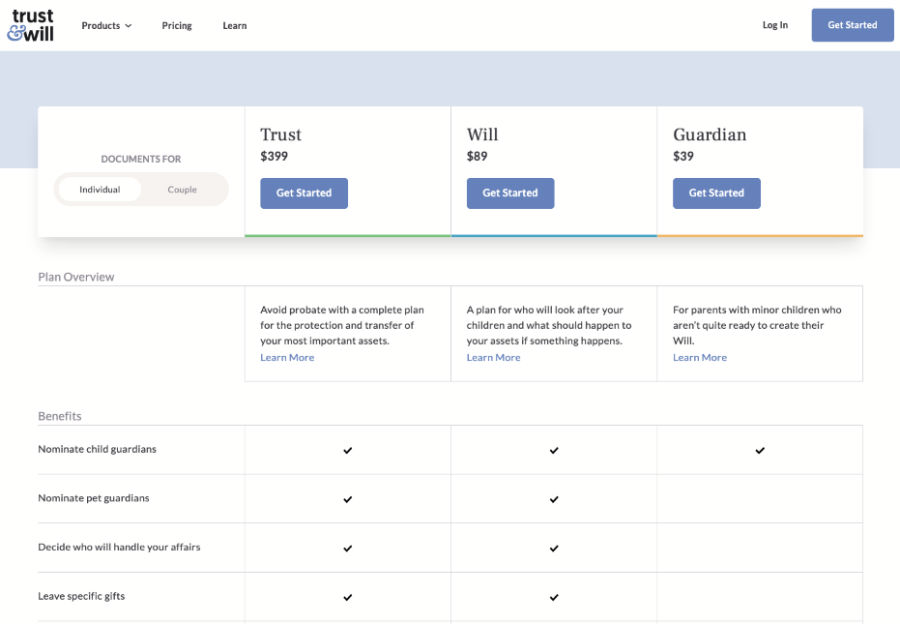

另外一种常见的做法是使用专业的信托和遗嘱咨询服务,如 Trust&Wills,提供了个性化和专业的在线成立信托服务,费用为$399。

在Nolo和LegalZoom提供的基本参考价格中,雇用一名美国律师起草生前信托的费用,通常在$1,000到$1,500之间,如果是一对夫妻,价格在$1,200到$2,500之间。

虽然可以如果需更多有关遗产规划,财富传承方面的资讯或服务,美国人寿保险指南网建议请直接向各州律师公会索取免费材料。

在美国人寿保险指南社区里的调查中,投保人如果成立生前信托只是纯粹用来持有人寿保单资产,那么设立生前信托的费用大概在$500到$1,000之间。

>>>推荐阅读:[评测]如何使用家族保险信托,实现每年$30万的退休收入和财富传承规划?

相关专栏