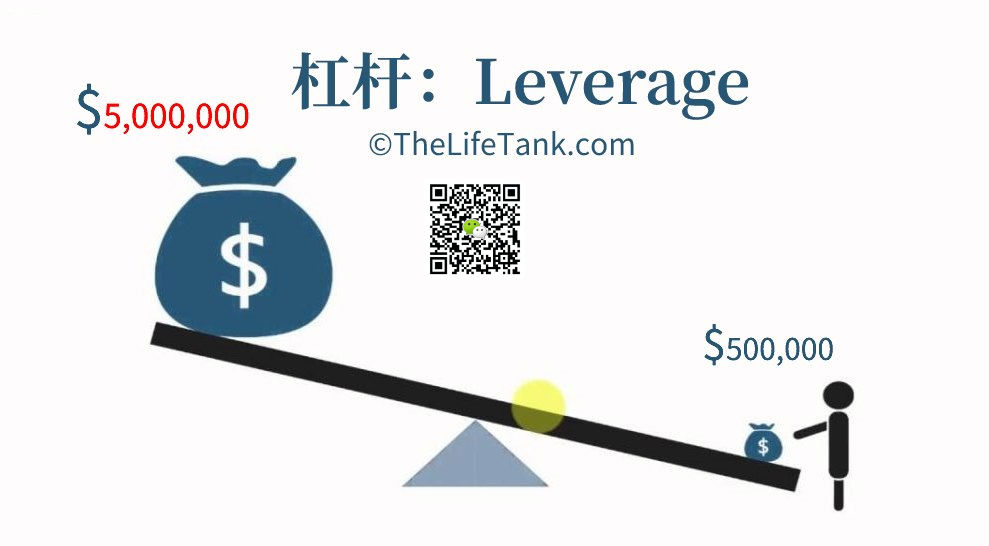

杠杆,是我们日常生活中常见事物,通常指用少量成本,撬动大额资金。 当我们使用信用卡购买电视时,或者当我们使用抵押贷款购买房屋时,我们就是在使用杠杆。

如上图所示,一个人使用了“杠杆”,以少量的钱,撬动起巨额的资金。

如上图所示,一个人使用了“杠杆”,以少量的钱,撬动起巨额的资金。

而人寿保险产品,就是一个典型的“杠杆”产品。而我们所说的“保险杠杆”,英文是 Leverage,指的就是以小搏大的比例。

“保险杠杆”是什么东西?

