固定收益年金(Fixed Annuity),是美元退休储蓄计划和家庭资产的重要组成部分。

这类年金产品为我们提供保护本金,保证年化收益率,并且享受税务优惠的理财储蓄方式。在insurRetire©️退休学院的“年金先生”专栏里,将帮助消费者了解,固定收益年金的基本运作原理,以及它的优缺点及适用人群。

固定收益年金(Fixed Annuity):高配版定存

固定收益年金(Fixed Annuity),是年金合约的一种。在我们向年金保险公司一次性存入一笔保费后,年金保险公司承诺,无论市场或外部环境发生多么剧烈的变化,都会支付给我们固定的年度回报。

往固定收益年金账户里缴费的阶段,称为“积累期”,从年金账户里拿钱的阶段,称为“分配期”。固定收益年金产品主要由商业保险公司发行,在insurRetire©️退休学院专栏中,我们也分享到,各国中央政府是最大的年金保险发行机构,用来为国民提供养老保险。

对于固定收益年金,最形象的一个比喻就是,它是超级豪华版本的定期存款(Supercharged Certificate of Deposit)——年金账户持有人在购买存钱的那一刻,就已经确定好了固定的收益率,而这个收益率往往比定存CDs高很多。

用年金保险为自己储蓄养老账户

我们在购买了固定收益年金后,到了退休的年龄,可以按月或按年领取固定金额,作为养老金。我们可以选择领终身,也可以选择领我们希望的时间长度,比如领10年,20年或者30年。在这个合约期内,保险公司需要一直支付给我们这笔钱。

使用固定收益年金,等于是自己为自己储蓄一个养老理财账户。到了领取的时候,我们就像是领工资收入一样,每月从保险公司得到固定金额的一笔钱,成为我们的月收入。

由于每个月的收入金额是固定下来,这种用固定型年金来养老的方式,能帮助我们有效的管理家庭支出和预算。

固定收益年金(Fixed Annuity)的优点

- 简单。与其他类型的年金相比,固定收益年金的最大好处,就是简单。 我们可以轻松比较条款和价格,找到最适合自己的需求产品。 相比之下,指数年金和证券型年金更加复杂的,并且有了各种各样其他的费用和风险。 虽然指数年金和证券年金各有其优点,但从合同条款的清晰度,简洁度这些角度来说,固定收益年金胜出。

- 回报是保证的。当我们签约购买固定收益年金后,保险公司将保证我们在合同有效期内获得最低的投资回报。固定年金的收益率通常高于从CD或储蓄帐户的利息,从而降低了获得较高回报的风险。跟CD或储蓄帐户不同的是,固定年金不是联邦FDIC保险来兜底的,而是由再保险公司和各州来兜底。 尽管年金通过其他方式进行了再保险,但在选购的时候,应该优先考虑健康的财务状况,充足的资金储备,口碑相对较好的保险公司。

- 定量,可预测。由于固定收益年金的收益是固定的,因此我们可以预测未来的收入数字,从而更加容易地对退休后的财务状况进行规划。 对于证券年金和指数年金,我们的实际收益取决于不同的投资表现。 我们可以赚得更多(或更少),但是这两种年金,我们都无法清楚地了解自己的未来收入。

固定收益年金(Fixed Annuity)的缺点

- 较小的收益增长能力。虽然固定收益年金能避免市场下跌给投资者造成的损失,但“旱涝保收”的代价是,在市场行情好的年头,固定收益年金已经固定下来的收益率,可能要比证券型年金和指数年金的收益率低一些。

- 保证回报率可能最终改变。年金保险公司通常在合同期内,给出保证的固定回报率, 该期限结束后,保险公司仍将继续向您支付利息,但续约的回报率可能会降低,具体取决于年金的合同条款。

- 通货膨胀可能影响回报。在通货膨胀率高的年头,固定收入年金可能跑不过通胀。虽然我们可以选购通胀调节附加条款来减少这种损失,但是Rider的使用,可能会减少我们的首次提领的金额。

- 在59.5岁之前从年金账户里提取,面临10%的提前支取罚金。

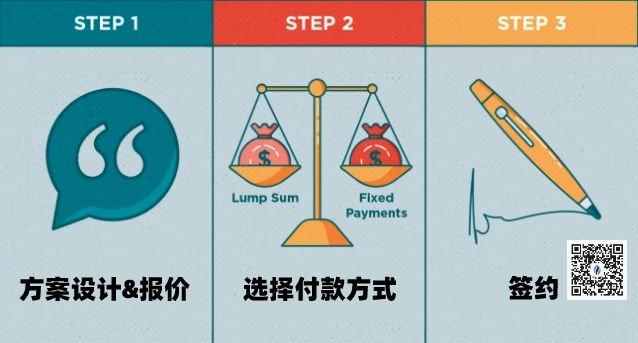

(购买年金保险的3个步骤 ©️ Credit:TurboTax)

(购买年金保险的3个步骤 ©️ Credit:TurboTax)

哪些人适合买固定收益年金?

- 追求稳定,可预期的收益,不愿意承担任何市场风险的群体

- 因为健康问题,成本等因素无法申请到人寿保险的群体

- 希望退休后有长期稳定的收入,提前规划退休收入计划的群体

- 希望为401(K)s,403(b),IRAs等账户资金寻找转移风险的退休收入渠道的群体

- 45岁以上的群体

- 为家庭资产组合配置低风险产品的群体

文章小结

商业年金保险,是对各国政府的国民养老保险的一个强有力互补,为我们构建全球范围内的美元退休计划,打造自己的养老收入“保险箱”,提供了一个强有力的选项。

而在我们对家庭资产进行结构化配置和优化的过程中,低风险和固定收益类目,是一个重要的资产组成部分,而固定收益类年金,就具备这两大核心优势。

本文介绍了固定指数年金的原理,列举对比了优缺点和适用人群。在2019年的年终专栏里,insurRetire©️退休学院也按照“年金市场占有率”这个指标,发布了美国年金保险公司排行榜Top8排名。

对于固定收益年金的选购,可以和专业年金保险经纪人共同合作,进行产品方案的设计和对比,从而找到最适合我们每个家庭的产品和方案。(全文完)

(>>>推荐阅读:比较|指数年金和基金年金,哪一款年金保险更好?(2022版))

(>>>推荐阅读:专栏|购买美国年金保险必读!您最关心的8个常见问题及误区 )