我们可以把”保险杠杆“,理解为一个工具,或者一个产品。它代表了“保费”和“理赔金(保额)”之间的比例关系。

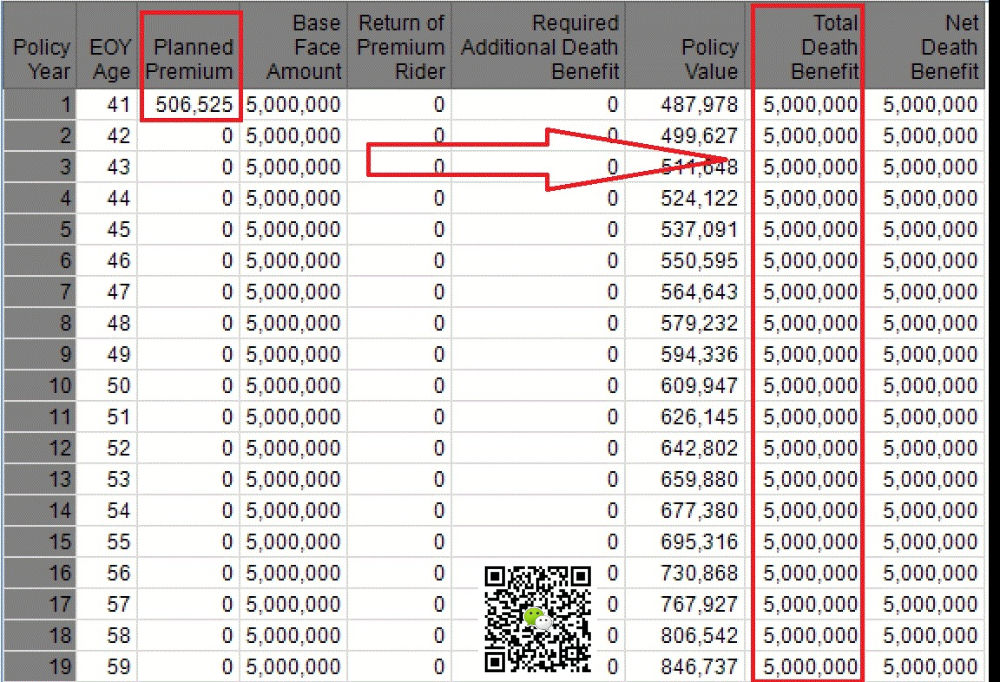

如下图举例来说,家人为李先生够买一份全球范围理赔的终身人寿保险,支付了50万美元,保险公司承诺,当李先生去世时,家人将获得理赔金$500万美元。

在这个案例中,身故是必然事件,李先生投入保费$50万,理赔金额$500万美元,那么这边保单的理赔保险杠杆比率倍数为10倍杠杆,计算方法如下:

$500 ➗ $50 = 10

保险杠杆的好处

保险杠杆的好处

站在李先生家人的角度,这份保单起到了“以小博大”的杠杆作用,给家人提供了一笔财富。10倍的杠杆率,加上理赔金的免税条款,也帮助家庭实现了财富在家庭成员或两代人之间的有效转移和传承*。

说到这里,接下来的问题就是,

如何选购适合的保险杠杆?

作为具有国际视野和身份地位的全球居民,在选购人寿保险产品时,实际上,就是在选购和对比不同国家和地区的的保险杠杆比率。

我们还是以上面的李先生家庭来举例。假设在A国市场,李先生的保费一次性支出50万美元,理赔金为500万美元。而在B国市场,李先生的保费同样是50万美元,但理赔金是2000万美元。

您会怎么选?

上面这个例子比较夸张极端,但现实原理却大抵如此。人寿保险产品的杠杆比率,从上到下,从宏观到局部,分别由“国家”、“保险公司”和“保险产品”这三点来决定。

- 选择国家:选购的是国家制度,司法管辖权和保险分红法规制度

- 选购保险公司:选购的公司信用和品牌历史

- 选购保险产品:选购的是量身定制的保险方案

而我们时常看到,或听到下面这样的说法,这是真的吗?

同类美国人寿保险理赔的杠杆比率,约是台湾和新加坡人寿保险的2倍,香港人寿保险的3倍,中国大陆人寿保险的5倍。

这句话属实。

如果单纯以“国家/地区”来区分的话,保险理赔金杠杆倍数的大小关系如下:

美国>台湾>新加坡>香港>中国内地

理由也很简单,中国内地第一家商业保险公司,诞生于1985年,法律制度和相应配套监管体系的建设发展时间为40年。

而对应榜首的美国或离岸商业保险公司,首先,这些国家以保护私有财产为基石,公司历史和美国建国历史相近,百年以上的商业保险公司较多,在社会发展过程中,有近200年的时间,来完善相关支付法规和信用制度;其次,在这样的市场竞争环境中,自由市场国家里,公司之间的竞争非常激烈,没有独特的性能和保费优势,很难在上千家保险公司的市场竞争中存活。

因此,从理赔杠杆倍数来说,美国的人寿保险,是全球范围内保费最低,杠杆倍数是最高的。

保险杠杆可以再加和订制吗?

可以。通过订制的人寿保单账户,理赔杠杆可以做到1:20,甚至1:30。虽然全球的居民都可以申请,但对人寿保险财务顾问的专业型要求较高,申请门槛也相对较高,一般要求家庭资产组合里,至少有$300万美元的短期流动性资产。

杠杆是一款有效的日常金融工具。做好保险杠杆的设计,评估和风险管理,并让它为我们的财富工作。——Heather Xiong, CFP®️

同时请牢记,高额的保险杠杆并非我们追求的唯一目标,保险除了提供理赔金以外,还有更多其他用途。(全文完)

(>>>相关阅读:评测|错用10倍保险杠杆,收入减少了$186万美元?)

(>>>相关阅读:【知识帖】如何解读一家保险公司的信用评级?了解评级对我有什么好处?)

(>>>相关阅读:【科普帖】美国保险公司会倒闭吗?保险公司倒闭后怎么办?)